Click here to download the report

An Upcoming Challenger in the API Industry

Solara Active Pharma Sciences Limited (“the Company” or “Solara”) is involved in the business of researching, developing, and manufacturing Active Pharmaceutical Ingredients (API) based drugs. Active Pharmaceutical Ingredients or API are chemical compounds which along with their bonding agents, are used in the manufacture of drugs. As of FY20, Solara operates in over 75 countries and has more than 75 products. They primarily provide services in the following areas:

- Anti-Diabetic

- Neuromuscular

- Beta-Blockers

- Anti-Parkinson

- Muscle Relaxants

- Hyperkalaemia

- Anthelmintic

The Company has over 140 scientists and more than 2500 associates currently employed. Strides Sashun Pharma, the Company that Solara had a demerger with, is also one of Solara’s major clients.

The Company operates in the following segments:

- Active Pharmaceutical Ingredients (API)

- Contract Manufacturing and Selling (CRAMS)

How was Solara Formed?

Solara came into existence as a result of the demerger of the Commodity API business of Strides Shasun and Human API business of Sequent Scientific Limited to form a new ‘API only’ entity. The Company although young has been backed by a significant experience of more than 30 years.

Shasun Pharmaceuticals Limited had merged with Strides in November 2015 to integrate its formulations business and secure the API capabilities of Strides. The Commodity API business was a part of Shasun Pharmaceuticals Limited. Besides, the Human API business of Sequent had been organically developed for more than 10 years. The management of Solara had been associated with the Commodity API business of Strides and Human API business of Sequent before the demerger took place, hence bringing with them the relevant experience.

Subsequently, Solara also acquired Sequent Scientific Limited which makes it a pure-play API Company. Sequent Scientific Limited, a pure-play animal API health company was formed way back in 1985.

Initially, Mr. Jitesh Devendra took over the Company as the CEO but was later replaced by Mr. Bharat R Sesha. Mr. Devendra now continues as the Managing Director of the Company. Mr. Devendra has over 20 years of experience in managing API and formulations business, including 10 years spent in the US focusing on expanding the API business and establishing Shasun Pharmaceuticals Limited and thereafter with Strides since 2004.

Indian Pharmaceutical Industry

- The Pharmaceutical industry in India was valued at $36 billion in FY19 and out of the total exports, 20% account of generic drugs, making India the largest provider of generic medicines globally.

- India’s domestic pharmaceutical market turnover increased by Rs.0.11 lakh crore, and touched Rs.1.4 lakh crore in 2019, up 9.8% YoY from Rs.1.29 lakh crore in 2018. Export revenue was $19.14 billion in FY19.

- Pharmaceutical exports in India reached $16.28 billion in FY20 which include intermediates, bulk drugs, biologicals & herbal products drug formulations, and surgical. The drugs are exported to more than 200 countries around the world, and the US is one of the key markets for Indian drugs.

- This industry has more than 1000 players which makes it a very competitive market.

- As per the industry estimates, the global API market was valued at $187.3 billion in 2020 and is expected to reach $248.3 billion in 2025.

- The consumption of API domestically is expected to reach $18.8 billion by FY22.

- Over the next 5 years, medicine spending in India is projected to grow at 9% to 12% owing to a large population size with a high proportion of older adults, coupled with increasing chronic diseases and high demand for proper healthcare facilities.

Business Model

As mentioned before, Solara deals in 2 segments – API and CRAMS.

Active Pharmaceutical Ingredients (API): APIs are the main ingredients of any medicine, which helps to generate the intended effects of the medicine. Solara’s business of manufacturing and selling API involves about 70-75 products. This segment currently generates more than 90% of the total revenue for the Company.

Contract Manufacturing and Selling (CRAMS): Increasing costs of R&D, coupled with low productivity and poor bottom lines, have forced major pharmaceutical companies worldwide to outsource part of their research and manufacturing activities to low-cost countries like India. This segment currently generates less than 10% of the total revenues for the Company but is expected to contribute more in the upcoming future. CRAMS is one of the fastest-growing segments in the pharmaceutical and biotechnology industry.

Solara aims to deliver value-based products while maintaining customer needs. Currently, there are 140+ scientists, 2 R&D centres, and 5 manufacturing facilities. The Company is also the largest supplier of Ibuprofen, globally and has one of the highest Drug Master Files (DMF) filings in India. It further aims to file more than 10 DMFs every year. A DMF is a submission to the Food and Drug Administration (FDA) that may be used to provide confidential and detailed information about facilities, processes, or articles used in the manufacturing, processing, packaging, and storing of one or more human drugs.

Solara depends on third-party vendors and suppliers for the purchase of their raw materials. A significant portion of raw materials is sourced from multiple vendors except for a few which is sourced from a single vendor.

The Company further brings in the expertise of Strides and Sequent in its Commodity API business and Human API business respectively with the goal of being one of the largest standalone API companies in India. It has a diversified, high-value product portfolio for the global market, with 40 APIs predominantly in the anthelmintic, anti-malaria and anti-infective categories. The Company is able to identify API products much earlier due to their rigorous process and this helps them to build intellectual property in a timely and successful manner. The Company has its customers spread across more than 40 countries including North America, parts of Latin America, Europe, Japan, India.

Impact of COVID-19

- The ongoing coronavirus pandemic didn’t have a major impact on the demand for medicines in India since they are necessities, but it did lead to the supply chain disruption.

- Since India went into a complete lockdown for almost 21 days, production was suspended on Solara’s manufacturing sites for almost 10 days, which in turn also led to logistics issues in importing of raw materials for manufacturing of medicines (mainly from China) and export of finished goods also came to a halt. This resulted in lower number of sales and EBITDA in Q4FY20 compared to the previous quarters.

- The low sales were also due to orders being delayed and suspended production across all sites during the lockdown.

Differentiating Strategies

- Cost Reduction

Solara always has had its focus on reducing the costs of manufacturing its products. There is a cost improvement program that has led to steady progress in the PAT and EBITDA of the Company. This is an efficient strategy that can lead to an increase in profits for the company in the future. - Product Differentiation

Solara’s focus has been on differentiated products with complex formulations across diverse categories. With this strategy, the Company creates and launches new products in the market, which in turn are expected to improve the Company revenues. Solara has approx. 70-75 products in its product mix and the top 10 products accounted for 78% of the revenue generated by the Company which makes Solara a Company with an optimal product mix with high margin products in focus. - R&D Investments

Solara focuses on commercializing its API business by delivering the best quality products for the customers, by being compliant with every regulation. The Company also focuses on researching and developing new products, with almost ₹46 crore spent in R&D in FY20. During the last US FDA audit at the Company’s Cuddalore and Puducherry facility, it was established that the two sites are in an “Acceptable State of Compliance” with Zero Form 483 inspectional observations. The massive investments made by the Company allows them to focus on products characterized by complex formulations across diverse therapeutic categories as well as on products developed specifically for their key markets.

SWOT Analysis

Strengths

- One of Solara’s main strengths is that they have a strong R&D pipeline which enables Solara to keep launching new products regularly. Solara is planning to launch almost 15 new APIs for the year FY2020-21.

- Currently, Solara has its currently in more than 75 countries. Given that the Company came out with its IPO just over 2 years back, it shows how the Company has been expanding remarkably, which will eventually lead to more sales for the Company in the future.

- Solara has commissioned Phase I of the Greenfield Facility at Vizag, and the commercial production is likely to begin in H2FY21. The greenfield facility will have a dedicated CRAMS manufacturing area. Therefore, having an extra facility increases Solara’s ability to manufacture more which will lead to more sales in the future.

Weaknesses

- Solara has a very large working capital requirement because of its continuous R&D and DMF filings which the Company has to do. Investments in R&D was nearly 46 crores in FY20.

- In the past, the Company has faced supply disruptions, which had led them to incur additional costs in procuring their raw materials. This effects the company’s ability to manufacture products in a timely and cost-effective manner. This can even make their products less competitive in the market.

Opportunities

- The Production Linked Incentive scheme, introduced by the GoI allocates ₹100 billion for 53 products. This is expected to strengthen the manufacture of domestic APIs and reduce imports from China.

Threats

- Regulations by the Government have been increasing over the years, which in turn can lead to an increase in the chances of products getting suspended. This remains a threat for the business because as we saw that the suspension of one of Solara’s products from the market – Ranitidine led to lower sales for the Company.

Michael Porter’s 5-Force Analysis

Barriers to Entry

- The Company focuses on developing Intellectual Property, to create entry barriers and build strong intrinsic value which is difficult for other competitors in the industry to duplicate because most of the medicines are patented and until the patent ends, other companies can’t produce the same drug.

- Entering into the pharma sector would require huge R&D investments into manufacturing, research, approvals, testing, setting up facilities and alike. These time consuming and expensive processes act as a significant barrier for new entrants.

- Before a company can even make a drug, it has to take approval from Food and Drug Administration (FDA) in the United States and from Central Drugs Standard Control Organisation (CDSCO) in India, which in itself is a very complicated and time-consuming process and also requires a lot of money. Moreover, regulatory requirements have been increasing every passing day and will continue to do so to increase transparency in the supply chain.

- Therefore, high R&D costs and regulations have increased the barriers to enter this industry.

Bargaining Power of Suppliers

- The companies in the pharma industry can switch between suppliers without incurring a very high cost because the pharma industry depends on a variety of organic chemicals that are available with a lot of suppliers and are not differentiated. This in turn makes the bargaining power of suppliers very low.

Bargaining Power of Buyers

- A buyer does not seem to have much power over the prices of the product in this industry simply because medicines are a necessity and whatever is the price, a customer has to buy that medicine only, this is why the Government tries to regulate the prices by putting a cap on them so that customers don’t have to overpay and medicines are accessible to everyone.

- In most cases, customers don’t have a choice but to buy what the doctor prescribes, which also makes the customer’s bargaining power very low.

Rivalry Among Competitors

- The top player in this industry has only a 6% market share, while the top 5 players have a concentration ratio of 18% which indicates that there are a lot of players in this market and therefore, there exists intense competition.

Threat of Substitutes

- Since the API segment in the pharma industry is relatively new with the Government looking to promote the manufacturing of API products in India, there could be new companies coming up with different strategies to gain the market share of this industry soon.

- Ayurvedic medicines have been on a rise and give immense competition to this industry. The Ayurvedic segment of this industry might hold a large market share and be a threat to the API business.

Branding and Other Initiatives

- Risk-Based Process Safety Management (RBPSM)

In one of the facilities Cuddalore, the RPBSM process is implemented which monitors all aspects of risks and tries to minimize all the risks associated with the Company. - Health-Related Initiatives

The Company tries to provide medical services for free to almost 700 people every month. They have also given support to Pulse Polio Program and Dengue Source Extradition Drive and extended its hospitality to about 500 volunteers for 4 days. - Drinking-Water Initiatives

The Company aims to provide safe drinking water to the community around Puducherry’s site and had installed 8 Reverse Osmosis (RO) plants at different locations of Puducherry, including 2 schools. Additionally, they have volunteered to supply safe drinking water to Kudikadu, a village facing drinking water scarcity. - Support for Education

To recognize and reward academic achievement, the Company gave cash awards to school level toppers of the Secondary and Higher Secondary Schools in and around the unit at Puducherry. Additionally, over one lakh rupees was used to sponsor students of different departments of Puducherry University and Dr. Ambedkar Law college for various events.

Financial Analysis

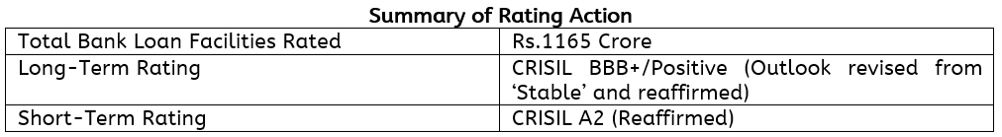

- Debt-to-Equity

The debt-to-equity ratio of the Company has been constantly improving. The Company had an equity infusion of ₹148 crores, which keeps Solara in a very good position to repay debts.

- ROE and ROA

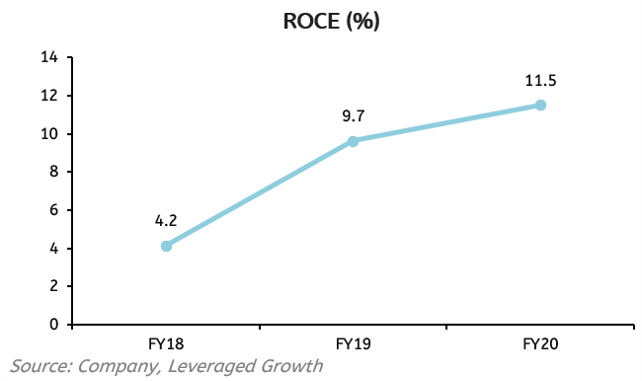

Significant increases have been seen in ROE and ROCE over the past year itself. If we look at ROE, it was around 0.55% in FY18 but it grew to 9.14% in FY20. This is mainly because of the increase in Net Profit from ₹51.71 crores to ₹93.69 crores in just 1 year and is expected to increase significantly in future also because of strong fundamentals of the Company. The ROCE, however, has also increased from merely 4.16% in FY18 to 11.52% in FY20. This significant change has also been seen because of a massive increase in EBIT in just one year. This has happened because of the management’s commitment to develop better cost structures and build a better revenue model which has been seen in the rising profits of the Company.

- Profitability

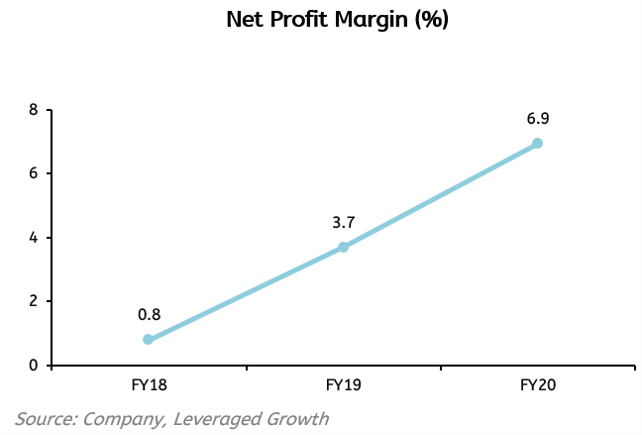

Solara is in a very competitive business where cost reduction is very important because a rise in the input prices can take a massive hit on the profitability of the business. The EBITDA margin increased by more than 4%, from 16.67% in FY19 to 21.27% in FY20 and Net Profit Margin increased from 3.7% to 6.9% in FY20.The only matter of concern is that pharma companies might have to put a lot of fixed costs and Solara especially has just put up a new plant which is estimated to have a value of ₹200-250 crores itself, it can become challenging for Solara to incur this much cost, especially when there is a global pandemic going on.

Risk Analysis

- High Dependence on R&D

The pharmaceutical industry is non-cyclical/defensive as it is a necessity. Hence, a slowdown in economic growth should not hurt the sales of the Company. However, an economic slowdown may hamper investments in R&D and expansion projects. - Product Quality Risk

If a product has been stored in the inventory for many days and in inaccurate temperatures, its quality can downgrade very sharply. This is exactly what happened during the lockdown when inventory was stored and the product became impure. Therefore, inventory management has been of utmost importance. - Forex Risk

Solara has been exposed to foreign currency risk as it does transactions in various foreign currencies, besides this, it also took up debt in foreign currency.

Corporate Governance

- The Company’s Board consisted of 8 Directors out of which 4 were Independent Directors including 1-woman Director.

- A Familiarisation Programme for Independent Directors has been put in place where an orientation program is held that includes familiarisation with the company, their roles & the industry in which the company operates.

- One of the independent directors of Solara, Mr. Nirmal P Bhogilal, is the Chairman and the Managing Director of the Batliboi Group. The Group operates in, machine tools, textile machinery, air engineering, logistics and wind energy, rotating machines, and another member, Mr. Ronald Tjeerd de Vries (Ron) is an IMD executive Leadership Alumni and an M.Sc. in Chemical Engineering.

- The Company had 4 board meetings during FY20 and the independent directors of the Company met once to discuss the aspects relating to quality, quantity, and timeliness of the flow of information between the Company and its Board of Directors.

- None of the directors of the Company hold Directorships in more than 20 Companies and none of the Independent Directors of the Company holds Directorship in more than 7 listed companies.

- There are no inter-Corporate relationships between the board members.

- In Dec 2019, promoters had a shareholding of 40.14% that increased to 44.1% in Dec 2020.

The End-Note

- Solara has been successful in maintaining and achieving higher growths with its superior product mix and effective manufacturing capabilities. It has been improving its EBITDA margin along with its bottom line. With the world moving towards prioritising healthcare, we can see the role of APIs to improve in the near future. These things will help the Company in increasing its growth prospects and maintain healthy fundamentals.

- The current pandemic has made the Company pile up huge inventory which in turn increased the inventory risk of the Company. The huge inventory due to lower sales led to less cash generation and in a way affected the planned R&D spend of the Company for the development of its new products and expansion of its facilities. The pandemic has also impacted the launch of its new CRAMS segment which was supposed to be up and running in full force but has now been delayed. The sales of the Company were merely impacted because medicine shops were always open even during the lockdown.

- There are signs that the Company can be a leader in the pharma market but it needs to find better methods to diversify its supply chain and come up with new products regularly which it has been doing till now. Because one of its major products, Ranitidine, was suspended because of new regulations coming up, it has to give that space to some of its other products so that the Company’s sales aren’t hampered in the future.

Disclaimer: The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. Certain transactions -including those involving futures, options, another derivative products as well as non-investment grade securities – involve substantial risk and are not suitable for all investors. No representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alternations to this statement as may be required from time to time without any prior approval. Leveraged Growth, its associates, their directors and the employees may from time to time, effect or have effected an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any Company referred to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting the document. This report has been prepared on the basis of information that is already available in publicly accessible media or developed through analysis of Leveraged Growth. The views expressed are those of the analyst, and the Company may or may not subscribe to all the views expressed therein. This document is being supplied to you solely for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Leveraged Growth to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. Neither the Firm, not its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The person accessing this information specifically agrees to exempt Leveraged Growth or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold Leveraged Growth or any of its affiliates or employees responsible for any such misuse and further agrees to hold Leveraged Growth or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

Contributor: Team Leveraged Growth

Co-Contributor: Pratik Sharma

Research Desk | Leveraged Growth