Click here to download the report

Key Highlights

- Due to a significant surge in freight volume, VRL had its highest-ever EBITDA of INR 26,035.04 lakhs in FY22, representing a 61.7% increase.

- The Company declared an interim dividend of INR 8 at the end of the third quarter of FY22.

- The Bus Operations division performed markedly better than the previous pandemic-affected years growing by 57.16% from FY21 to FY22.

- As a result of the government’s scrapping policy, the Company has proactively discarded 141 vehicles.

- Significant B2B clients have been acquired by the Company, which is projected to drive higher business volumes in the future.

Indian Logistics Industry

- Valued at – USD 410 billion in FY22

- Concor leads the logistics market with a 48% market share, followed by Aegis Logistics (10.3%) and Allcargo Logistics (9%), and we find VRL Logistics market share to stand at 5.73%.

- Other players in the market capture the remaining 14%.

- Significant reforms like GST and E-way bills have increased transparency and consolidation of the logistics industry.

VRL – Logistics Through Innovation, Dedication, and Technology

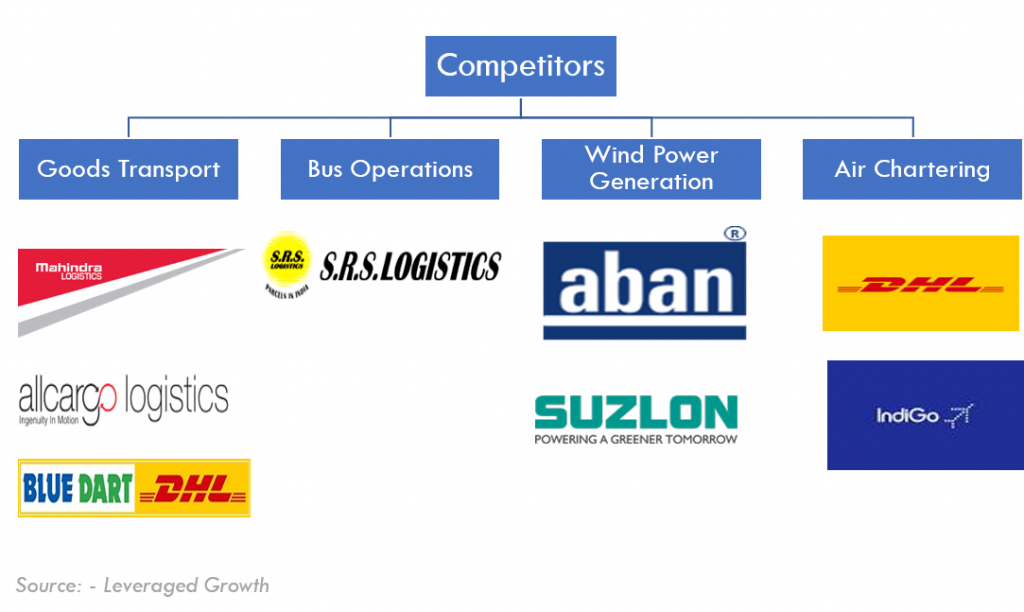

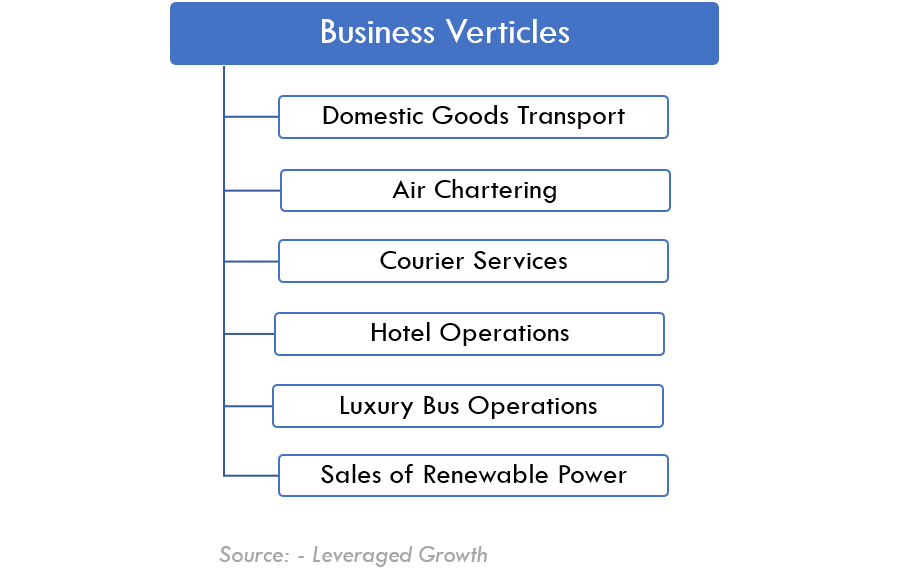

VRL Logistics Limited (NSE: VRLLOG) is a company that transports commodities, operates buses, sells power, and provides air chartering services. It provides customers with a variety of road transportation options, including Less than Truckload (LTL), Full Truckload (LTL), and express cargo services, for the delivery of products across India. VRL is a private sector participant at the forefront of the Indian passenger transport industry. The electricity segment comprises the wind farm, which comprises wind turbine generators (WTGs) with an individual capacity of about 1.25 MW. The Company offers jet aircraft to transport passengers to corporate works, the leisure, and tourism sector, event management, advertisement agencies and VIP flights.

How was VRL born?

VRL, founded in 1976 by Dr. Vijay Sankeshwar, had a vision ahead of its time. VRL has come a long way since its inception, expanding from three cities (Bangalore, Hubli, and Belgaum) to a countrywide transport organization. With 4,575 goods and transport vehicles and 291 passenger cars, the Company is India’s largest fleet owner of commercial vehicles.

Dr. Sankeshwar persevered in acquiring vehicles and expanding his client base despite considerable financial setbacks in the early years owing to enormous investment and losses to become one of the leading operators in the goods transport sector. VRL has led the way in delivering a safe and dependable parcel transportation network over the years. VRL’s 3PL (3rd Party Logistics) and warehousing solutions are tailored to the specific demands of its broad customer base. VRL has diversified into other industries like passenger transport, air charter, and wind power. In 2003, VRL entered the Limca Book of World Records as the largest fleet owner of commercial vehicles in the private sector in India. In 2015, the Company was listed on BSE and NSE. Vijay Sankeshwar, Chairman & Managing Director, was awarded Padma Shri in 2020.

Indian Logistics Industry

The Indian Logistics industry is currently valued at USD 410 billion and is predicted to rise at a CAGR of 6.3%, reaching USD 556.97 billion by 2025. Several causes will contribute to this expansion, including the rapidly growing E-commerce industry, upcoming technological advancements, and an expanding retail sales market. According to Agility Insights, India ranked 2nd behind China in the 2022 Agility Emerging Markets Logistics Index, which ranks Emerging Countries based on their logistics performance.

The logistics industry has seen a significant change in the last few years with the introduction of reforms like Goods & Service Taxes (GST) and E-Way bills. The implementation of GST has eliminated several state and central taxes resulting in a smooth and more efficient inter-state transit. E-Way bills have increased transparency in the formerly disorganized road freight industry. Furthermore, relaxed Foreign Direct Investment (FDI) regulations and granting infrastructure investments have benefited the logistics industry. With increasing infrastructure investment, the logistics sector now has access to long-term finance at competitive rates.

In India, the road transportation sector is highly fragmented, with many unorganized operators. Almost 70% of truck owners in India have a fleet of around one to five trucks. Small trucking companies lack pricing power, whereas more prominent fleet owners serving LTL and FTL has relatively better pricing power. The logistics industry had been battered by the lockdown imposed amidst the pandemic. However, the industry witnessed a sequential recovery after the first covid wave. The rebound produced both demand and supply-side issues, which eased in the subsequent months as the economy recovered.

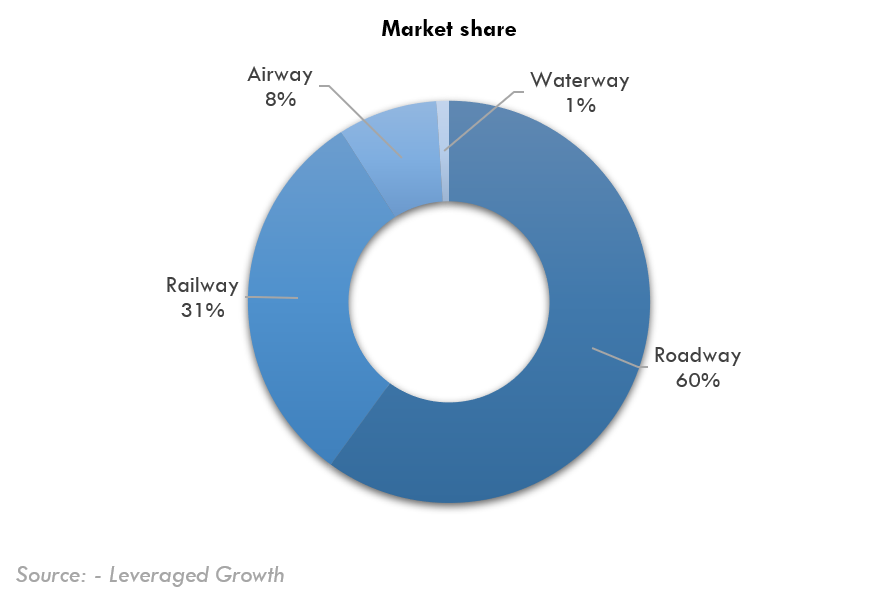

The Indian logistics industry is divided into:

Roadways

- The surface transportation sector is expected to grow at a CAGR of more than 8%, becoming the fastest-growing area of India’s infrastructure. It currently contributes ~ USD 140 billion in revenue.

- Surface transportation can be further divided into (i). Full Truck Load (ii). Part Truck Load, and (iii). Express.

- The Full Truck Load (FTL) is the major contributor to the transportation sector. The FTL market is estimated to generate USD 120 billion and is expected to grow at 7-8% in the coming years.

- The trucking industry is also highly fragmented and unorganized, with 70% of the truck owners having less than five trucks.

- These small truck owners are getting attached to some large aggregators or service providers as a vendor.

Railways

- India has the world’s fourth largest rail network after the US, China, and Russia, and accounts for nearly 31% of the entire cargo movement across the Country.

- While railways can be one of the cheapest options in terms of long-distance movement of goods, concerns regarding its time sensitivity and the safety of the goods remain.

- The World Bank’s Board of Executive Directors have approved a USD 245 million loans to support India’s efforts to modernize rail freight and logistics infrastructure. The rail logistics project will help India shift more traffic from road to rail, making transport- both freight and passenger- more efficient and reduction of greenhouse each year.

Waterways

- Waterways account for only 8% of the cargo movement in India.

- Water transportation has a definite edge over other modes in terms of possessing the highest carrying capacity and being the best suited for long-distance carriage of bulky goods at the lowest cost.

- India has a vast coastline of 7517 km and is surrounded on three sides by seas. The subcontinent has 11 major and 168 minor/intermediate ports across the Country.

- India has witnessed a growth of 11.3% in cargo movement on coastal routes from 2015-16 to 2020-21. The total cargo movement is expected to reach 250 MTPA by 2025.

Airways

- Airways share less than 2% of the total cargo movement in India. While airways primarily focus on the air passenger market in India, the air cargo segment is also becoming an essential part of India’s growth story.

- Airways are mostly preferred for the movement of cargo like pharmaceuticals, healthcare, electronics, wireless telephony, automotive spares, and perishable items.

- The government has introduced the Krishi Udan Scheme under Union Budget 2020-21. This scheme gives airlines financial incentives for domestic and international routes and encourages farmers to transport their agricultural products faster at affordable prices.

- Air cargo’s role is critical due to its efficiency in transit times. More than 75% of the air freight market in India is with organized players.

Business Model

VRL is one of India’s leading transportation and logistics providers for goods and passenger transportation services. VRL operates goods transportation services across 678 cities in 22 states and 5 Union Territories. It is a well-established surface transportation brand in the Country and an industry leader in parcel transportation space. The asset-intensive model (where the Company’s own fleet of vehicles and hubs are used in its operations) of the Company, when compared with its competitors who operate on an asset-light model (where leased vehicles or hubs are used in day-to-day operations), makes VRL independent of 3rd party players. This way, VRL can maintain better quality and flexibility regarding capacity utilization. Owning fuel stations at crucial locations like Hubli, Bangalore, Mumbai, etc., and in-house software systems have further helped the Company research and develop better vehicle designs.

Besides the asset-intensive model, VRL also operates in a labour-intensive model (because of its fleet drivers) to ensure complete control of its operations, allowing it to maintain quality and flexibility. VRL owns most of the vehicles and plants used in all segments in which it operates. Most of its consignment and ticket bookings happen through its branches in 906 locations spread across the length and breadth of the Country. However, the Company has a significant concentration in South and West India.

The ‘Hub-and-Spoke’ operating model increases capacity utilization. This model starts with registering and collecting consignments by the booking office. The goods are consolidated at a spoke and shipped to a hub from where goods are reduced as per destination spoke, from where the consignment is delivered.

VRL has a well-diversified customer base of corporates and traders with an exclusive focus on B2B services.

VRL provides door-to-door services with the express delivery option along with delivering LTL consignments to enterprises. This enables the Company to generate a higher margin by charging higher prices due to lower competition in the LTL segment than in the FTL model.

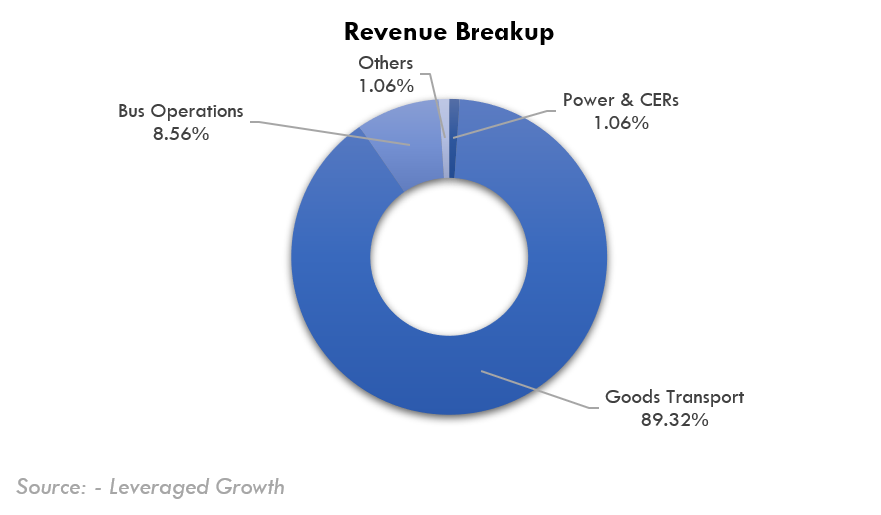

Revenue Break-up

SWOT Analysis

Strengths

Own Vehicles and Systems:

- The Company has its fleet and infrastructure, which allows it to customize vehicles as required and reduces reliance on third-party vehicles or service providers. This gives the Company a strategic advantage over its competitors because this improves service quality and helps tackle issues immediately.

- Owning trucks also ensures safer trips, and the Company has complete control over payload, route, and operations. This contributes to VRL’s on-time delivery, enhancing overall service quality and customer satisfaction.

Network:

- VRL is present in 23 states and 4 union territories, serving 906 locations allowing it to be a market leader in LTL goods transportation. This network increases the customer base since a consignment can easily be transported from one place to another without hassle.

- The Company has also established a vast network of branches and franchisees with in-house designing of vehicles body and maintenance facilities to cater to parcel transportation.

In-House Research and Development:

- In-house research enabled VRL to experiment with newer products and technologies on vehicles and design them to increase the utilization life of the asset and decrease maintenance costs. The Company has created lighter and long-lasting vehicles allowing them to transport higher payloads. This improves the margins of the business.

Diversified Customer Base:

- VRL serves a diverse customer base, most of whom are B2B customers. The Company has a well-diversified customer base of 7 lakhs + clients across several industry sectors. As of FY22, the Company’s largest and top 10 customers contribute only 1% and 3% of the revenues of the Goods and Transport Business, respectively.

- The Company also has no product or geography-related dependence, which insulates it from its competitors.

Weaknesses

Lack of Own Infrastructure at Key Locations:

- Contrary to the Company’s model of owning infrastructure, in locations like Chennai, Delhi, Hyderabad, Bengaluru, Pune, Kolkata, etc., it operates with the help of long-term leases in other areas, which restricts business operations to a certain extent because the Company is unable to implement its best practices and techniques on leased hubs.

- The ownership of premises at crucial business locations would have provided the Company with better operational flexibility, leading to considerable cost savings and enabling the Company to scale up its services.

Labour Shortage:

- The Company depends highly on skilled labor and drivers for its day-to-day operations. Supply of trained drivers and labor is low, making the Company vulnerable to disruptions in operations due to labor agitations.

Capital Expenditure:

- Although the asset-intensive model has several advantages, the Company is at risk of incurring massive CAPEX at frequent intervals due to replacement costs. This is likely to raise the debt burden. Several states have laws stating that vehicles over a particular age cannot be utilized; such laws may soon become applicable in other states, reducing the fleet’s useful life and resulting in considerable replacement costs.

Opportunities:

Government Initiatives:

- Revision in Safe Axle Weights for goods transport vehicles by the Ministry of Road Transport and Highways transport has permitted carrying heavier weights on goods transport vehicles. This enables VRL to carry higher payload at the exact cost resulting in better profit margins. Specific fundamental legislative changes regarding bus operations to reduce competition are expected in the near term in favor of organized private-sector players.

E-way Bill and Fast Tag

- Earlier verification of documents and inter-state vehicle movement permissions consumed about 60% of the time to reach the destination. However, with the implementation of e-way bills and fast tags, the freight transport industry has primarily benefited significantly from the organized players as it has been easier for them to adapt to the changes compared to small and unorganized players.

Threats:

Fuel Cost:

- Fluctuations in fuel prices resulting from diesel de-regulation, input costs, lorry hire charges payable to third-party vehicles, and toll taxes significantly affect the Company’s profit margin. The cost of fuel, in particular, has drastically increased in the past few years, resulting in poor profit margins.

Road Network:

- VRL’s operations are heavily reliant on roads and highways. Several factors beyond the Company’s control, such as political upheaval, adverse weather conditions, natural disasters, and inadequate road maintenance, can influence passenger travel and goods transport industries.

Differentiating Strategies

1. Own Fleet and Infrastructure

- VRL has a strategic advantage because it owns a large fleet of vehicles. Apart from 4,754 trucks, 337 buses, 2 aircraft, and 47 transshipment hubs with advanced facilities, the Company also owns fuel stations at critical locations and software systems enabling them to reduce operational costs, improve quality, and tackle issues immediately. Own buses ensure safer and better services. Overall, the Company is free to decide payload, route, and control its operations.

- The asset-heavy model is said to be advantageous for road logistics to ensure on-time delivery in India, based on research conducted by Deloitte. The Company has outperformed peers in the past ten years with a 12% CAGR in revenue. Currently, third-party vehicles account for only 8-10% of the total kilometers covered by the goods transport business.

- VRL has invested in IT infrastructure which connects all agencies, branches, hubs, and vehicles and enables real-time operations tracking.

2. In-House Research and Development, Interior Development, and Vehicle Maintenance

- Having an in-house research facility, the Company can design its vehicles to make them lighter and more durable. When vehicles are more lightweight, they can carry additional goods while still adhering to all Government regulations related to weight. The trucks can carry an excess of 1.5 to 2 tons due to this design, increasing the margin. Also, the Company can track fuel consumption on a real-time basis.

- VRL has also built a robust indigenous capability and achieved a high level of integration in its operations, allowing it to maximize capacity utilization and profitability. Its in-house bodybuilding factory produces lighter cars with more extended bodywork, allowing it to carry more freight per vehicle and sustain increasing profitability.

3. Differentiated Consignee

- VRL has created a distinct consignee-driven business model, emphasizing the high-margin Less than Truckload (LTL) industry. The fundamental rationale for the unique consignee model is to meet the needs of small and mid-sized clients underserved by large companies. VRL’s extensive network of delivery locations limits its reliance on a few large customers and, as a result, the risk of business concentration.

4. Large Network

- The Company serves 906 locations across the Country. The ‘Hub-and-Spoke’ model improves utilization and reduces the cost in the case of LTL and express delivery consignments. This distribution model needs transshipment hubs at multiple locations to be effective. VRL owns 47 hubs spread across 22 states and 5 union territories. An extensive network has helped the Company gain a large customer base because customers prefer a service provider who is present at both the source location and destination.

- Most players in the industry own less than five trucks and have a small customer base. Hence LTL service is less profitable for them. While its competitor, Mahindra logistics, serves only 500 locations in 12 cities.

5. Technology and Automation transforming VRL into a NextGen Player

- All of the Company’s operations are linked through software. Bookings, transhipment, and delivery all take place in real time. Truck maintenance and material management may also be tracked in real time.

- The bodybuilding of trucks is done in-house, strengthening the truck’s body. Robots undertake the painting of trucks in their workshop.

6. Cost Management & Reduction Strategies

- Cost efficiency is a part of VRL’s vision. The Company maintains an efficient working capital model by serving customers only with pre-paid or payment-on-receipt options reducing the trade receivable days. The Company has shut down 81 non-performing branches and added 49 new branches.

- Further, the Company has reduced the overall distance covered by 3rd party vehicles to only 8% to 10% of the total distance travelled because they are expensive, impacting the margins of the Company. VRL uses hired vehicles only when it reaches a 100% utilization level of its vehicles and incurs lease expenses only when used in business operations. The Company also has a centralized maintenance facility and sourcing of spares, in-house designing, and tie-up with Indian Oil Corporation to benefit from economies of scale.

- VRL controlled key costs by using biofuel instead of diesel and procuring fuel directly from refineries. The Company also owns its fuel stations at key locations that help it procure diesel directly from refineries at a cheaper rate than other domestic operators. Furthermore, VRL is even planning to increase the life of spares and is changing the maintenance schedule to reduce the cost of consumables.

Michael Porter’s 5-Forces Analysis

Barriers to Entry

- Logistics is a capital-intensive business model requiring a high amount of capital along with the cost incurred while replacing assets. Moreover, depending on 3rd party vehicles is always a less preferred solution as certain vital benefits are lost. VRL’s ownership of its fleet and infrastructure gives it a leading advantage over its competitors.

- Buses and trucks must get permission and approvals from the state and federal governments to operate smoothly. Regulations frequently change, making it difficult for small truck owners to adapt and comply.

- Any company that intends to establish operations in major cities would need acres of land in the coming years. Land prices are already skyrocketing in metropolitan cities. This can increase the amount of capital required even more. Therefore, the barriers to entry are very high for the logistics industry.

Bargaining Power of Suppliers

- The transport and logistics businesses are highly dependent on labor and drivers who are well-trained and willing to travel long distances. Also, they are prone to accidents on-site or during travel; since not everyone is willing to work under such conditions, their bargaining power is high. The formation of trade unions can further strengthen labor power, especially in decisions related to compensation or wage hikes.

Bargaining Power of Buyers

- The goods transport industry has very few players in the organized sector that own a sufficiently large network that can cover long distances and achieve economies of scale. Furthermore, relatively few players have the vehicle design expertise to carry a variety of commodities. Since only prominent players can provide better service at a competitive price, it weakens the power of the customers in the goods transport business.

- The bus operations division has significant competition due to many state-run operators and private players. Due to the increased usage of online booking websites allowing comparison between service providers, buyers tend to have higher bargaining power.

Rivalry among Competitors

- The market is fragmented, with a large number of players in the unorganized sector, making it challenging to achieve leadership in all locations or routes. About 70% of the players own less than five trucks. Moreover, small players can easily dominate local markets.

- Most start-ups are set to capture the market share using an aggressive pricing strategy, even at the expense of profitability. However, significant players have an advantage due to their network and diverse customer base across different locations and industries. Therefore, the rivalry among competitors in the industry is intense.

Threat from Substitutes

- Fluctuations in fuel prices resulting from diesel de-regulation, lorry hire charges payable to third-party vehicles, and input cost significantly affect the Company’s profitability margins.

- Several states/cities have prohibited the entry of commercial diesel-driven vehicles beyond a certain age. This necessitates the shifting the older vehicles over the permitted routes, thereby entailing costs.

Branding & Other Initiatives

- 28% of the total fuel used by VRL in FY20 is biofuel. Also, Radio Frequency Identification Devices (RFID) are used in all vehicles to monitor fuel usage. RFIDs help in tracking the fuel type and quantity re-filled.

- The Company has a Certified Emission Reductions (CERs) balance of 3,18,800 units which it earned through the use of bio-diesel and wind power generation. VRL entered into a long-term agreement with Asian Development Bank (ADB) to purchase all its carbon credits.

- Providing drivers with all the benefits provided to full-time employees and incentives based on performance are unique benefits. Drivers are registered under the group insurance policy and are offered unique training at their Hubli facility. The Company annually conducts awareness programs in rural areas to encourage more people to choose this occupation.

- VRL’s wind power project has received accreditation from United Nations Framework Convention on Climate Change (UNFCCC).

- The Company currently operates around 40 electric trucks for its last-mile operations and continuously adds to this number.

Financial Analysis

1. Profit Margin: VRL Logistics reported a profit of INR 16,011.26 lakhs in FY22, rising by a staggering 255%. After a persistent decline in profit since FY18, the Company resumed its uptrend in FY22 due to cost-cutting strategies implemented by management. These strategies include using biofuel, implementing fast tags on all vehicles, resulting in a significant discount on toll costs, and deploying owned vehicles, reducing reliance on outside cars. Increased clients from 0.4 to 0.7 million have also contributed considerably to the increased earnings.

2. EBITDA Margin: The Company’s EBITDA grew in absolute terms from INR 24,846.44 lakhs in FY18 to INR 25,191.92 in FY19 but declined as a proportion of revenue from 12.83% to 11.90%. Despite many cost-cutting measures such as the implementation of fast tags, the procurement of bio-fuels, the termination of 43 non-performing branches, and the addition of new functioning units, the Firm has failed to run efficiently, as seen by the drop in EBITDA margin.

EBITDA decreased by 15.63% in FY21, from INR 30,858.48 lakhs to INR 26,035.04 lakhs, mainly owing to the pandemic. In FY22, EBITDA climbed by 6.7%, from INR 26,035.04 lakhs to INR 42,098.16 lakhs, and as a proportion of revenue increased from 14.66% to 17.46%. The improvement in EBITDA is mainly because of the increase in Goods Transport (GT) and freight rates. Higher GT resulted in growth in revenue, and specific variable and fixed costs declined due to operational synergies.

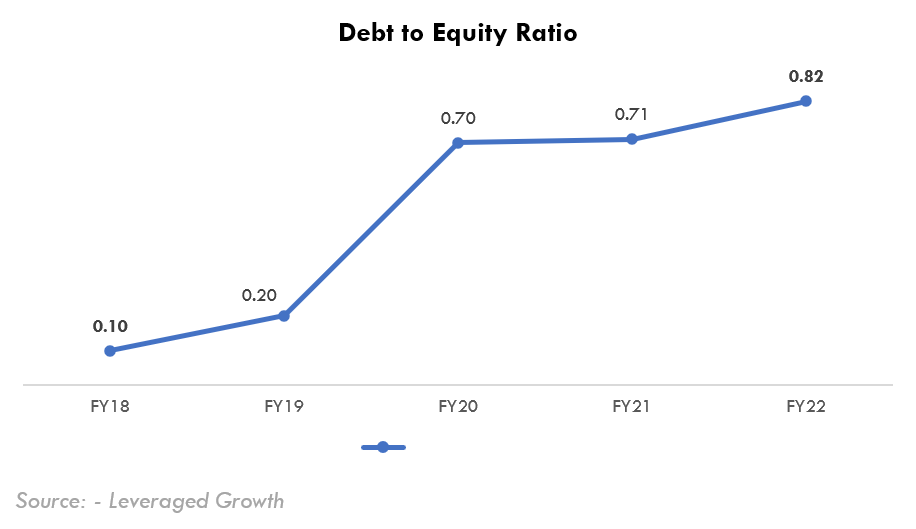

3. Debt to Equity Ratio: The net debt level escalated from INR 6,277.58 lakhs in FY18 to INR 12,879.84 lakhs in FY19, rising 105.2% primarily to fund capital expenditure through increasing debt. During FY19, the Firm secured a loan to support the purchase of certain Goods Transportation Vehicles and establish Surat’s logistics infrastructure. The debt in FY20 grew to INR 43,081.24 lakhs as fixed lease payments increased. The Firm raised loans during the year primarily to acquire Goods and Transportation Vehicles. In FY21, the Company did not raise any further debt, thereby keeping the same debt-to-equity ratio. The debt-to-equity ratio increased by 16.62% to 0.82 in FY22, with an increase in debt of INR 53,660.48 lakhs. The increase in the ratio is on account of additional borrowings made by the Company to incur capital expenditure during the current year and an increase in the lease liabilities on account of additional premises taken on long-term leases for the expansion of the Company’s operations.

4. Current Ratio: The Current Ratio of FY18 stood at 1.07, which increased to 1.38 in FY19. The current asset for this period remained relatively the same, and the improvement in the ratio is due to a drastic reduction in short-term borrowing through the utilization of cash credit limits. The current liability spiked up from INR 12,388.18 in FY19 to INR 25,249.48 in FY20, rising by a staggering 103.8%, mainly resulting from a significant increase in lease liability of INR 8,389.32, thereby increasing the Company’s current liability resulting in a substantial fall in the Current ratio to 0.69.

Environmental, Social, and Governance

Environmental

VRL is continuously shifting to a battery forklift model, eliminating the need for gas and oil. Not only is this good for the environment, but it is also safer for employees. These slashes the incidents related to hazardous materials handling and cost reduction, which drives up the bottom line. For environmental conservation, the Company has started replacing normal lead acid batteries with lithium-ion batteries since the latter has an advantage of about 70% efficiency compared to lead acid batteries.

Social

VRL Logistics has always been committed to the cause of social service and has repeatedly channeled a part of its resources and activities to affect society socially and ethically. The Company and its promoters have taken up various Corporate Social Responsibility (CSR) initiatives such as the development of healthy and safe working conditions, the establishment of management of orphanages, old age homes, sanatoriums, dharmshalas, and institutions of similar nature for enhancing the value of the community. VRL has developed and has been transferring to the use of biofuel to limit the emission of pollution.

Governance

The Company is committed to maintaining steady standards of corporate governance and adhering to the requirements set under the extant law. As of 31st March 2022, the board consists of twelve directors, of which two are managing directors who are also the promoters of the Company, two are whole-time executive directors, and the rest are non-executive directors. These twelve directors also consist of one independent woman director. There are a total of six independent directors on the board.

None of the directors are disqualified as per the provisions of section 164(2) of the Companies Act 2013. The company directors have made necessary disclosure as required by various provisions under the Companies Act.

Risk Analysis

1. Liquidity Risk: Liquidity risk is the risk that the Company will not be able to settle or meet its obligations on time or at a reasonable price. For the Company, liquidity risk arises from commitments on account of financial liabilities – borrowings, lease liabilities, trade payables, and other financial liabilities. The Company’s senior management and treasury department are responsible for liquidity and funding. The administration further monitors the Company’s net liquidity position through rolling forecasts based on expected cash flows.

2. Credit Risk: Credit risk arises from cash and bank balances, current and non-current financial assets, and other assets carried at amortized cost. To manage credit risk, the management periodically assesses the financial reliability of customers and counterparties, considering the financial condition, current economic trends, and aging accounts receivables.

3. Cyclicity: VRL owning a large fleet, needs to incur maintenance costs even when vehicles are not used. The business is at risk during a low business season or economic downturn like COVID-19, where revenue is less, but the price remains at risk.

4. Changes in Government Policies: Policies are subject to frequent changes. Different states have different policies. For example, restrictions on the usage of vehicles beyond certain useful life and change in the weight that can be carried by trucks. These regulations can impact the Company’s vehicle utilization.

COVID-19 Impact

The trucking industry, considered the backbone of India’s economy, had been battered by the imposed lockdowns at the onset of the pandemic’s second wave, especially after seeing a steady recovery over the last couple of months from the first wave. The profitability had come under significant pressure for the Company and the industry due to subdued asset utilization and higher fixed costs.

With cost-control measures undertaken by the Company and a focus on working capital management, it has been able to alleviate concerns about profitability to a large extent. The management believes that the Company hit its trough during the raging pandemic last year and is better prepared to handle such a crisis and ensure the continuity of business operations.

The EndNote

VRL Logistics has performed well this fiscal year and looks to improve this performance by implementing several cost-cutting strategies, including converting diesel forklifts to electric ones. The Company is giving special preference to procuring energy-efficient equipment and replacing the existing ones. The Company has started using lithium-ion batteries in 112 branches across the Country and has adopted 19 electric vehicles for fuel conservation.

The Company has entered into a Memorandum of Understanding (MOU) with Ratna Cements Limited for the sale of the Wind Power Generation Business on a going concern basis. The Company’s main strengths are the asset-intensive model and its own research capabilities because it allows them to have control and flexibility and implement best practices to stay ahead of its competitors. VRL’s diverse customer base allows it to generate revenues throughout the year, irrespective of the season or economic cycle. For example, during the lockdown, VRL could function by serving businesses that manufacture or distribute essential goods.

Considering all the cost-cutting strategies taken up by the management: – Will VRL’s market share in the logistics industry see an upward trend?

Disclaimer: The report and information contained herein is strictly confidential and meant solely for the selected recipient and maynot be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. Certain transactions -including those involving futures, options, another derivative product as well as non-investment grade securities – involve substantial risk and are not suitable for all investors. No representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alternations to this statement as may be required from time to time without any prior approval. Leveraged growth, its associates, their directors and the employees may from time to time, effect or have affected an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any company referred to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting the document. This report has been prepared on the basis of information that is already available in publicly accessible media or developed through analysis of Leveraged Growth. The views expressed are those of the analyst, and the Company may or may not subscribe to all the views expressed therein. This document is being supplied to you solely for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, Country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Leveraged Growth to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. Neither the Firm, not its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The person accessing this information specifically agrees to exempt Leveraged Growth or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold Leveraged Growth or any of its affiliates or employees responsible for any such misuse and further agrees to hold Leveraged Growth or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

Contributor: Team Leveraged Growth