Introduction to Personal Finance

Personal finance is the management of your money through saving and investing. It is concerned with budgeting, insurance, mortgages, taxes, and retirement planning. It is about achieving your financial objectives, whether they are short-term financial needs, retirement planning, or education planning for your child based on your income and living expenses. To become the ‘jack’ of managing personal finances, it is crucial to be financially literate.

In a country like India, where literacy is at 80%, financial literacy accounts for 27% of the population. Only 3.7% of those who are financially literate invest in financial assets. However, China’s financial literacy rate is 12.7%, whereas, in the United States, 55% of the population invests in financial assets.

As per National Centre for Financial Education (NCFE) 2019 survey, overall financial literacy is observed to be highest in 18 years to 29 years old. Whereas, salaried and retired people are observed to manage their personal finances better as compared to the self-employed group.

The Paradigm Shift in Personal Finance post Pandemic

The pandemic has had a significant economic impact. Many consumers have changed their spending habits, carefully allocating resources between ‘wants’ and ‘needs.’ According to the InterMiles Consumer Spending Sentiment Index report, 90% of consumers have changed their personal spending habits since the pandemic began. Spending habits have also shifted, with 21% of consumers increasing their spending on essential products while only 3% increased non-essential spending.

According to surveys, 70% of people aged 17–36 in India are concerned about their future finances, compared to 49% globally. Following the pandemic, roughly half of the younger generation has already started their investment journey, owing to increased digitization and internet penetration.

The popularity of digital payments has skyrocketed. Digital payments, online streaming, online grocery shopping, and other previously restricted services are now widely available in India, including in small towns. Digital transactions increased to 98.5% of total non-cash retail transactions in FY21, up from 97% in FY20.

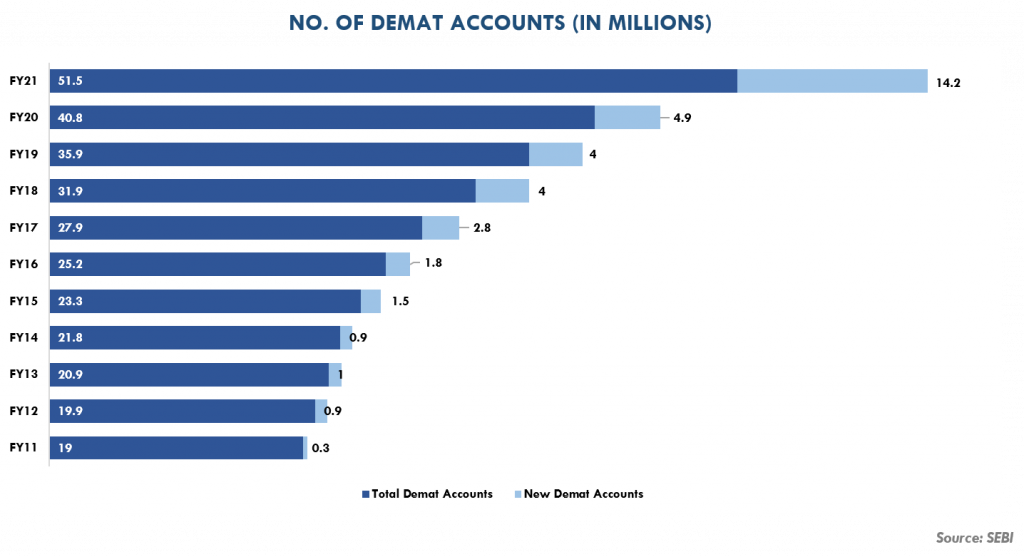

The pandemic-driven restrictions and job losses left millions of people at home with little to do but participate in the booming V-shaped recovery post-June 2020. Brokerages and exchanges on average added approximately 1.7 million demat accounts in January 2021 alone, taking the total to 51.5 million accounts as of January 2021. The addition of new demat accounts during FY2021 has been the highest since the past 10 years i.e., 14.2 million accounts. The lower stock prices served as an additional impetus for investors to enter the markets and explore opportunities in equities. Individual investors’ share of total turnover on stock exchanges has increased by 6% to 45% in March 2020, up from 39% the previous year.

Investors discontinued their SIP during the pandemic year due to job losses and rising healthcare costs; as a result, SIP collection for FY’20 fell 4% from the previous year’s collection of ₹1,00,084 crores.

However, with the economy on the path to recovery, SIP contributions continue to record robust inflows every month, as investors have become more cautious in building an emergency fund for a rainy day. The SIP contribution totalled ₹77,978 crores from April to November 2021, which is approximately 24% more than what was received during the same period last year, raising hopes that it will soon reach pre-covid levels.

Thumb Rules of Personal Finance

- Start early to be free: Even if the investment amount is the same, early investors have a much larger corpus at the end of the maturity period than later investors. The earlier the investments are made, the lighter the monthly savings burden. Compounding has no effect unless investments are put to work for an extended period with no interruptions. According to research, people do not start planning for retirement in the first five years of their careers. Even after ten years, only 20% of people start thinking about retirement.

- Save aggressively: While most investors start saving early, inflation causes them to underestimate their financial needs. Even with a nominal inflation rate of 6%, monthly expenses can skyrocket to unfathomable heights.

- Avoid Debt trap: When interest rates are low, it is best to pay off or refinance the highest-interest-bearing debt in the portfolio first. Increasing expenses in relation to income may lead to greater use of EMIs, which can be a costly option. Household debt as a percentage of GDP has risen from 32.5% in FY20 to 37.3% in FY21, primarily as a result of the Covid-19 pandemic.

- Use the 70-20-10 Rule: Divide your monthly income into 3 parts based on a specific percentage (i.e., 70%, 20%, and 10%). Use 70% of your income for your monthly expense (i.e., your needs and wants). Divert the 20% of your pay into savings. And the remaining 10% of it is used to pay off the outstanding debt/loans.

- Investing in the right options: Since only 27% of Indians are financially literate, it is critical to invest in the right options because the time value of money dictates that some financial assets are more expensive to invest in. Furthermore, the amount collected would be much lower if the corpus was invested in other assets.

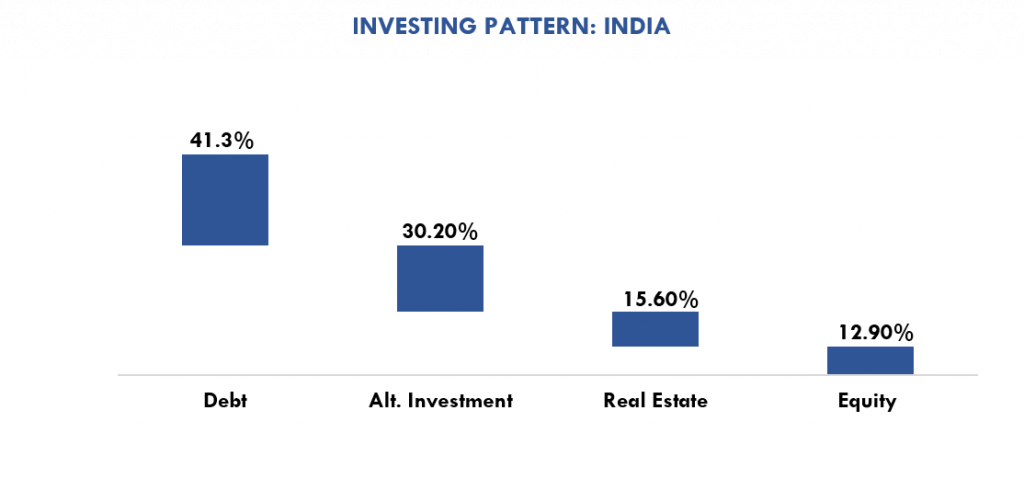

Despite higher returns, fixed income accounts for 53% of total financial savings, while stocks and mutual funds account for 10%.

Investing Pattern

Equity investments account for 12.9% in India in comparison to the rest of the world which invests 26.1%. The presence of more risk-averse investors in India makes debt and alternate investments one of the most preferred assets.

With an aim to create financial awareness, the RBI released the second National Strategy for Financial Education (NSFE) for the period 2020-25 on 20th Aug 2020. The strategy focuses on developing adequate knowledge, skills, and behavior needed to manage money among the various sections of society. NSFE lays down 5C’s approach to achieve its objectives: Content, Capacity, Community, Communication, and Collaboration.

There has been a substantial improvement in understanding financial products in the past 5 years, with financial literacy reaching 27% in 2020 as compared with 13% in 2013.

Contributor: Team Leveraged Growth