A real estate investment trust (“REIT”) owns, operates, and finances income-generating real estate properties. REITs offer a pleasing investment opportunity to benefit from the developing real estate market, which supplies regular income in the form of dividends and total returns.

Approximately 145 million Americans own houses that are invested in REITs through their 401(k), Individual Retirement Accounts (IRAs), pension plans, etc. The U.S. listed REITs have a whopping equity market capitalization of $1.35 trillion

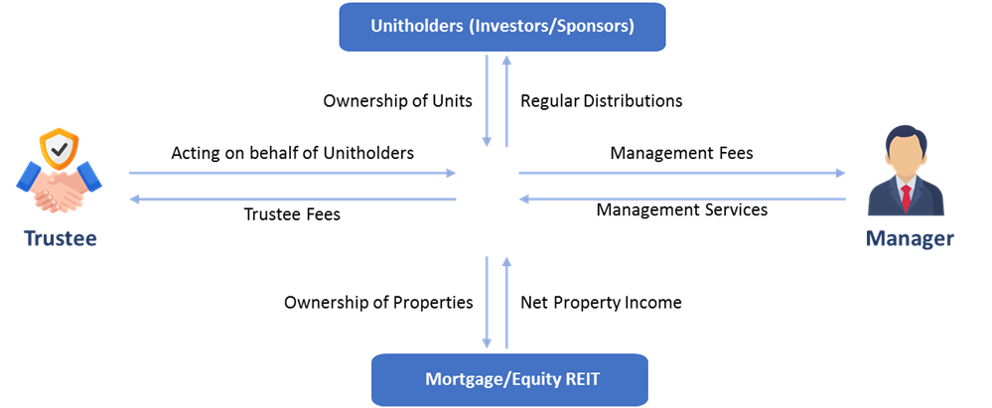

Structure of REIT

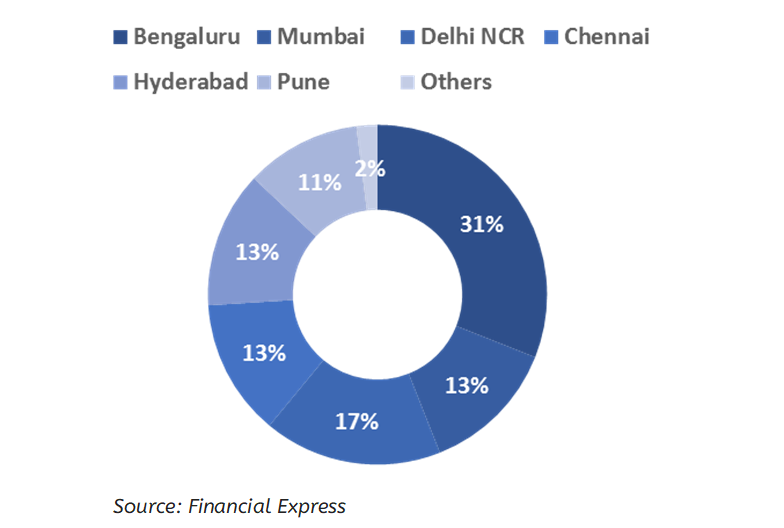

REIT has been proven successful in established and matured markets and is predicted to leave a dent in the Indian property market as well. REITs can only own or invest in income-generating residential, industrial, specialized, retail, etc properties across all sectors. In India, office segment REIT alone occupies 294 Mn. sq. ft, which might cause an inflow of approximately $35 bn. The concentration will be largely seen across all metropolitan cities such as Bengaluru, Hyderabad, Chennai, Delhi-NCR, Pune, Mumbai, etc. REITs pay no corporate tax in exchange for fulfilling its requirements of distributing 90% of their taxable income to shareholders as dividends. However, this is only applicable in Belgium, Finland, Germany, Hungary, Italy, Malaysia, Singapore, UK, and India. Globally, REITs have a combined market capitalization of approx. $1.70 Tn.

Stages of REIT Maturity Regime

Here are some unique features of the REIT structure:

- Minimum investment by the REIT should be ₹500cr.

- REITs can invest in securities, properties, or Transfer of Development Rights (TDRs) in India but not in vacant land or agricultural land.

- A REIT must hold a minimum of 2 projects (max 60% per project) with 80% of the REIT assets invested in completed rent-generating properties.

- Assets should be held by the REIT for a minimum of 3 years from the date of purchase.

- A minimum of 75% of the regular revenues of the REIT must be from rental and leasing activity, and 90% of that rentals and proceeds of sale to be distributed to unitholders.

- Have a minimum of 100 shareholders after its first year of existence.

- Do not have more than 50% of its shares held by five or fewer individuals.

Due diligence and Consideration Analysis of REITs:

1. Remaining Lease Terms

In a booming environment, short term lease expiry offers an opportunity to mark to market on rents. Whereas a declining economy affects the lease contracts by fetching lower rental rates through mark to market. The weighted average lease expiry of REITs in India is 6.5 years.

2. Geographic/Tenant Concentration

Tenants that occupy significant spaces of the REIT should be noted as they could pose a serious threat to the performance of the REIT. The maximum amounts of rent collected from the specific geographic regions should also be noted due to any natural calamity or loss in the region at the macro level.

3. Cost of Re-leasing Space

When the old lease expires, the landlords have to bear downtime between two leases, allowance for tenants’ improvements, brokerage commission, etc.

4. Market Rent Analysis

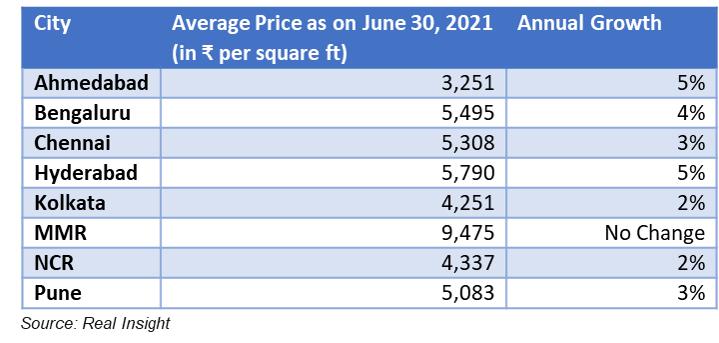

The current market rent environment is to be analyzed to compare with rents paid by existing tenants of the REITs. This can be used to predict future cash flows. The returns of REITs can increase with the increase in rents and lower vacancy rates and vice-versa. Since the start of the pandemic in March 2020, the vacancy rates in office spaces have shot up to 16.6% in June 2021. However, the collection rates for REITs continued to be 99%, which means the existing tenants are paying rent in full and rental rates haven’t fallen much. The residential real estate rent has increased in Q1FY2022 and rates of new apartments have risen by 2% – 5% owing to the pandemic-hit economic recovery.

Price Growth: City-wise Break-up

5. Management/ Leverage Analysis

The balance sheets of REITs are highly capital intensive; hence they are highly leveraged in terms of debt. The leverage tends to increase in the crisis period due to delayed lease renewals and early tenant exits. The review of management’s skills, qualifications, performance records, years of experience, etc. must be analyzed while investing in REITs.

Bengaluru has the largest IT spaces occupied by prominent global players; quality asset space forms a favorable REIT. Bengaluru has the highest REITable assets aggregating to 97.8 Mn sq. ft., which is worth $10.7 bn, followed by Mumbai aggregating to 49.7 Mn sq. ft., worth $ 8.6 bn. Mumbai has REITable assets half of Bengaluru but, in value terms, it is approx. near Bengaluru due to the high per sq. ft office capital values of Mumbai. Chennai, Pune, and Hyderabad also are preferred choices by IT and global companies, this might drive the REIT growth. These three cities together culminate 37% of the entire REITable assets in India.

What is its past performance?

When annual returns (%) of FTSE NAREIT (National Association of Real Estate Investment Trust) All Equity REITs are compared to S&P500, the performance between the two differs by a small margin from 2008. After the GFC, the growth in the real estate sector as compared to the index has not bounced back. NAREIT tracks historical returns of REITs since 1972. REITs outperformed the S&P500 index over the long run till 2008. The year 2008 was a turning point within the performance of REITs keeping in view the GFC and from then on, the returns have shown sluggish growth.

Performance of S&P500 VS FTSE NAREIT All Equity REITs

Within the first six weeks of 2020, The FTSE Nareit All Equity REITs index reached a high with a year-to-date total return of 7.4%. REITs outperformed the broader markets early in the year, as the S&P 500 had a 5.1% total return at its peak in mid-February. As COVID-19 was discovered and spread rapidly in the United States, these gains quickly vanished and were replaced by double-digit losses. Markets hit rock bottom in mid-to late-March, with REITs down 41.9% from their peak in February. Broader market indices, such as the S&P 500 and the Russell 1000, fell by comparable amounts. Data Centres and Infrastructure have shown outperformance since joining the REIT sector in 2015 and 2012 respectively. Demand for data centers and infrastructures has increased in recent years due to the rapid growth of data usage. Self-Storage REITs have grown in popularity due to their low construction and operating costs, which allow them to be profitable even at low occupancy rates.

Performance by Property Sector from 1994 – 2020

The success of REITs in the international markets before 2020 encouraged the setting up of the first REIT in India by Blackstone with Embassy Group, which stimulated the possibility of the real estate sector to achieve new growth heights. In FY2020, the Net Operating Income and Revenue from Operations of Embassy Office Parks REIT grew by 15% to ₹1817 crore and 14% to ₹2144.9 crores. Since its listing, Embassy has paid out ₹2,760 crore in total distributions to its shareholders. Since the performance of REITs is closely dependent on the economic cycle, this may serve as a stumbling block in times of low growth and recession. While there are two sorts of REITs—commercial and mortgage—in India, only commercial REITs are available now.

What impact does it have due to COVID?

The effects of the GFC were felt in industrial, residential, and mortgage property values in 2008. With the 2020 pandemic, the retail, mortgage, and hospitality sectors are likely to face situations that are irreversible for several years. This is in contrast to the 2008 GFCs, which had a negative impact but did not have the same level of impact on human behavior toward REIT services. Data centers and self-storage REITs are the least affected sectors that have thrived globally during the pandemic. They have provided an annualized return of 21% and 12.91%, respectively.

In India, commercial real estate continued to be a resilient, low-risk asset class as India is an IT outsourcing hub globally. Embassy and Mindspace REITs have underperformed against NIFTY50 in June 2020 and Embassy REIT hasn’t regained pre-Covid levels till now.

The current trend of Work from Home and teleconferencing culture has led to new leasing decisions and expanding office spaces defer for the short term. Deposit rates falling in the range of 6 – 8% coupled with the declining value of the rupee against the US Dollar have facilitated NRI investments in real estate assets. The NRI investments have stood at $13.3 billion in FY2021. Bengaluru has emerged as one of the favorite destinations of NRI investments in REITs.

What investment opportunities it has?

An active proposition of steady returns and a low-risk instrument as an investment tool for retail investors gives an edge to benefit from the movements in the real estate market. The property market is not as liquid as the stock market, and each share of REIT offers liquidity and flexibility to bet on the real estate market. Additionally, the absence of effective operational costs and other costs associated with ownership enhances the lucrativeness of REITs. In India, retail investors must commit at least ₹ 50,000 to be a part of REIT issuance. SEBI has reduced the lot size from ₹50,000 to ₹10,000 – ₹15,000 to increase participation and liquidity.

However, stabilization in the near term is not expected on account of retail bankruptcies and store closures. It is observed that rents have declined for straight two years after the 2001 recession and 2008 GFC, this suggests that after the 2020 recession, the losses in real estate will not bottom out till 2023 even if the economy continues to recover.

The reduced construction as a percentage of the total existing stock has kept the vacancy rates in check. The long-term leases for most types of commercial real estate with tenants having several years remaining may have continued to pay rent even if the office spaces are largely empty. This may have acted as a buffer against the crisis for REITs.

Contributor: Team Leveraged Growth

Co- Contributor: Tisha Agrawal

Research Desk | Leveraged Growth