Click here to download the report

Key Highlights of Linc

- The company was renamed on 13th December 2021 as Linc Limited (formerly known as Linc Pen and Plastics Limited)

- Linc Limited has graduated from a stationery-centric company to a multi-product organization

- It has embarked upon an expansion plan in Gujarat and has simultaneously discontinued its manufacturing operations at Falta (SEZ), West Bengal

- The company has adopted a “phygital” (physical+digital) approach for the distribution of its products

- There has been a major debt repayment, and the current net debt to equity ratio stands at 0.02 in FY22 as against 0.54 in FY18

- Promoters’ holding has decreased marginally in FY22 due to liquidation from one of its non-core promoters

The Indian Writing Instruments Industry

• The Indian market size for writing instruments is approximately ₹10,000 crores

• In the non-paper category of stationery products, ball pens and gel pens account for the largest share of the market

• The market for pens below ₹15 is growing at 7-8% annually, whereas the market for pens above Rs 15 is growing at the rate of 8-10% annually

• The major growth drivers for this industry are the rising population, greater emphasis on education, and the demographic dividend opportunity for India

Linc-Ing the Gap Between Thinking & Writing!

The 46-year-old, Kolkata-based brand, Linc Limited (NSE: LINC), is one of India’s most trusted writing instrument manufacturers and distributors, with an international presence in over 50 countries. Being one of the top three companies in the Indian writing instruments industry, Linc enjoys a market share of 7.8% (as of 2020) in the Indian pen market. Moreover, the company relishes monopoly power in India as the exclusive importer and distributor of products of Deli (Asia’s biggest stationery brand) and Uni-ball (the renowned pen and pencil brand of Mitsubishi Pencil Company Limited of Japan). Linc also has its plethora of products to offer; Markline and Pentonic being its flagship brands. Office Linc and Just Linc are the direct retail front superstores launched by Linc Limited, which are filled with an assortment of stationery and office supplies. The company caters to both B2B and B2C markets. Integrity, innovation, and inclusion are the three I’s that the company swears by, and to retain its mammoth position in the writing instrument industry, Linc focuses on enhancing its availability, accessibility, and affordability.

Journey

The journey of Mr. Surajmal Jalan (the founder of Linc Limited) can be described as going from rags to riches. Born in 1938 in rural Rajasthan, Mr. Surajmal is an epitome of a man with a vision in his mind and vigor in his veins. At 19, he decided to write his destiny and headed to Kolkata to earn a living. In 1966, his efforts had to pause as he was called back home to take care of his aging parents. However, this turned out to be a blessing in disguise. Instead of sitting idle at home, Mr. Surajmal decided to use his savings to sell pens in his village. He started with an investment of ₹5,000 and, amidst this, he realized that there were no quality pens in the market. This gave way to a bigger vision and ignited the entrepreneur in him. After two years, Mr. Surajmal again headed to Kolkata, and this time he started a retail shop for pens in the city’s biggest stationery market, Bagree Market. He also opened his own pen manufacturing unit with an investment of ₹10,000 and started making plastic parts for ball pens. Soon, these pens became the cynosure of the writing instrument industry, and finally, it was in 1976 that Mr. Surajmal launched the brand “Linc” (which means “to connect”). In 1980, his son, Mr. Deepak Jalan, joined as a sales trainee when the company’s turnover was ₹1.5 crores. Mr. Deepak is the Managing Director of Linc Limited, whose market capitalization is ₹413 crores as of 31st March 2022.

Industry Analysis

Owing to both a national and international presence, we must analyze both geographical markets to understand Linc’s overall growth prospects.

- The global writing instruments industry is estimated to reach a market size of $20.6 bn by 2027, growing at a CAGR of 3.8%. This sector is set to increase by $758.48 mn between 2021-2026.

- The global ballpoint and gel pen market is estimated to grow at a CAGR of 5.7%, i.e., from $5.8 bn in 2020 to $8.5 bn by 2027.

- The United States dominates the international writing instruments industry with a market share of ~ 27%. Its innovative, multi-purpose, and digital-friendly stationery products are major threats to any player in the global market.

- In India, the writing instruments industry comprises pens, pencils, markers, and highlighters; pens (the core product line of Linc) account for the largest share of the market. ~80% of the revenue of the Indian pen industry comes from pens that are below ₹15 per piece.

- The Indian writing instruments market size is ~ ₹10,000 crores and is expected to grow by over 8% per annum in the coming years.

- As per recent statistics, ~55% of the consumers of writing instruments in India are students, and ~20% are working professionals. This makes growth prospects in India even stronger as the country has the largest number of school-going students (~25 crores). Moreover, India has the largest population in the age bracket of 5-24 years (~58 crores), and the country’s working population is estimated to grow by approximately 20%.

- Linc, Cello, and Reynolds are the major players in the Indian pen market in the mass segment category, where the price of the writing instruments is below ₹20.

- Some important growth drivers for the writing instrument industry are the increased use of writing instruments by companies as promotional products, rising literacy rates, and the increasing population.

Business Model

1.Product Mix

- The pandemic forced Linc to virtually transform its DNA by taking a step forward to become a multi-product organization. The company plans to expand its product portfolio further by incorporating non-stationary items. They target a market share of ~15% in the Indian pen market.

- Apart from its flagship brands, Linc also sells products of other brands like Lemon, Cruiser, Klipper, Uni-ball, Deli, Lamy, and a few others.

- Its international product portfolio is different from the one for India. The former tends to be higher, with more metal components and intricate designs.

2. Revenue Mix

- As of FY22, 21.3% of the revenue has been obtained from exports, and the remaining from the domestic market. Linc is diligently working towards expanding its international footprint to make its existence even more prominent worldwide.

- Pens are the most significant product line for Linc, as over 90% of the company’s revenue is derived from the sale of ball pens and gel pens alone.

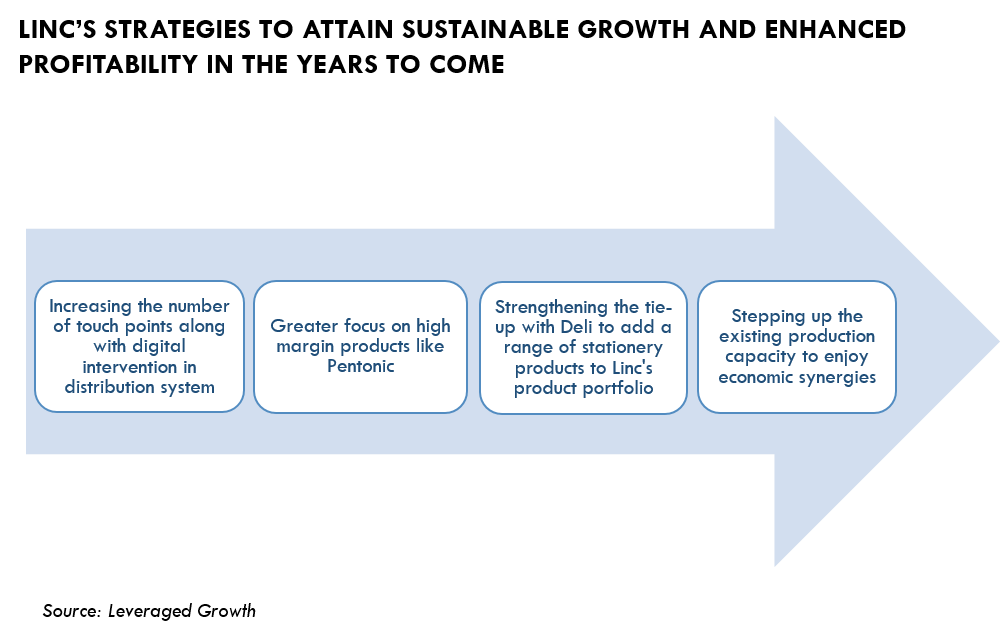

- Linc expects that its strategic partnership with Deli should add about ₹100 crores to the company’s revenue in the next three to four years, thereby increasing its contribution to approximately 15% in the total revenue of Linc.

- Moreover, Linc also aims to increase the share of Pentonic in its annual revenue from approximately 25% to ~ 32% to improve its overall margin (Pentonic has the highest profit margin in Linc’s product portfolio).

3. Manufacturing Facilities

- Linc has its manufacturing units in Umbergaon (Gujarat) and Serakole (West Bengal). The company has discontinued its operations at Falta. In a recent interview, Mr. Deepak Jalan mentioned that the company’s overall capacity is to make ~5 crore pens per month.

- Linc outsources ~50% of its products. The Pentonic wooden pencils, for example, are not produced in-house. Moreover, the margins on the outsourced capacity are 2-3% lower than the company’s in-house production.

- This blend of outsourced and in-house production is done, keeping the shareholders’ value creation goal.

- Moreover, Linc intends to double the capacity of its Umbergaon facility. However, this expansion will be executed in two phases to use capital judiciously. In phase 1, the capacity will be increased by 5,00,000 pens per day, and in phase 2, it will be increased by another 5,00,000 pens per day, thereby taking the daily production capacity to 20,00,000 pens per day.

- The total project cost is expected to be ~₹50 crores, out of which ₹35 crores will be required in phase 1. The expansion will be largely funded by internal accrual and a small loan of not more than ₹15 crores. Moreover, the phase 1 expansion will be operational by Q4FY24.

4. Distribution

- The company channels its products to the ultimate consumers through every possible access point. Its distribution footprint has trebled since FY20, reaching more than 2,15,000 touchpoints. Linc aims to achieve a minimum of 5,00,000 outlets by FY25.

- Also, the distribution process is improved due to digital intervention making the process more automated and efficient.

Tailwinds

1.Company’s Resilience and Customer-Centric Approach

Linc has shown traits of exceptional resilience, especially during the COVID-19 pandemic when the stationery industry suffered a major blow. Instead of waiting for the educational institutes to reopen, Linc understood the need of the hour and forayed into the production of various COVID-19 essentials to recover its lost revenue. The company’s strategically-sound strategies, comprehensive market knowledge, and customer-centric approach have been the key drivers of its growth and sustainability to date. The very evolution of this brand resulted from a deep market understanding of the problems faced by the customers – the unavailability of value-for-money writing instruments.

2. Strategic Tie-Ups

Exclusive strategic tie-ups with Deli and Uni-ball are Linc’s economic moat. According to Mr. Deepak Jalan, the relationship with Deli will help Linc learn about various categories of stationery, their demand, market acceptability, customer grievances, etc., thereby assisting the writing instrument giant in launching new products of its own shortly. Moreover, Linc earns a margin of ~20% on the sale of products of Deli, thereby increasing the profitability of Linc.

3. The “Thinking Out-Of-The-Box” Strategy

Innovation is the motto for a market full of almost identical products. As a result, Linc launched various unique products like Linc Twinn (the world’s first pen+pencil incorporated in one body), Linc Touch (a pen+stylus), Pentonic pens (known for their sleek look and design, which differentiates it from the traditional pens), among others.

4. Pentonic- A Watershed in India’s Writing Instruments Sector

In 2018, Linc revolutionized the industry’s belief through the launch of Pentonic pens. The bold, neat aesthetics and unconventional product building ensured that the margins of Pentonic were significantly higher than others. Pentonic pens have a gross profit margin (GPM) of about 43%, while the company’s overall profit margin is around 25%. However, despite strong growth in revenue in FY22, the company’s GPM declined by 18 basis points YoY due to an unprecedented sharp rise in the price of raw materials (crude oil and polymer). Linc launched the retractable Pentonic gel pen for ₹30 in June and will introduce another gel pen with a cap for ₹20 this year. This higher mix of Pentonic in Linc’s revenue will lead to improved profit margins, thereby giving the company a competitive edge.

5. Linc – The Name Says It All

Built on the pillars of trust, integrity, innovation, and value-for-money products, Linc has a strong brand reputation in the industry. People want to keep its products, and distributors frequently ask about future product introductions, which is a green flag for the company’s business.

6. Customer Acquisition

The stationery industry is not characterized by strong brand loyalty, making customer acquisition much easier. Hence, Linc’s attempt to maximize its reach with value for money and innovative products would be fruitful for the company.

7. Macroeconomic Factors

a. Improved Customer Approach

Recently, there has been a notable shift in customers’ approach while purchasing writing instruments in India. From being very price-sensitive, people have now become aspirational. They do not want to compromise on the quality of a pen for a marginally lower-priced product. This is a major tailwind for big players in the market because of the increased potential customer base and opportunities to widen geographies (organized market players can now enter the rural areas where there was no scope earlier due to decreased price sensitivity).

b. India’s Demographic Dividend Opportunity

India entered the demographic dividend opportunity window in 2005-06 and will remain in it until 2055-56. The Union Budget 2022-23 allocates ₹1,04,278 crores for education, and various government initiatives like Mid-day meal, Skill India, Rashtriya Madhyamik Shiksha Abhiyan, Eklavya schools, etc., are aimed to boost the literacy rate in the country. Hence, with the education sector booming and a greater proportion of students in the country’s total population, the demand for stationery products will also increase.

Headwinds

1.The Unorganized Players in the Market

There has been acute competition from the unorganized segment that offers products at a very low price, a level that the organized segment cannot breach. According to Mr. Deepak Jalan, the prominent players can’t provide pens below ₹5 per piece as it would erode their profitability. However, the unorganized segment provides pens at a price as low as ₹3 per piece.

2. Inflated Raw Material Prices

As per research, consumers rank price as the second most crucial factor behind ink color when choosing a pen. Though consumers are now relatively less price sensitive, the rise in the price of inputs can be transferred to the ultimate consumers only to a certain extent. Recently, the writing instrument industry witnessed an unprecedented rise in crude oil and polymer prices (polymer accounting for over 60% of its total raw material purchase). As a result, Linc’s GPM fell sequentially by 18 basis points, YOY, and 241 basis points. Hence, any further hike in the price of inputs accompanied by the company’s inability to simultaneously hike the price of its products can lead to a major challenge in Linc’s sustainability in the near future.

3. Customer Retention – Major Challenge

The core target audience of the stationery industry is students, who account for ~55%. As these students are dynamic, any innovative and eye-catching stationery grabs their attention. This makes customer retention a major challenge, especially if the companies do not launch new products frequently in the market. Moreover, the absence of products in the stores due to distribution-related issues exacerbates the problem of customer retention as people quickly shift to other products because of negligible brand loyalty.

4. Digitalization

Another concern of the writing instrument industry is the growing digitalization in every field accompanied by a change in exam format. These factors may not evacuate the demand for writing instruments but may suppress their need to a certain extent. For instance, the MCQ-type examinations have partially reduced the requirement of good quality pens that enable good handwriting. These pens, in turn, are manufactured by the organized players of the market, thereby giving way to a potential hindrance in the future growth prospects of such companies.

5. Trade Restrictions

Linc recently witnessed a fall in its exports from around ₹100 crores during the pre-Covid period to approximately ₹80 crores in FY22. This was due to high tariff barriers in some countries like Egypt, Turkey, and Iran. Hence, future trade restrictions or hampered international relations may adversely affect the company’s growth.

Differentiating Strategies

Since FY21, Linc has decisively undergone a paradigm shift in its business model. The fundamental goal is to expand the “Range” and widen the “Reach” of its products which is coined as the “Two R’s Approach” for business expansion. Let us look at the company’s differentiating strategies to fuel the Two R’s approach.

1.Diversified Product Portfolio

The pandemic made Linc realize that solely dealing with stationery products was insufficient. This gave way to the launch of Pentonic COVID-19 Killer (a pocket-sized, retractable, sterilizing marker), followed by the launch of Lincplus (a herbal hand sanitizer). However, the company has now discontinued the sales of sterilizing markers. Also, the company’s partnership with Deli added a range of synergic stationery products to Linc’s portfolio, helping it penetrate deeper into the market.

2. Bundling Offers to Tackle the “Pen-In-Pain” Situation

The price of the company’s products increased due to the rise in raw materials prices and the changing tax structure (GST rates were increased to 18% for all pens from October 2021). To ensure that this hike in price does not result in compromised revenues, Linc introduced certain bundling offers at the retailer’s end to spike the number of units sold. Three pens at ₹7 each, which would have cost a customer ₹21, were available at ₹20. This strategy was adopted to maximize revenue via increased units sold, even at inflated prices.

3. Reducing Dependency on Wholesalers

The company’s overreliance on wholesalers to distribute its products turned out to be self-destructive. It limited its reach, interfered with the timely flow of goods, and provided very low incentives to the ultimate retailers for selling the products. The company addressed these issues by taking self-charge of the distribution process. It reduced the number of intermediaries, thereby reducing costs and increasing profitability for retailers.

4. Deepened and Digitalized Distribution System – “Linc Kahi Bhi Milega!”

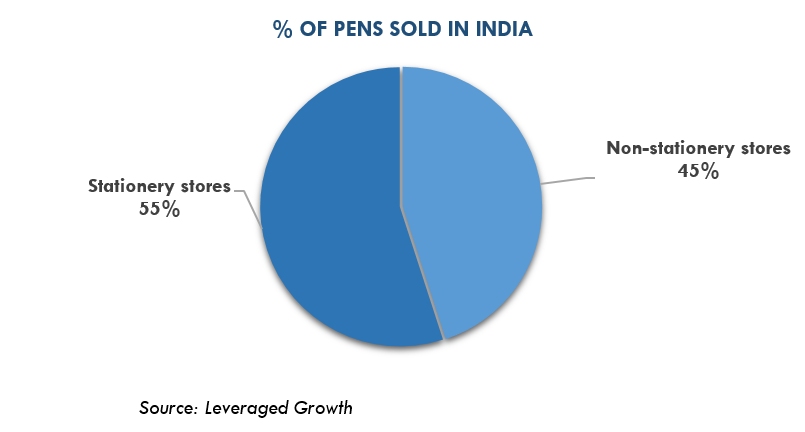

Earlier, the products of Linc were available at the stationery shops only. However, since FY21, the company has widened its footprint to gift shops, kirana stores, general stores, mom-and-pop stores, and paan dukaans. Moreover, Linc smoothened its distribution process by becoming a “phygital” company. This implies that its conventional feet-on-street distribution was accompanied by a team of 100 dedicated tele-callers and Linc’s application. The tele-callers engaged in business-enhancing conversations with the counterparties and consistently checked the stock availability at each retailer’s end. Anyone can reach out to the company through the application anytime and anywhere. All these initiatives together will result in the company’s enhanced and smoothened reach.

5. Data-Driven Operations

Linc has been making judicious use of the data gleaned from its app. Earlier, the company’s production decisions were purely instinct-based. However, the app (updated on a real-time basis) has facilitated evidence-based sales forecasting and ensured that the company could meet the required demand on time. This has improved the efficiency of Linc’s business operations and ensured efficient working capital management.

Michael Porter’s Five Force Analysis

1.Barriers to Entry

The writing instruments industry experiences low barriers to entrydue to the following reasons: –

- The existing market is highly fragmented, so new entries can consider participating. There is an absence of monopoly power which otherwise would have hindered the entry of new players into the industry.

- It is a comparatively capital-light industry, reducing the need for hefty finances to start operations.

- Negligible brand loyalty also entices new parties to enter the market, hoping for potential demand for their products.

Hence, as a consequence of low barriers to entry, there might be sudden competition in the market for Linc, thereby challenging its existence and future growth prospects. However, whether Linc will make it difficult for new companies to sustain themselves in the market remains a question.

2. Bargaining Power of Suppliers

Suppliers of Linc Limited have moderate to high bargaining power because of the following reasons:

- Since most of the raw materials purchased by the company are polymer-based, Linc is highly vulnerable to crude oil price fluctuations. The crude oil suppliers are limited in number, making companies like Linc price-takers.

- However, the supplier’s bargaining power remains moderate in the case of non-polymer-based raw materials.

Hence, as a consequence of the suppliers’ moderate to high bargaining power, along with Linc’s inability to pass on the burden of hiked input prices to the ultimate consumers, the company’s margins might be under pressure due to inflated raw material prices in the future.

3. Bargaining Power of Buyers

The bargaining power of the buyers remains high in the writing instruments industry.

- One reason is the availability of many low-cost substitutes in the market. This further implies that the companies cannot charge an exceptionally high price for their products. Hence, the only way to increase profitability and enhance the company’s growth is by targeting a larger customer base and reducing the overall cost of production by implementing various cost-cutting strategies.

4. Rivalry among Competitors

Rivalry among competitors is high in the writing instruments industry.

- The players compete on price, quality, and innovation in the organized segment. Advertisements and marketing are tools that make the competition more intense.

- In the case of the unorganized segment, Linc mostly faces competition due to the exceptionally low price of the writing instruments. Even though the customer approach has improved over time, people are still price-sensitive. This turns out to be a major challenge for companies like Linc.

5. Threat Of Substitutes

- Writing implements amenable to digital technology, and rudimentary chalk and slate pens are possible substitutes. However, it is only in the long run that digital pens may possess a threat to writing instruments. Also, people no longer write with traditional chalk and slates because they are not user-friendly. Hence, we may conclude that the short-term threat of replacement is still negligible for writing instruments.

- However, the threat is immense if we consider the substitution of Linc pens in particular. The only way to mitigate this threat is to stand out by launching innovative products at attractive price points.

Branding And Other Initiatives

- Despite a 35% reduction in revenue due to the COVID-19 pandemic, Linc still allocated ₹4.95 crores on brand promotion in FY21. This proves that Linc favored moderation in advertising rather than outright bans.

- The company has roped many famous faces, like Shah Rukh Khan (in 2008) and Katrina Kaif (in 2011), to endorse its products. It has also been the official sponsor of various IPL teams like the Kolkata Knight Riders and Sunrisers Hyderabad to enhance its visibility among the youth.

- The aim of Linc’s advertisement goes beyond simply encouraging brand loyalty for its products. The business has always promoted literacy and touched people’s sentiments by reminding them of their childhood days and lauding students’ resolutions and hard work. This leaves a distinct image of Linc in people’s minds.

- The company has incurred an expenditure of over ₹78 crores on branding in the past 12 years, i.e., ~2.2% of the revenue earned. It plans to increase the expenditure to ~3% of the same, shortly.

Financial Analysis

1.The Robust Recovery of The Top-Line

- The revenue of Linc declined by 35.4% in FY21 due to the unprecedented COVID-19 pandemic, which suppressed the demand for writing instruments to a great extent.

- However, in FY22, the company delivered strong top-line growth of 38.3% to ₹354 crores. This growth was partly due to revived demand for writing instruments and multiple initiatives the company took to promote its sales (like increasing the number of touch points and including a range of synergic products in Linc’s portfolio).

- It should be noted that in Q2FY22, Linc recovered 93% of its pre-COVID level revenue. This, in turn, is a shred of evidence that Linc no longer had to depend on the complete reopening of the educational institutes for its revenue growth.

- By FY25, Linc aims to reach annual revenue of over ₹604 crores with a CAGR of 20%.

2. Improved Bottom Line (Profit After Tax)

- The steep rise in Profit after Tax (PAT) in FY20 was due to Pentonic pens launched in 2018. When introduced, these pens had a GPM of around 50%, resulting in an increase in PAT by 273.78% between FY19 and FY20.

- However, PAT reduced drastically in FY21 by almost 99.84% on account of fixed costs that needed to be absorbed without corresponding revenues.

- In FY22, Linc again showed a remarkable improvement in its PAT due to various factors like higher revenues, increased contribution of high GPM products in the revenue mix, and adoption of digitalized and improved distribution system (which reduced the cost of the company’s operations)

3. Linc’s Light and Liquid Balance Sheet

- Linc realized that it was necessary for the company to repay its debt (taken to address capacity creation) during the COVID-19 pandemic to reduce the cost of staying in business. Hence, it generated free cash flows of over ₹67 crores and repaid ₹43 crores of debt, thereby strengthening its debt-equity ratio from 0.33 in FY20 to near-zero in FY22.

- The immediate impact of debt repayment was a decline in net debt to ₹290 lacs and a decline in interest outflow from ₹5.46 crores in FY20 to ₹0.73 crores in FY22.

- Moreover, Linc aims to maintain a healthy, deleveraged balance sheet in the future by financing its operations largely through cash accruals.

4. Earnings Per Share (EPS)

- In FY20, the EPS increased by approximately 260.98%. This immense jump was due to the launch of Pentonic pens, whose GPM is the highest in Linc’s portfolio.

- However, in FY21, EPS reduced to ₹0.03, the lowest in the past 10 years on account of the COVID-19 pandemic.

- To increase the EPS in FY22, Linc undertook a dual approach of revenue maximization and cost minimization. The EPS increased by almost 18233.33% i.e., from 0.03 in FY21 to 5.47 in FY22.

Environmental, Social, And Governance

1.Environmental

- The industry’s urge to reduce dependency on plastic has given way to Linc’s new packaging solution. The individual plastic wrappers have been replaced with paper bulk packaging of 10 to 20 pens in a single paper box. This saved 60 tonnes of plastic in FY22.

- Linc has been actively working on projects that will enable it to recycle used pens. This, along with its refill-more campaign, will help the company reduce its demand for plastic drastically, thereby contributing to a greener tomorrow.

All these efforts, cumulatively, will go a long way in reducing the carbon footprint on our planet.

2. Social

- Linc has employed more than 1,200 females in its manufacturing facilities.

- It has also employed specially-abled individuals in its workforce after providing them with appropriate training.

- The business has a long history of supporting Friends of Tribal Society and other similar groups by funding their educational programmes and other welfare initiatives for the less fortunate members of society.

- Spellinc and Write-O-Values are contests organized by the company to encourage literacy in India. The former is an annual national event that focuses on aspects like spelling, grammar, phonology, syntax, etc., and the latter is an intra-school handwriting competition with a strong emphasis on moral values. Spellinc has covered over 1,500 schools across 23 cities of the country, and its winners are given cash prizes for their future education, academic assistance, stationery supplies, and attractive gift hampers. This competition has also been extended to special children, thereby ensuring the promotion of inclusive education.

3. Governance

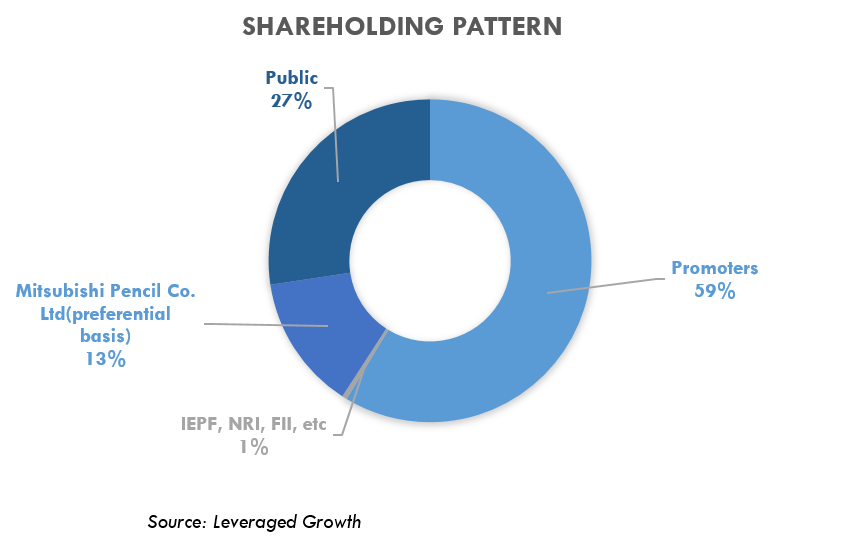

The following pie chart represents the shareholding pattern of the company as of 31st March, 2022.

- There are eight Board of Directors of the company whose composition is as follows,

- 3 Promoters, Executive Directors

- 1 Executive Director

- 4 Independent, Non-Executive Directors, including one Woman Director

- The internal control and risk management system is structured and applied strictly in accordance with the principles and criteria established in the corporate governance code of the organization. Moreover, they are under the supervision of the Board- appointed Statutory Auditors.

- There has been a slight reduction in promoters’ holding in FY22, from 59.02% as of 31st December 2021 to 58.7% as of 31st March 2022. This is due to a sell-off from one of its promoters. However, there has been no dilution from the other promoters of the company.

- The company has maintained a consistent dividend pay-out track record of greater than 30% (except during the COVID-19 years due to the cash conservation policy). The company has paid a dividend of ₹1.80 per equity share for the year ended 31st March 2022.

Risk Analysis

1.Economic Risk

The writing instruments industry (especially the organized segment of the market) is susceptible to economic slowdowns. During the COVID-19 pandemic, Linc faced an existential crisis due to a significant reduction in demand for pens. A rise in tax rates also impacted the company’s slower development, and high tariff barriers put in place by some nations, rising gasoline costs, labor shortages brought on by the epidemic, and supply chain interruptions. Linc continues to be at risk from rumors of a future worldwide economic downturn. To lessen the effects of economic uncertainties, Linc has expanded its distribution in current areas and geographically diversified its presence.

2. Competition Risk

Due to conflicting pressures, Linc’s market share may experience a reduction or growth constraint. Everyone in the sector attempts to introduce unique, affordable items. However, Linc makes significant investments in R&D every year to enhance the quality of its current products and concurrently introduce new, innovative, and cost-effective items into the market to reduce the danger of competition.

3. Raw Material Risk

A rise in the price of crude oil results in an increased cost of production for the company. To mitigate the risk of inflated raw material prices, Linc has decided to increase the contribution of high GPM products (like Pentonic) in its annual revenue and simultaneously restore various cost-effective strategies like digitalizing the distribution system. This will help the company absorb the increased cost without compromising the profit margins.

4. Quality Risk

Linc has never worked for quick gains at the cost of the quality of its products. However, an inability to maintain or provide better quality products in the future may adversely affect the brand image of the company. However, the company’s commitment to quality is protected through integration, the utilization of superior polymer quality, and compatible design.

Q2FY23 Highlights

- Q2FY23 has been a landmark quarter for Linc Limited as the company recorded the highest-ever quarterly revenue and profit during this timeframe

- Operating income stood at ₹12,698 lacs-up 35.2% YoY and 29.7% QoQ; the highest against any quarter in the past

- Operating EBITDA is up sharply by 104.6% YoY- at ₹1,557 lacs; the highest against any quarter in the past

- PAT grew by 167% YoY at ₹956 lacs; the highest in a quarter and exceeding the full-year PAT of FY22

- Gross profit margin stood at 30.5%-the highest in a quarter.

- Net Debt was nil as of 30th September, 2022 and the company had a net free cash flow of ₹822 lacs on the same date.

- The company has added another 7,046 touch points this quarter.

The Endnote

Not everyone who starts from scratch touches the tops of skyscrapers—Linc has unambiguously been an exception. Over the years, the writing instrument giant has earned the reputation of a brand that delivers value for money and has expanded from its Indian roots to a global presence. Its resilience is commendable, and this has helped Linc break through the clutter in an industry full of me-too products. The company has mastered the game of adaptability and innovation—a trait that every successful organization possesses! With strong growth prospects, especially in India, we remain optimistic about Linc’s future. However, will Linc be able to capitalise on the upcoming opportunities or will the challenges overpower its ability to grow remains a question! Also, to be gauged is the impact of Linc’s strategic move to include products from Deli in its product portfolio. What do you think? Will this move turn out to be a boon or a bane for Linc?

What is Linc Pvt Ltd?

What is Linc’s approach to innovation?

What is Linc’s market share in the writing instruments industry?

What is the vision and mission of Linc Pvt Ltd?

How has Linc Pvt Ltd adapted to changes in the market?

Disclaimer: The report and information contained herein is strictly confidential and meant solely for the selected recipient and maynot be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. Certain transactions -including those involving futures, options, another derivative product as well as non-investment grade securities – involve substantial risk and are not suitable for all investors. No representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alternations to this statement as may be required from time to time without any prior approval. Leveraged growth, its associates, their directors and the employees may from time to time, effect or have affected an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any company referred to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting the document. This report has been prepared on the basis of information that is already available in publicly accessible media or developed through analysis of Leveraged Growth. The views expressed are those of the analyst, and the Company may or may not subscribe to all the views expressed therein. This document is being supplied to you solely for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, Country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Leveraged Growth to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. Neither the Firm, not its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The person accessing this information specifically agrees to exempt Leveraged Growth or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold Leveraged Growth or any of its affiliates or employees responsible for any such misuse and further agrees to hold Leveraged Growth or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

Contributor: Team Leveraged Growth