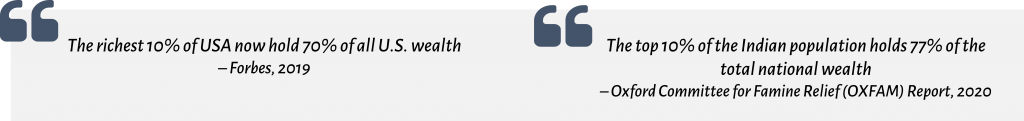

Industries in the U.S. have been experiencing an increased level of concentration of profits & revenues in the hands of a few corporate giants that till today stand unstirred. According to Fortune 500, 20% of the companies in the U.S. have been capturing around 74% of the profits every year since the 1950s, as of 2019. Even in FY20, top 20 companies of Fortune US 500 reported revenues that represented almost 20% GDP of the U.S.

A similar pattern has been witnessed in India as well. Among the 5000+ listed companies, only a handful of companies have been earning gigantic shares of profit in their respective industries, since 2009. Hence, there is a clear indication of profit concentration, thereby leading to suppressed competitors & making way for market monopolies & oligopolies.

According to Economic Times, the top 20% Indian companies have been taking home almost 80% profit share earned in the Country since 2009. This shows that in both the countries, a massive amount of profit is getting concentrated in a handful of such reigning leviathans (dominant leaders). Such inference on the market concentration provides significant implications as to how one needs to invest & think about its portfolio construction.

Leviathans prevail in India

The profits earned by the top 20% Indian companies increased from 70% in 2009 to 78.5% in 2019. Moreover, on a deeper insight, the top 20 companies ended up earning almost half of the total profits earned by the Indian corporates in FY19. Such inference of profits getting concentrated in the hands of a few indicate their competitive advantage over other peers.

Why is it favouring a handful of few?

- A strong network helps the leviathans in improving its distribution efficiency significantly. The development of improving highways, road networks, airport constructions has enabled stronger players to have a Pan-India presence across the Country.

- Advanced technological adoption at an early stage helps them in gathering huge amount of data to strategically place their products in the market.

- Regulatory barriers have been one of the hindrances for new entrants to survive in the past. Tax implications, licence approval, regulatory filings, etc. crushes the unorganised & weak players that leads to an increase in profit concentration.

- Mature companies enjoy low cost of capital due to predictable & consistent cash flows as compared to new ones. It certainly places such companies in a better position to access cheaper capital in times of financing.

India’s Profitable Universe

One may assume India’s GDP growth story to be quite fascinating but the profitability story reflects a totally different picture. According to BSE, there were more than 5400 companies listed as on Mar’19, but to one’s least expectation, only 435 were found to be profitable in FY19. If you do the math, you will find that only 8% of the BSE universe are profitable.

On analyzing the above data, it was found that even though there was a 10.2% increase in the number of companies listed on BSE between 2009 & 2019, the increase in the number of profitable companies was only 1.9%.

A probable reason for such under-performance among the new companies has been mainly because of its giant peers with a high competitive advantage over scale & pricing power. Hence, the smaller players are being crushed away due to weakening profit margins leading to high profit concentration among industries.

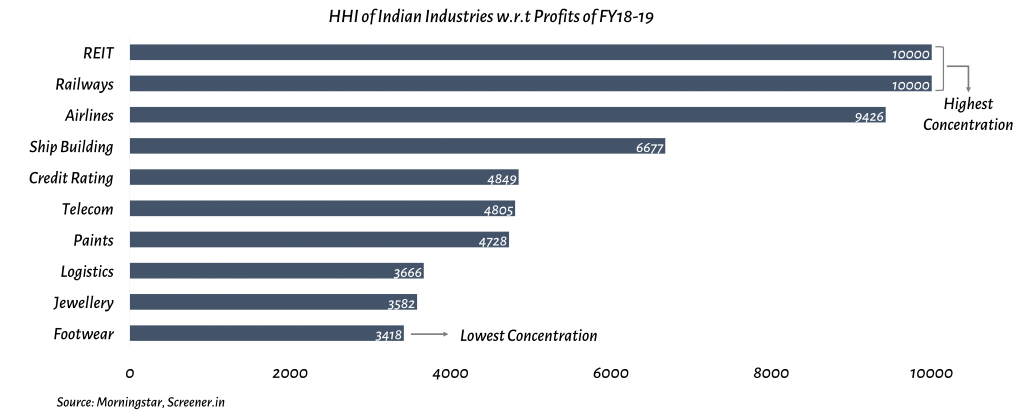

HHI – The measure of Market Concentration

Herfindahl-Hirschman Index (HHI) is a simple & commonly accepted methodology to measure concentration. It is calculated by squaring the market share of each firm in the industry and then summing them up. It ranges from 0 to 10000.

The formula for the Herfindahl-Hirschman Index is:

HHI = s12+ s22+s32+ … +sn2

Where, sn = the market share percentage of firm ‘n’ expressed as a whole number, not a decimal

Let’s say there is only one firm in an industry, hence it will have a 100% market share of profits, then HHI of the industry will be equal to 10,000 (as per above formula), indicating a monopoly.

The combined profits of all the companies in an industry gives the industrial profit for that Financial Year. Some companies have a significantly high share of profits than the rest of their peers, showing monopolistic/oligopolistic attributes. HHI helps to calculate & analyze such industries with high profit concentration.

The above graph was the result of a sample of 43 industries analysed across India, wherein the industry profit constituted the profits earned by the companies belonging in those industries. Some important aspects & insights that could be concluded from the analysis were as follows.

- 86.1% of sectors have HHI > 1000. It shows high concentration of profits in sectors.

- 16.3% of sectors have HHI > 4000. It shows duopoly profit sectors of India like Paints, Footwear.

- 7.0% of sectors have nearly full monopoly profits with HHI > 9000 like Railways, REIT & Airlines.

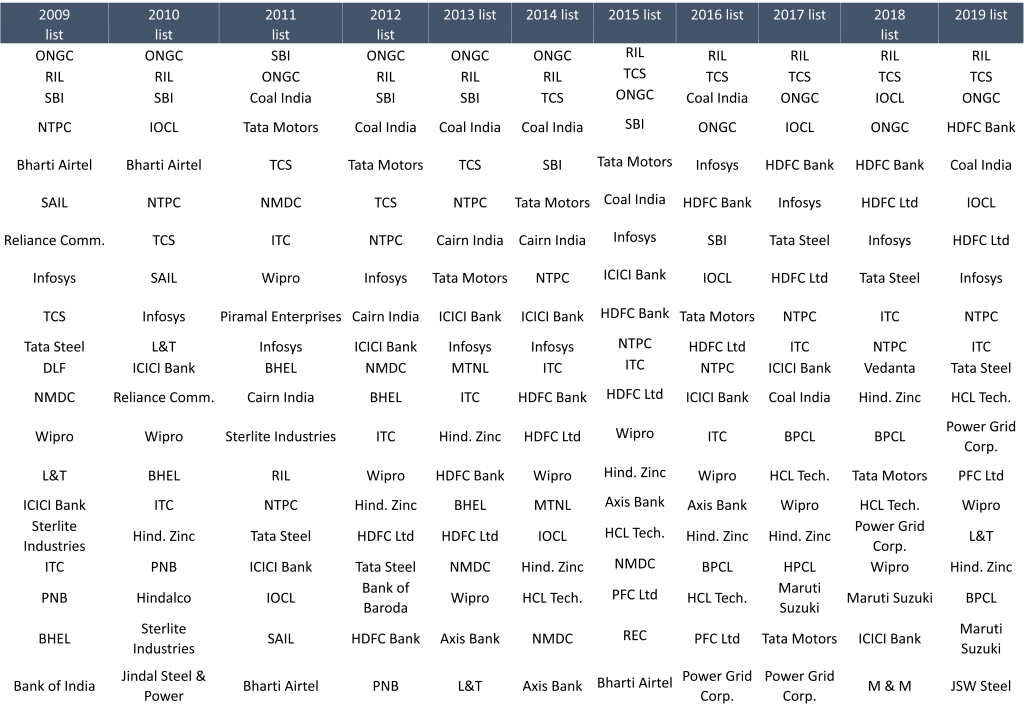

India’s list of Top 20 companies from 2009 to 2019

When we are talking about the top companies, it becomes important to notify the same. Here is the list of Top 20 Indian companies from various sectors that share the leviathanic profits.

Considering the recent list of 2019, we aim to construct a portfolio with these top 20 leviathans & check the results of their stock returns for confirmation. We allocate equal amounts in each of the 20 stocks & measure the Compounded Annual Growth Rate of 1-year, 2-year, 3-year, 5-year & 10-year returns of this portfolio till 31st May-20. The result has been compiled in a Heat Map where, darkest green to darkest red signifies best returns to worst returns compared to Sensex.

- On average, only 7 companies have managed to beat Sensex returns over the five periods.

- If one considered investing in an equal-weighted portfolio of top 20 profit makers in 2019, it has been observed that the portfolio would have surpassed the index only when the investment was made for 10 years.

Contributor: Debayan Saha

Research Desk | Leveraged Growth

I have completed my engineering graduation from Jadavpur University, Kolkata & currently working in the hydrocarbon sector. I am also a CFA Level 1 candidate at CFAI, USA, aspiring to move into investment & equity research industry. One of my impetus remains to be a voracious reader across various genres like finance, productivity, psychology, strategy, marketing, etc. I strongly believe that books are the building blocks of one’s personality. It inculcates the mindset of not just learning new things but also about the experiences of great personalities within a few pages.