For decades, gold enjoyed an almost sacred status in portfolios. Wars, recessions, inflation scares—gold was where capital was put in when confidence collapsed. But in recent times, something unusual has happened. Sharp rallies, sudden crashes, violent intramonth swings—gold has become anything but dull. The question investors are now asking is simple yet unsettling: how did the ultimate safe haven become so volatile?

The Original Safe Playbook

Gold’s reputation wasn’t built overnight. From 2005 to 2025, gold prices in India rose from roughly ₹7,000–₹8,000 per 10 grams to over ₹1,54,000, delivering a near 22x return over two decades. This wasn’t just price appreciation—it was a reflection of trust. Gold protected purchasing power during global financial crises, survived currency devaluations, and acted as insurance when equity markets collapsed.

Unlike financial assets, gold carries no credit risk, no earnings dependency, and no default probability. For Indian households, especially, gold served a dual purpose—emotional security and financial hedge. Central banks treated it similarly, steadily increasing reserves to diversify away from the US dollar. Stability, predictability, and scarcity defined gold’s appeal.

When Gold became a meme stock

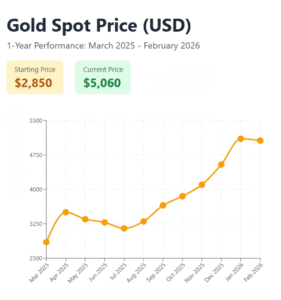

The precious metals market, be it gold or silver, witnessed an extraordinary 67% rally through 2025, marking its strongest annual gain since 1979. January 2026 shattered every assumption about gold’s predictable behavior. The metal that typically moved in measured monthly increments began exhibiting intraday swings akin to cryptocurrency. On January 30th alone, gold posted its worst single-day collapse on record, plummeting nearly 10% and erasing billions in market value within hours. Just then, gold staged an equally spectacular recovery, posting its best single-day gain since 2009 with a 6% surge that left institutional desks confused. These weren’t the gentle movements of a safe haven; they were the violent convulsions of a momentum-driven speculation frenzy.

The Perfect Storm: What Fueled Gold’s Historic Rally

Three powerful forces converged to drive gold’s extraordinary 67% surge through 2025, creating conditions unprecedented in modern commodities markets.

First, geopolitical tensions multiplied across continents—from escalating Middle East pressures to Russia-Ukraine conflict continuance and US-China trade disputes—each crisis accelerating uncertainty and prompting ‘flight to safety.’

Second, central banks globally engaged in their most aggressive gold-accumulation campaign in history, purchasing 863 tonnes in 2025 alone, signaling a fundamental shift away from dollar-denominated reserves. The People’s Bank of China led this buying spree, diversifying its massive foreign exchange holdings while other emerging economies followed suit, creating sustained institutional demand that absorbed limited supply.

Third, retail and institutional investment demand reached fever pitch, with gold ETFs attracting 801 tonnes of inflows. The World Gold Council reported total global demand surpassing 5,000 tonnes for the first time ever, valued at an astounding $555 billion.

Thus, these factors left investors wondering whether the rally would continue or whether they would see a market correction.

The Crash: When Three Strikes Hit Simultaneously

The January reversal wasn’t triggered by a single event but rather a three-pronged crisis that drained liquidity precisely when markets were most vulnerable.

The first prong was in the form of Kevin Warsh’s nomination as Federal Reserve Chair, announced on 30th January. Viewed as a “bullish” choice, Warsh’s appointment signaled a stronger dollar and higher interest rates, which increases the opportunity cost of holding non-yielding gold.

The second prong was CME Group’s unexpected margin requirement increases—hiking gold futures margins from 6% to 8% and silver margins from 11% to 15%. These technical adjustments, announced Friday evening, forced highly leveraged traders to either put substantial additional collateral or end their positions immediately.

The third and most decisive factor was widespread recognition among institutional investors that gold had become severely overvalued. After 53 record highs in a single year and almost touching $5,500 per ounce, major banks, including Goldman Sachs and BofA Securities flagged elevated prices as unsustainable, with profit-taking catalyzing a cascading selloff.

Thus, for a brief period, the safest part of the portfolio began swinging sharply into territories that fundamentals alone couldn’t justify.

What does this mean for Investors?

The storm might look violent on the surface, but the underlying demand remains robust. As an investor, you should focus on long-term discipline rather than chasing the “Midas touch.” If you allocated gold as a hedge in your portfolio, you are well-protected and should stay the course. However, if you became overexposed during the rally, you should consider rebalancing according to your goals. After all, all that glitters is not gold—and even gold, when chased blindly, can lose its shine.

Contributor: Team Leveraged Growth