The next economic revolution is already here and it’s being driven by experiences and culture in ways traditional industries never anticipated.

From Steel Mills to Sold-Out Stadiums

For two centuries, economic power meant steel mills, assembly lines, and shipping containers. Nations built wealth through what they could manufacture and export in bulk.

But the 21st century is proving something unexpected: a sold-out concert tour can generate more GDP velocity than a new automotive plant and with a fraction of the capital investment and construction time.

When a $5 billion factory takes five years to build, employs 10,000 workers, and produces steady output for decades, that’s the traditional growth model. When a BTS world tour generates $5 billion in economic impact across six months, creates temporary employment for 100,000+, and leaves lasting brand value that appreciates over time, that’s the new paradigm.

The difference isn’t just scale, it’s the nature of the asset itself. Physical infrastructure depreciates. Cultural moments compound.

The Mathematics of Attention

For every dollar spent on a World Cup ticket, economists estimate $3-7 circulates through the local economy, hotels, restaurants, transportation, retail. Compare this to manufacturing: every dollar invested in a factory generates approximately $1.40 in economic activity. The velocity difference is dramatic. [1}

Qatar’s GDP grew by 1.2% in 2021. In 2022, it jumped to 4.2%. The catalyst wasn’t a new trade policy or foreign investment package it was the FIFA World Cup, which generated $6 billion in a single month.[2]

The real action happens everywhere except the stadiums. Broadcasters negotiate billion-dollar deals. Airlines and hotels see months of bookings compress into weeks. Sponsorship agreements run into hundreds of millions. Transport systems operate at full capacity. Event venues undergo upgrades, creating thousands of jobs.

Then there’s the spillover: merchandise sales surge, visitors extend their stays beyond match days, and cities gain visibility that translates into long-term tourism. India’s Cricket World Cup 2023 generated $1.39 billion roughly equivalent to the country’s entire toy export industry for that year, but concentrated into six weeks. Google searches for “visit India” surged 340% globally during the tournament.

When Music Became Infrastructure

Music has demonstrated how cultural export can generate sustained economic momentum beyond one-time events.

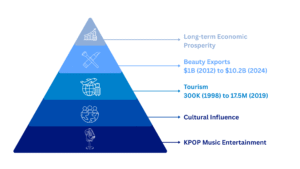

Korean pop music became a self-perpetuating cultural engine. Artists evolved into global ambassadors, carrying their country’s image across borders without formal trade agreements. Albums stopped being just music. They became collectibles, fans bought multiple copies not to listen, but to own the artwork, photo books, and photocards inside. Fashion, beauty, media, and advertising all plugged into the same cultural current.[3]

By 2025, K-pop album exports crossed $300 million for the first time. Korean beauty exports hit $10.2 billion in 2024, a tenfold increase from $1 billion in 2012. Tourism surged from 300,000 visitors in 1998 to 17.5 million by 2019. What South Korea built wasn’t a one-time event, it was a repeatable export engine with 20+ years of groundwork. Culture became infrastructure. [4]

Joseph Nye, the Harvard professor who coined the term “soft power” in the 1990s, argued that cultural influence would eventually shape trade negotiations as much as tariffs. Three decades later, South Korea’s cultural exports now open doors for its technology, automotive, and consumer goods in ways traditional diplomacy never could.

What This Means for the Next Decade

As of 2026, the shift is accelerating. Nations are competing for cultural relevance the way they once competed for manufacturing capacity, the UAE is positioning Dubai as a “cultural capital,” while India expands film studio infrastructure to capture global streaming markets.

Cities now bid for gaming championships and influencer festivals alongside traditional mega-events. Several countries fast-track visas for cultural creators the way they do for investors: a YouTuber with 5 million subscribers creates more tourism impact than a single factory investor.

New metrics are emerging. “Cultural GDP” and “Attention Share” are moving from academic concepts to policy discussions, because traditional indicators can’t measure the value of trending globally for 48 hours.

For policymakers: Investment in arts infrastructure and creator programs isn’t social spending, it’s economic development.

For businesses: Brand partnerships with cultural moments now rival Super Bowl ads in impact at a fraction of the cost.

For individuals: Your cultural consumption directs billions in investment capital. Platforms track what you watch to decide which markets to enter next.

The New Competitive Advantage

Traditional growth drivers remain important. But in a world where passion scales into profit, cultural influence has become economically indispensable.

In 1900, nations competed for coal and steel. In 2000, they competed for silicon and servers. In 2026, they’re competing for something far harder to extract: moments that billions of people choose to care about simultaneously.

The question isn’t whether cultural power will shape the next century’s economy—it already does. The question is whether traditional economic superpowers will adapt fast enough, or whether they’ll watch influence shift to nations that understood earlier that attention is the new oil.

Contributor: Team Leveraged Growth