Solar power traces its roots back to 1839, yet it wasn’t until the mid-20th century that we realized sunlight’s true potential beyond boosting vitamin D.

The solar electricity industry shows clear signs of being in its early stages, with a volatile supply chain for critical materials like polysilicon, a wide range of competing technologies, and a noticeable lack of companies that manage the entire value chain. As the industry matures, we can expect significant consolidation, leading to fewer technologies and more streamlined operations.

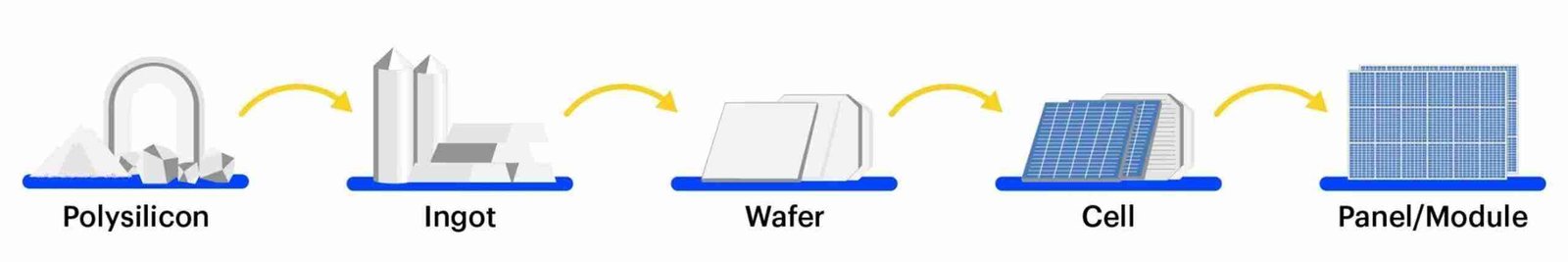

The solar power ecosystem consists of distinct stages, from manufacturing equipment to installation and operation. Key products in the manufacturing process include

| Polysilicon is a highly pure form of silicon made up of multiple crystals. It’s created from quartzite, a type of rock that contains quartz. | The process of extracting, purifying, and refining silicon into high-purity monocrystalline ingots requires substantial energy and has notable environmental impacts. | Slicing ingots into thin, single-crystal silicon wafers forms the basis of solar cells. Accurate cutting and minimizing waste are essential for efficiency. | This stage represents the most complex part of the value chain. It involves processing wafers through various steps, including texturing, diffusion, laser treatment, annealing, edge isolation, etching, passivation, coating, and metallization. | Connecting cells in series and parallel, then encapsulating them with protective layers such as glass and encapsulant, and framing them for added durability and ease of installation is crucial. Automation significantly enhances efficiency in this process. |

Unleashing Global Growth in Solar Energy

The global solar market is rapidly expanding, offering significant investment opportunities as countries transition to Renewable Energy (RE) to combat climate change. The global solar energy market was valued at $207.36 billion in 2024 and is anticipated to reach $335.16 billion by 2031. It is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031. Key factors driving this growth include declining costs in cell module manufacturing, technological advancements, and strong government support. Investments in solar energy are increasing from both public and private sectors, with many nations prioritizing solar in their energy strategies.

U.S. Cracks Down on Xinjiang Labor Links

The ban on import material from Xinjiang(China) province by the USA extended upto 4 years. Europe is also taking steps to reduce dependence on China.

- The U.S. and European regions are projected to have a demand for 50-60 GW of solar modules annually.

- It is expected to take approximately 3 to 4 years to establish a domestic supply chain in the United States.

- Over 90% of India’s solar exports are directed to North America, which may encourage Indian manufacturers to establish production facilities in the U.S. to meet this growing demand.

India’s Growing Solar Energy Capacity

As of August 2024, India holds the fourth position globally in solar Photovoltaic deployment, with an installed capacity of 89.4 GW. In 2023, it was the third-largest solar energy producer, following China (710 GW), the USA (200 GW), and Germany (90 GW). With abundant sunshine for over 300 days a year in many states, India has significant solar potential. To harness this, the Indian government is actively implementing policies and initiatives aimed at promoting solar energy adoption and reducing import dependence by bolstering domestic manufacturing capabilities. The country’s ambitious goal is to achieve a total of 500 GW of renewable energy capacity (with a solar component of 280 GW) by 2030. This commitment not only highlights India’s efforts to expand its renewable energy sector but also positions it as a key player in the global transition to sustainable energy.

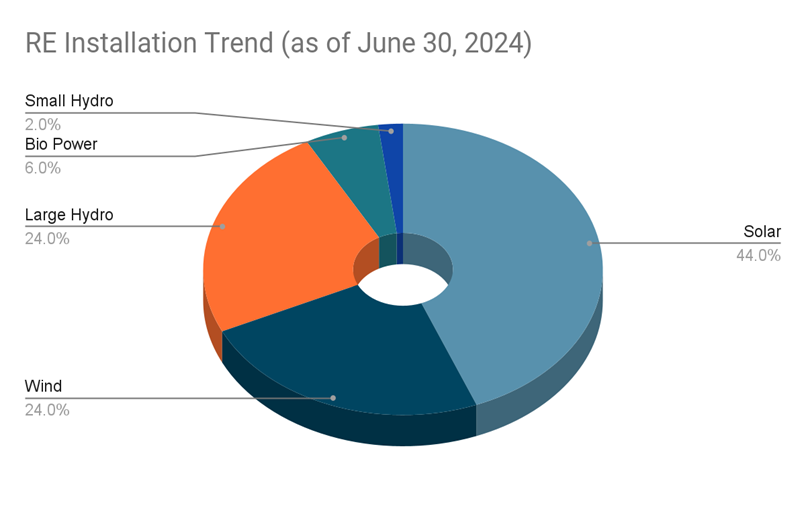

As of June 30, 2024, India has installed a total of 195 GW of renewable energy capacity. Solar energy leads the way, making up 44% of this total, followed by wind and large hydro, each contributing 24%. Specifically, India has installed about 85.5 GW of solar and 46.7 GW of wind capacity. Looking ahead, there is a pipeline of 110.6 GW of combined solar, wind, hybrid, and storage projects expected to be completed in the next 4-5 years. Additionally, there are 71.4 GW of projects currently in the bidding phase, where tenders have been issued but auctions are yet to be finalized.

Solar Power Gets Cheaper

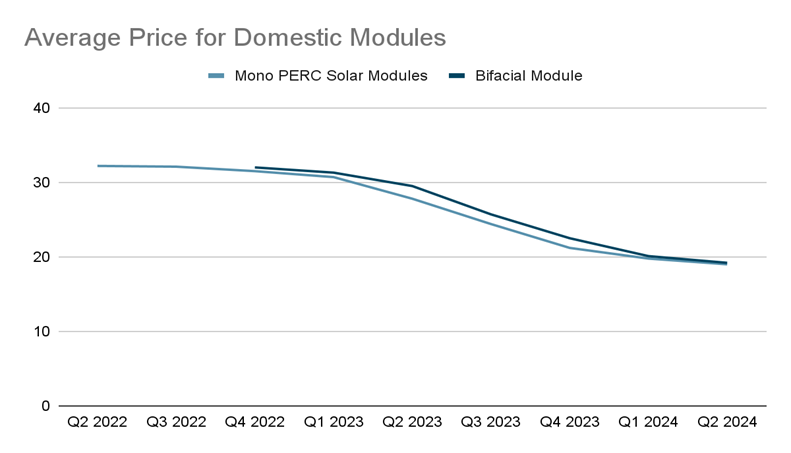

In the second quarter of 2024, the prices for solar cells and mono-PERC modules in the international market saw a quarterly decline of 17% and 6%, respectively. Additionally, when compared to the same period last year, solar cell prices fell sharply by 67%, while mono-PERC module prices decreased by 48%.

Average price for Domestic Module – In the second quarter of 2024, the all-inclusive domestic price for mono PERC 500 Wp modules, including freight charges and GST, was INR 19 per watt peak (Wp). This represents a 31.7% drop compared to the same period last year. Similarly, bifacial modules were priced at INR 19.2 per Wp, showing a 4.5% decline from the previous quarter and a 35% reduction year-over-year.

The Role of Policy in India’s Solar Power Revolution

The solar Production Linked Incentive(PLI) scheme aims to enhance solar PV module manufacturing in India, reducing reliance on imports. With government support, India is expected to achieve an increase in production capacity of 100 GW per year by 2026, fulfilling domestic needs and enabling exports to earn foreign exchange.

Domestic Content Requirements (DCR) are a key policy implemented by the Indian government, mandating that a specific percentage of solar components—such as cells and modules—used in government-funded projects must be sourced from domestic manufacturers. This requirement has been progressively increasing, with targets set at 45% for projects starting in 2025, 50% in 2026, and 55% thereafter. The DCR aims to enhance domestic manufacturing, create jobs, and reduce import dependency. While some exemptions exist, the DCR applies to grid-connected solar power plants, rooftop installations on government buildings, and off-grid solutions.

DCR provides several advantages for India’s solar manufacturing sector:

1.Guaranteed Market: DCR mandates that a percentage of solar components in government projects come from local manufacturers, creating stable demand that boosts local economies, encourages investment and job creation.

2.Reduced Competition: By decreasing pressure from cheaper imports, DCR allows local firms to establish themselves and focus on scaling their operations for long-term growth. Which in turn enables them to increase efficiency and compete with global players.

3.Technology Development: DCR incentivizes R&D, enhancing product efficiency and quality, which boosts global competitiveness and builds a skilled workforce, fostering excellence in renewable energy.

Overall, DCR is crucial for strengthening India’s solar manufacturing landscape and driving sustainable growth.

The Indian government’s imposition of Basic Customs Duty (BCD) on solar modules (40%) and solar cells (25%), effective April 2022, is a significant move towards achieving self-reliance in the solar manufacturing sector under the ‘Atmanirbhar Bharat’ initiative. This policy aims to reduce dependency on imports, particularly from China. While the BCD may increase capital costs and solar tariffs for projects with import modules, it encourages domestic production by exempting certain manufacturing equipment from the duty. This is expected to bolster confidence in local suppliers, supported by the Approved List of Models and Manufacturers of PV Modules (ALMM).

Who’s Leading the Way in Solar Power Expansion?

1)Waaree Energies Ltd., India’s largest solar panel manufacturer with 12 GW capacity, offers diverse solar products and customized Engineering, Procurement and Construction (EPC) solutions, including floating, ground mount, and rooftop systems. Their modules feature advanced technology for improved performance and safety, serving global markets.

2)Vikram Solar, with 3.5 GW capacity, is a leading Indian solar panel manufacturer offering EPC and Operation and Maintenance (O&M) services. Known for innovations like India’s first floating solar plant, its modules feature enhanced efficiency, reliability, and remote monitoring, They will supply 393.9 MW of solar modules for MLC India’s Solar project in Gujarat. The contract includes a total provision of over 1 GW of PV modules for Khavda Solar Park.s.

3)Premier Energies Limited, India’s first LEED(Leadership in Energy and Environmental Design) Gold-rated solar manufacturer, uses M10 Gallium-doped wafers and ARC-coated glass for high-efficiency modules. Notable for their SMBB technology, the company recently secured a 350 MW project in Rajasthan, supplying modules to Apraava Energy.

4)Adani Solar, a division of Adani Green Energy Ltd., India’s largest vertically integrated solar manufacturer, overseeing the entire solar panel process, from design to installation, excels in high-efficiency mono PERC and bifacial PV modules. Recognized for reliability, the company aims for 45,000 MW capacity by 2030, with 1,000 MW operational in the Khavda Renewable Energy Park.

5)Tata Power Solar, a division of Tata Power Ltd., is a comprehensive solar company. Its services encompass project development, wholesale distribution, design, engineering, construction and maintenance, EPC services, and solar product innovation. With over 1,000 dealers, it supports various sectors, including banking, education, and healthcare. The company recently launched a 4.3 GW manufacturing facility in Tamil Nadu and initiated the “Ghar Ghar Solar” program under the PM Surya Ghar Yojana, aiming to install rooftop solar with bifacial panels for 10 lakh homes in Uttar Pradesh. Known for its high-quality, reliable modules, TPS plays a vital role in the country’s solar growth.

| Current Capacity | Post Capex Capacity | |||

| Company | Module Capacity | Cell Capacity | Module Capacity | Cell Capacity |

| Waaree Energies | 12 GW | 5.4 GW | 21 GW | 11.4 GW |

| Vikram Solar | 3.5 GW | – | 4.5 GW | 3 GW |

| Premier Energies | 4.13 GW | 2 GW | 8 GW | 6 GW |

| Adani Solar | 4 GW | 4 GW | 10 GW | 10 GW |

| TATA Power Solar | 3.73 GW | 2.26 GW | 4.9 GW | 4.9 GW |

Navigating Trade: Key Import-Export Insights!

Solar module imports fell by 73% in the second quarter of 2024, and exports decreased by 31.3% compared to the previous quarter. This significant drop in imports is attributed to the reimposition of the ALMM order, which took effect on April 1, 2024. Additionally, solar cell imports declined by 16.7%, while exports of solar cells surged by 90% compared to the previous quarter.

Export by Key Domestic Players – Over the past year, Adani, Waaree, and Vikram Solar have been at the forefront of the solar module export market, with exports comprising 39-65% of their total production. However, in the second quarter of 2024, there has been a noticeable decline in their export capacity. This decrease is primarily due to the reimplementation of the ALMM order and an increase in domestic demand as this allowed smaller players to participate and export solar modules, which has led to higher consumption within the local market.

Solar Hurdles: Navigating the Challenges and Drawbacks of Solar Energy

The solar sector’s expansion has been significantly influenced by government policies, with subsidies and tax incentives playing a pivotal role in its growth. However, these policies can also pose risks to the industry’s stability if they are subject to sudden changes. To maintain resilience and profitability, the solar industry must adeptly navigate potential policy shifts while adapting to market conditions. This requires a proactive approach to regulatory changes, ensuring that the sector can continue to thrive even as the regulatory landscape evolves.

The current landscape of the global commodity market presents both challenges and opportunities for India. The vacuum created by supply disruptions has indeed allowed local companies to thrive, as they capitalize on the immediate demand. The technologies we rely on today may not be the same ones we use in the future. For example, the significant decrease in polysilicon prices has made some thin-film technologies less attractive compared to how they seemed just a year ago. To adapt to such changes, companies should diversify their product portfolios by incorporating alternative technologies as part of their strategy. However, for enduring success, a strategic approach is necessary, integrating the entire value chain from raw materials to finished products. This integration will not only enhance competitiveness but also ensure resilience against future market volatilities. The shift towards such a comprehensive framework could position India as a key player in the global commodity market, fostering long-term economic growth and stability.

Innovations in PV technology, such as bifacial panels and enhanced energy storage solutions, are improving efficiency and reducing costs. The ongoing global shift towards decarbonization is expected to further accelerate solar energy adoption, with predictions of continued growth in capacity and technological improvements.

Contributor: Team Leveraged Growth