For nearly eight decades, the U.S. Dollar has held a position that few currencies have even dared to challenge as the world’s financial kingpin. From oil trades in the Middle East to electronic components in East Asia, chances are, the deal is being sealed in dollars. But in a world where economies are evolving, political tensions are rising, and digital currencies are knocking on the door, the question naturally arises: Will the USD continue to rule, or is its crown under threat?

Let’s unpack the story of the dollar’s dominance and why it still sits on the global throne.

How the Dollar Rose to Power

The seeds of the dollar’s supremacy were planted in 1944, during the Bretton Woods Conference, when world leaders created a new financial framework to stabilize the global economy after World War II. The U.S., with the largest gold reserves and a booming economy, became the anchor of this system. The dollar was pegged to gold, and other major currencies were pegged to the dollar.

Even after the gold standard was abandoned in the 1970s, the world continued to place its trust in the dollar. Why? Because of the sheer size, depth, and credibility of the U.S. financial system. Over time, this trust transformed into dependency.

By the Numbers: How Dominant Is the USD?

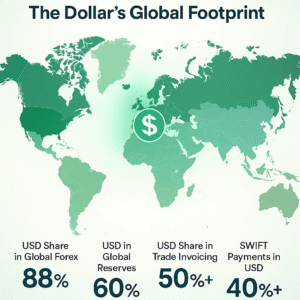

The U.S. Dollar’s dominance isn’t just a perception – it’s quantifiable:

- Over 88% of global forex transactions involve the dollar.

- More than 50% of international trade invoices are in USD – even when the U.S. isn’t directly involved.

- Roughly 60% of official foreign reserves are held in dollars.

- Around 40% of global SWIFT payments – the world’s financial messaging backbone are made in USD.

In short, the dollar is not just a currency. It’s a global operating system.

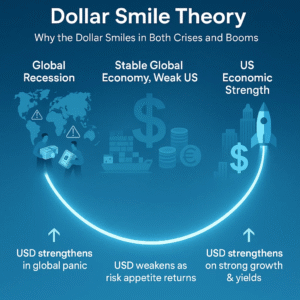

The Dollar Smile Theory: Strength in Every Scenario

A lesser-known but fascinating concept is the Dollar Smile Theory, an economic idea that explains why the dollar tends to rise in both good times and bad.

On one end of the “smile,” when the global economy is weak, investors flock to the USD as a safe haven. On the other end, when the U.S. economy is outperforming the rest of the world, capital pours into dollar assets, boosting its value again. It’s only in the middle, when the U.S. is weak but the rest of the world is stable, that the dollar shows signs of sagging.

In essence, the dollar has a reason to grin whether markets are celebrating or panicking.

When Crisis Hits, the Dollar Shines

Let’s rewind to the 2008 Global Financial Crisis. While banks collapsed and markets plummeted, the dollar… surged.

Amidst the chaos, the USD rose 26% as investors sought safety. Even though the crisis began in the U.S., the world still ran to the dollar. That’s the paradoxical power of trust. Even when the fire starts at home, the dollar becomes the fireproof vault.

SWIFT and the Dollar’s Hidden Muscle

Beyond perception and macroeconomic stability, there’s a powerful infrastructural reason behind the dollar’s influence: SWIFT, the global financial messaging system used by over 11,000 banks in more than 200 countries.

SWIFT doesn’t move money, but it moves the messages that facilitate the movement of funds. Also with over 40% of SWIFT payments made in USD, the U.S. effectively sits at the center of global financial traffic control.

Here’s where it gets geopolitical: when banks are cut off from SWIFT, they’re effectively cut off from the dollar and, by extension, the global economy.

Case in point: In 2022, following its invasion of Ukraine, Russia saw several of its banks removed from SWIFT. The result? A collapse in trade settlements, restrictions in dollar access, and a scramble to build alternative systems. It wasn’t just sanctions that hit; it was the exclusion from the USD-led financial highway.

Cracks in the Crown?

While the dollar remains dominant, the financial world is beginning to diversify – slowly but noticeably.

- The dollar’s share in global reserves has dropped from 71% in 1999 to about 58% in 2024.

- Countries like China and Russia are conducting more trade in local currencies to bypass the dollar.

- BRICS nations have been advocating for alternative payment systems.

- Over 130 countries are exploring or piloting central bank digital currencies (CBDCs) to reduce dollar dependence.

This isn’t an immediate threat to the dollar’s supremacy, but it’s certainly a signal: the world is preparing Plan B.

The Final Word: Is the USD’s Reign Ending?

Not quite.

Despite rising efforts to “de-dollarise” and a shifting geopolitical landscape, the U.S. Dollar remains unmatched in trust, liquidity, and legal backing. It’s the currency of global contracts, reserves, crises, and confidence.

But the future might not be about one king; it could be about shared power, where the dollar coexists with rising currencies, digital payment ecosystems, and new financial alliances.

Until then, the USD still wears the crown. But make no mistake, the world is watching.

Contributor: Team Leveraged Growth