“From the elegance of a Banarasi saree to the intricate artistry of a Kutch embroidery kurta, ethnic wear tells a story of India’s cultural evolution and artistic excellence.”

The Indian ethnic wear industry is a rich expression of the country’s cultural heritage, brought to life through intricate craftsmanship and timeless design. Once centered around handwoven, custom-made garments, the industry has evolved into a thriving ecosystem powered by e-commerce, organized retail, and contemporary designer labels. With changing consumer preferences, rising disposable incomes, and increasing global admiration for Indian aesthetics, traditional attire has found a strong footing not only in traditional and festive settings but also on global fashion platforms. As the sector navigates this transformation, it stands at the intersection of heritage and innovation, revealing both immense potential and complex challenges.

Our collaboration with Kala Niketan, a forward-thinking e-commerce traditional wear brand, gave us a first-hand look into this dynamic and ever-evolving space. It was a journey of discovery, exploring how tradition can be preserved while meeting the expectations of today’s consumers. Working closely with their passionate team, we gained insights into key industry challenges, such as balancing affordability with quality and expanding the limited scope for personalized tailoring in digital retail. Through strategic innovation and a deep respect for culture, Kala Niketan is redefining what it means to wear heritage with pride. In this blog, we share our learnings from the field, spotlighting trends, opportunities, and the future of Indian ethnic fashion.

Examining the Value Chain

Let’s take a look at how an Ethnic Wear piece is made from scratch:

– Raw Materials from Diverse Sources

This industry is deeply rooted in its cultural diversity, with each state contributing unique materials and techniques that reflect its traditions and heritage through outfits. The foundation of ethnic wear includes diverse materials like cotton, silk, wool, and jute, along with embellishments such as zari, sequins, and beads. Traditionally, these raw materials have been sourced via contracts with farmers and local marketplaces. Materials such as Banarasi silk of Uttar Pradesh, Kanchipuram silk of Tamil Nadu, and Pashmina wool of Kashmir showcase India’s regional richness and diversity. However, supply chain disruptions, fluctuating costs, and environmental concerns like water-intensive farming practices for cotton can affect the sourcing of high-quality raw materials.Such concerns not only impact crop yields but also drive up production costs, leading to supply shortages and price volatility in the ethnic wear value chain.

– Artisanal Mastery in Designing

The production involves intricate craftsmanship, with artisans specializing in various traditional techniques. The process begins with Dyeing, where fabrics are colored using natural or synthetic dyes, often incorporating tie-dye, batik, or block-printing techniques. Weaving follows, with skilled craftsmen producing region-specific textiles. Embroidery adds intricate detailing, with regional styles such as Zardozi, Chikankari, Phulkari, and Kantha enhancing the aesthetic and cultural appeal of ethnic garments. These meticulous processes preserve India’s rich textile heritage while adapting to contemporary fashion trends.

– Tailoring and Finishing

Once the fabric is prepared, it moves into the cutting and stitching phase, where tailors craft silhouettes according to modern and traditional designs. Advanced tailoring techniques, pattern-making, and draping styles help create structured fits for sarees, lehengas, kurtas, and sherwanis. Finishing touches like hemming, embellishments, and beadwork ensure the final product meets aesthetic and quality standards before reaching consumers.

– Distribution and Retail

These garments reach consumers through physical outlets, including boutiques, showrooms, exhibitions, and digital channels, like e-commerce websites and social media marketplaces. Platforms like Myntra, Ajio, and brand-specific websites have revolutionized the accessibility of traditional clothing, enabling small artisans to reach national and global markets. Indian conventional attire enjoys substantial global popularity, with exports reaching far and wide.

Global Perspective: Indian Ethnic Wear on the World Stage

The Global Ethnic Wear Market is projected to reach approximately USD 185 billion by 2034, up from USD 99.5 billion in 2024, growing at a CAGR of 6.4% from 2025 to 2034. It has become a celebrated symbol of cultural heritage in the global fashion landscape, embraced by both the Indian diaspora and international audiences drawn to its craftsmanship and aesthetic richness.

Its appeal lies in intricate embroidery, vibrant fabrics, and the storytelling embedded in traditional weaves, qualities that have earned it a growing presence in countries across North America, Europe, the Middle East, and Southeast Asia. Festivals like Diwali are increasingly celebrated by diaspora communities with traditional attire, while non-Indian consumers are also embracing Indian fashion for its elegance, especially in the wedding and resort-wear segments.

The rise of fashion diplomacy, where Indian celebrities showcase ethnic wear at global events like Cannes and the Met Gala, has elevated the profile of Indian designers and labels on international runways. Social media platforms have also played a critical role in global outreach. Influencers and creators worldwide are showcasing sarees, lehengas, and kurtas styled in fusion formats, making them more relatable and aspirational to global fashion audiences.

Furthermore, Indian Designers are entering multi-brand global platforms and pop-up stores in cities like London, Dubai, and New York, reflecting increasing international demand. The growth of cross-border e-commerce, along with simplified logistics and global payment solutions, has made it easier than ever for consumers to access Indian clothing, regardless of geography.

Current Market Scenario

Market Size and Growth

The Indian traditional apparel market, a key segment within the retail industry, was valued at USD 20.9 billion in FY 2023. Between 2024 and 2027, it is expected to grow further by USD 34.3 billion at a CAGR of 7.42%. Such substantial growth reflects increased demand as designers adapt to evolving consumer preferences.on from a credit card rewards app to a comprehensive financial services platform, emphasizing customer engagement, cost efficiency, and diversified offerings.

Segment/Demographics

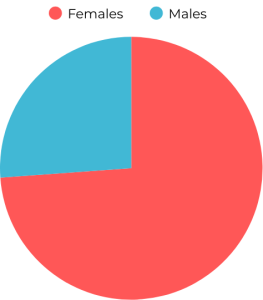

Distinct trends emerge across demographics in the Indian market. In 2024, women’s ethnic wear dominated with a 73.5% market share. In 2023, despite 80-85% of the market remaining unorganized, the organized segment, which is growing at 20% annually, demonstrates a shift in consumer preference toward branded traditional clothing. In this segment, mid-value brands constitute 40%, while premium and luxury brands each represent 30%.

Key Players

The Indian traditional fashion industry is vast, encompassing everything from small neighborhood boutiques to nationally recognized brands, each contributing to the rich and diverse fashion landscape. Amid this competitive landscape, some unique and differentiated players have carved a niche by blending traditional craftsmanship with modern appeal, catering to domestic and international demands.

- Manyavar: This specializes in men’s wear and is known for its sherwanis, kurta sets, and accessories. With quality and innovative designs, it has become a go-to brand for weddings and festivals, with retail outlets across India and globally.

- Biba: A leading women’s traditional wear brand offering a mix of traditional and contemporary designs in suits, sarees, and lehengas.

- Pernia’s Pop Up Studio: A premium multi-designer platform that curates a selection of ethnic and fusion wear from India’s top designers. It is known for its exquisite bridal collections, festive outfits, and luxury accessories.

- Anita Dongre: Renowned for her luxurious and elegant creations, Anita Dongre is a prominent designer offering bridal and festive apparel. Her collections feature a blend of traditional craftsmanship with contemporary designs, appealing to high-end clientele.

- Libas: A modern brand known for blending traditional designs with contemporary trends.

Key Trends

Fusion Fashion: Tradition Meets Modernity

Fusion fashion blends traditional designs with contemporary styles, appealing to younger consumers who value cultural roots and modern lifestyles. Indo-western outfits like kurta dresses, dhoti pants with crop tops, and sarees paired with jackets are increasingly popular. The market for Indo-Western and fusion wear is increasing, with a CAGR of 4.2% and 4.8%, respectively. One of the most influential drivers of this trend is the endorsement by Bollywood celebrities, fashion bloggers, and social media influencers. Their everyday looks and brand collaborations, especially on platforms like Instagram and YouTube, have significantly popularized fusion styles. These partnerships and innovative designs cater to evolving preferences, making fusion wear aspirational for millennials and Gen Z.

Sustainability and Revival of Handloom Textiles

Growing awareness of environmental sustainability and cultural preservation has reignited interest in handloom and handcrafted clothing. Consumers today are actively seeking eco-friendly alternatives, making handloom textiles such as Khadi, weaved by the Lambani Adivasi and Bhal communities; Ikat, weaved by the Tripurasundari and Bhuliya artists, and Jamdani, knit by the Julaha weavers, more relevant than ever. These fabrics reflect India’s rich heritage and support artisan communities, promoting sustainable livelihoods. Premium designers are redefining luxury with handwoven and handcrafted collections. Incorporating sustainability not only enhances the appeal but also strengthens its position as a unique offering in global fashion markets.

Customization and Personalization

This industry is experiencing a rise in customization as consumers look for distinct, personalized designs. Customization improves customer satisfaction through tailored fits, unique embroidery, and custom fabrics. This trend is especially advantageous for bridal and festive collections, as shoppers increasingly value individuality and uniqueness in their clothing choices. The online distribution channel is the fastest-growing segment in the ethnic wear market, indicating a shift toward personalized and customizable shopping experiences.

Government Initiatives Driving the Ethnic Wear Industry

The Indian government has implemented several initiatives to promote the growth and sustainability of India’s traditional fashion ecp-system, particularly focusing on handloom and artisanal sectors.

- Skill India – Launched in 2015, this initiative ensures that India’s rich textile heritage thrives in both domestic and international markets. Over 1.6 crore individuals have been trained under the Pradhan Mantri Kaushal Vikas Yojana (PMKVY) between 2015 and 2024, with 1.42 crore certifications awarded across various modules like Short-Term Training (STT), Special Projects (SP), and Recognition of Prior Learning (RPL). Additionally, more than 1,000 educational institutions have been integrated as Skill India Centres to increase access to skill development. These efforts foster domestic manufacturing, attract investments, and modernize infrastructure, while also empowering artisans and weavers through contemporary training.

- National Handloom Development Programme (NHDP) – Introduced Block Level Clusters (BLCs) in 2015-16, providing up to ₹2 crore in financial support per cluster for skill enhancement, product development, and infrastructure upgrades. The programme also includes Handloom Marketing Assistance, enabling weavers to participate in both domestic and international exhibitions, providing them with direct market exposure.

- Comprehensive Handloom Cluster Development Scheme (CHCDS) – This scheme focuses on the development of mega handloom clusters. Covering atleast 15000 handlooms with the Government of India (GoI) contribution upto Rs.40 crore per cluster over a period of 5 years. CHCDS also supports fair pricing by streamlining supply chains and enabling direct sales from weavers to consumers.

- India Handloom Brand (IHB) – Launched in 2015, IHB certifies high-quality handloom products to build consumer trust and expand market reach. As of 2023, 1,998 registrations have been issued under 184 product categories, reinforcing authenticity and encouraging export potential

- Amended Technology Upgradation Fund Scheme (ATUFS) – This scheme offers capital subsidies to boost investment in the modernization of textile and apparel units. By promoting sustainability and the adoption of advanced technologies, ATUFS enhances competitiveness in global markets and supports the transformation of traditional handloom operations.

- Export Promotion Council for Handicrafts (EPCH) – Operational since 1986-87, EPCH has been instrumental in boosting the export of Indian handicrafts and handloom goods. It organizes the biannual IHGF Delhi Fair, one of the world’s largest handicrafts trade shows, featuring over 3,000 Indian exhibitors and recognized by the Limca Book of Records for hosting the largest gathering of handicrafts exporters under one roof.

SWOT Analysis

Strengths

The Indian ethnic wear industry is deeply rooted in the country’s rich cultural heritage, offering a unique blend of traditional craftsmanship and contemporary designs. This legacy attracts a wide range of consumers, ensuring a timeless appeal. Heavy demand during festivals and weddings and consistent essential-wear demand drive revenue, while the industry’s global recognition boosts its export potential. Additionally, the rising shift toward sustainability, with an emphasis on handloom and eco-friendly textiles, strengthens the industry’s image. The growing organized retail and e-commerce sectors have enhanced accessibility, making it more appealing to urban and international audiences.

Weaknesses

This space faces challenges in fostering brand loyalty, particularly in the unorganized segment where price sensitivity and minimal branding often lead to customers switching between sellers. Additionally, logistical and distribution challenges hinder the delivery of handcrafted garments to global markets, especially for smaller players lacking the necessary infrastructure for scaling operations efficiently. The industry also grapples with intense competition from small local shops and large organized brands, creating a saturated market that pressures businesses to lower prices, ultimately impacting profit margins. Furthermore, limited innovation in traditional product segments restricts appeal among younger, trend-conscious consumers, making it harder for legacy styles to evolve with changing fashion sensibilities.

Opportunities

The traditional apparel market is ripe with opportunities, driven by evolving consumer preferences and expanding global reach. A rising trend of Indo-Western fusion styles presents opportunities for innovation and broader market appeal. Domestically, an 18.4% rise in India’s female workforce has fueled the need for versatile clothing that bridges professional and traditional aesthetics. Additionally, the industry can tap into untapped B2B potential by forging partnerships with global retailers and distributors to enhance export channels. The growing trend of culturally connected style has further strengthened the market’s foothold, with consumers seeking attire that reflects their heritage.

Threats

The Indian ethnic wear industry faces several challenges that could impact its sustained growth and market position. Hefty price tags attached to premium ethnic clothing deter budget-conscious consumers who still seek quality, while catering to diverse cultural preferences across regions complicates online retail operations. Navigating a vast spectrum of styles, motifs, and traditions makes it difficult to deliver a universally appealing product mix. Additionally, the sector grapples with inventory management issues, fluctuating demand, varied product lines, and unpredictable fashion cycles that often result in overstocking or shortages, particularly during festive seasons, leading to lost sales or increased holding costs. Compounding these issues is the growing competition from global fast-fashion brands, which offer trend-driven alternatives at affordable prices, making it harder for brands to retain younger consumers and maintain market share.

Innovations and Future Outlook

The Indian ethnic wear industry is embracing innovation to stay relevant in a dynamic fashion landscape. Brands are leveraging digital tools such as virtual try-ons, AI-driven personalized recommendations, and augmented reality (AR) to enhance customer experiences. Sustainable practices, including eco-friendly dyes and organic fabrics, are gaining traction as consumers prioritize ethical choices.

Global expansion presents another promising avenue, with Indian wear increasingly gaining popularity among international audiences.

Conclusion

The Indian ethnic wear industry stands at a compelling crossroads, where tradition meets innovation and local artistry finds global resonance. Its evolution is not only being shaped by shifting consumer preferences and digital advancements but also strongly supported by government initiatives such as Make in India and Skill India. These efforts are revitalizing the sector by encouraging domestic manufacturing, empowering artisans, and fostering sustainable innovation.

As timeless craftsmanship merges with contemporary design sensibilities, Indian ethnic wear is capturing international attention, becoming more than just cultural attire; it’s a global fashion statement. The growing appeal of personalized experiences, eco-conscious production, and seamless digital retail is propelling the industry forward, even as it navigates the hurdles of a fragmented market and rising fast-fashion competition.

Looking ahead, the future lies in its ability to stay rooted in heritage while embracing the opportunities of a modern world, ensuring enduring relevance for generations to come.

- Skill India – Launched in 2015, this initiative ensures that India’s rich textile heritage thrives in both domestic and international markets. Over 1.6 crore individuals have been trained under the Pradhan Mantri Kaushal Vikas Yojana (PMKVY) between 2015 and 2024, with 1.42 crore certifications awarded across various modules like Short-Term Training (STT), Special Projects (SP), and Recognition of Prior Learning (RPL). Additionally, more than 1,000 educational institutions have been integrated as Skill India Centres to increase access to skill development. These efforts foster domestic manufacturing, attract investments, and modernize infrastructure, while also empowering artisans and weavers through contemporary training.

Contributor: Team Leveraged Growth