When you think of investing, stocks and mutual funds usually come to mind first. However, in recent years, another investment vehicle has been making headlines across global and Indian markets: Exchange-Traded Funds (ETFs). With trillions of dollars invested worldwide, ETFs have become a favourite among both retail and institutional investors. But what exactly makes them so popular? Let’s break it down.

What is an ETF?

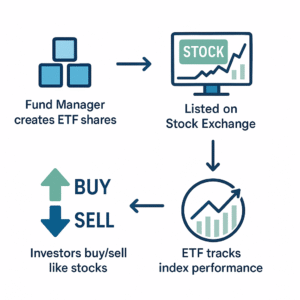

An Exchange-Traded Fund (ETF) is a type of investment fund that holds a collection of securities – such as stocks, bonds, commodities, or a mix and trades on stock exchanges, just like a stock. Think of it as a basket of assets packaged into a single tradable unit.

For example:

- A Nifty 50 ETF holds shares of all 50 companies that make up the Nifty 50 index.

- A Gold ETF holds physical gold or gold-related assets.

When you buy an ETF, you’re essentially buying into a small slice of all the assets it holds.

Why Do Investors Choose ETFs?

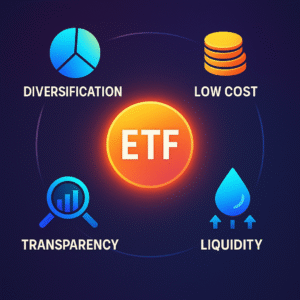

The global popularity of ETFs isn’t a coincidence. They solve many pain points investors face with traditional investment vehicles. Here are the key advantages:

- Diversification Made Simple

Instead of picking individual stocks, ETFs allow you to spread your investment across dozens or even hundreds of securities. One purchase = instant diversification. - Cost-Effectiveness

ETFs usually have lower expense ratios than actively managed mutual funds. Since most ETFs are designed to track an index passively, there’s no expensive fund manager actively buying and selling. - Liquidity & Flexibility

Unlike mutual funds, which are priced once at the end of the trading day, ETFs can be bought and sold throughout the day at real-time prices. This makes them attractive for investors who want flexibility. - Transparency

ETFs disclose their holdings daily, so investors know exactly what assets they own.

Types of ETFs

ETFs come in many flavors, making them versatile tools for investors with different goals:

- Equity ETFs: Track stock indices (e.g., Nifty 50, S&P 500).

- Bond ETFs: Invest in government or corporate debt instruments.

- Commodity ETFs Offer exposure to commodities such as gold, silver, or oil.

- Sector/Thematic ETFs: Focus on specific industries (IT, Pharma, Green Energy).

- International ETFs: Give access to foreign markets without investing directly abroad.

ETFs vs Mutual Funds

Many new investors often confuse ETFs with mutual funds, as both pool money to invest in diversified assets. However, there are substantial differences:

|

ETFs |

Mutual Funds |

|

Traded like stocks during market hours |

Bought/sold at NAV, calculated end of day |

|

Lower expense ratios |

Higher fees due to active management |

|

Passive index tracking is common |

Can be active or passive |

|

Intraday liquidity |

Suitable for SIPs & long-term holding |

Bottom line: ETFs are often cheaper and more liquid, while mutual funds offer flexibility in systematic investing (SIPs).

Global Leaders in ETFs

Globally, ETFs have transformed the way investors allocate capital. Two of the largest and most popular ETFs are:

- SPDR S&P 500 (SPY) – Tracks the S&P 500 index with assets of over $500 billion.

- Invesco QQQ (QQQ) – Tech-heavy ETF tracking the Nasdaq-100 index, favored by investors seeking exposure to growth companies.

Together, these ETFs manage more money than the entire GDP of many countries.

ETFs in India

India’s ETF market is still in its early growth phase but is expanding rapidly thanks to rising investor awareness and government backing. Some leading ETFs include:

- Nippon India ETF Nifty BeES – India’s first ETF, launched in 2001.

- SBI Nifty 50 ETF – Among the largest by AUM, providing exposure to India’s blue-chip companies.

- HDFC Gold ETF – Popular among investors seeking gold exposure without the hassles of physical storage.

The Indian government and Employees’ Provident Fund Organisation (EPFO) have also increasingly allocated funds into ETFs, further boosting credibility.

Are ETFs for Everyone?

ETFs are an excellent fit for:

- New investors seeking simple, low-cost diversification.

- Long-term investors looking to mirror market performance.

- Experienced traders who value liquidity and intraday trading opportunities.

That said, ETFs aren’t a magic bullet. They still carry market risk; if the index or asset they track falls, the ETF value falls too.

The Future of ETFs

Globally, ETFs are expected to continue their meteoric rise, with total assets possibly surpassing $15 trillion by 2030. In India, with growing financial literacy, digital platforms, and increasing retail participation, ETFs could soon shift from being “underrated” to “mainstream.”

Final Thoughts

ETFs represent the best of both worlds – the diversification of mutual funds with the liquidity and transparency of stocks. They are not about “beating the market” but about tracking the market at the lowest possible cost.

As John Bogle, the father of index investing, once said:

“Don’t look for the needle in the haystack. Just buy the haystack.”

And that’s precisely what ETFs allow you to do.

Contributor: Team Leveraged Growth