India’s aviation sector has been disrupted since the 1st week of December 2025, as IndiGo cancelled a large number of flights across major airports. What looked like routine delays quickly escalated into nationwide chaos, leaving passengers stranded, airports crowded, and airfares soaring to unprecedented levels.

Here’s a clear breakdown of what actually happened and why the impact became so huge.

The Immediate Trigger: New DGCA Fatigue Rules

The root of the disruption lies in the DGCA’s revised Flight Duty Time Limitations (FDTL) for pilots. These rules were updated to ensure better fatigue management and required airlines to provide:

- Longer mandatory weekly rest periods

- Reduced night-time flying hours

- Stricter limits on consecutive duty hours

- Tighter fatigue-management standards

These weren’t small tweaks; they changed how pilots could be scheduled across the system. When these norms came into effect, airlines were required to adjust schedules and crew availability accordingly.

Normally, airlines with excess pilot capacity can absorb such changes with minimal impact. That wasn’t the case this time.

Why IndiGo Was Affected the Most

IndiGo, long known for its strong on-time performance, admitted it had not planned adequately for the November 1 deadline to implement the stricter pilot rules. The gap in preparation meant the airline struggled with roster planning this week, resulting directly in flight cancellations.

IndiGo runs an extremely efficient operation. Its pilot rosters are designed to maximise utilisation and keep costs low, a model that works well under predictable schedules. But once the DGCA rules cut the available flying hours per pilot, IndiGo suddenly didn’t have enough reserve pilots to keep its full network running.

This created an instant bottleneck: with fewer pilots available, flights scheduled for the same day had to be cancelled.

Another major factor that amplified this challenge, IndiGo’s size. It is not just another airline. It controls around 64% of India’s domestic aviation market, meaning one out of every two flights in the country is operated by IndiGo.

So when a large operator with such dominance hits a capacity problem, the entire system feels the shock.

How One Airline’s Issue Turned into a Nationwide Crisis

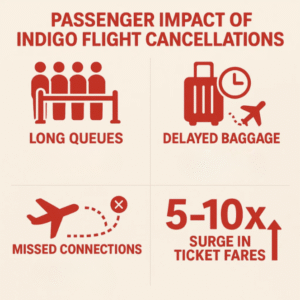

Because IndiGo handles the majority of domestic passengers, its cancellations had a ripple effect far beyond its own network.

Airports saw:

- Long queues

- Congested terminals

- Rebookings spilling into the next day

- Delays across connecting flights

Other airlines, already operating close to full capacity, simply didn’t have extra aircraft or crew to absorb the sudden surge in demand. Even a 5–10% drop in IndiGo’s flights translates to hundreds of cancelled or rescheduled trips as the company operates more than 2200 flights a day, affecting thousands of passengers across the country.

This is why the disruption felt so widespread, even though it began with a regulatory change affecting only one airline’s internal scheduling.

Why Airfares Shot Up 5x–10x

One of the most visible effects of the cancellations was the sudden surge in ticket prices.

With IndiGo pulling back flights, the total number of available seats in the market shrank dramatically. This caused fares on certain routes to jump:

- 5x on metro routes like Delhi–Mumbai

- 7x on several Tier-2 city routes

- In some last-minute cases, 8–10x increases were reported

Importantly, these price spikes weren’t restricted to IndiGo; all airlines saw higher fares because overall supply dropped.

When India’s largest carrier suddenly reduces capacity, the rest of the system simply doesn’t have enough spare seats to compensate.

IndiGo’s Response So Far

To manage the situation, IndiGo has started:

- Redrawing pilot rosters

- Adjusting flight frequencies

- Mobilising the standby crew where available

- Prioritising certain high-demand routes

The airline has communicated that flights should gradually return to normal as rosters stabilise under the new DGCA framework.

In Summary

IndiGo’s wave of cancellations wasn’t caused by a single operational failure but by a combination of industry-wide regulatory changes and the airline’s sheer size. The new DGCA FDTL rules reduced pilot availability at a time when IndiGo was running lean rosters. And because IndiGo commands around 64% of India’s domestic market, the resulting disruption spilt over into the entire aviation ecosystem, affecting flight schedules, airport operations, and ticket prices that surged as high as 5–10x.

A change in just one part of the system ended up affecting nearly every traveller in the country.

Contributor: Team Leveraged Growth