Warren Buffett, the revered Chairman and CEO of Berkshire Hathaway, is globally hailed as one of the most successful investors of all time. With a long-term, value-driven investment approach, he has grown Berkshire into a conglomerate worth over $900 billion. But even Buffett, despite his investing genius, hasn’t always been right.

And to his credit, he admits it publicly, honestly, and humbly. His missteps aren’t blemishes; they’re blueprints for better investing.

Let’s walk through some of Buffett’s most expensive and enlightening “misses” and the timeless lessons they offer.

Berkshire Hathaway: An Emotional Beginning

It might sound ironic, but Buffett’s biggest regret was buying Berkshire Hathaway itself.

In the 1960s, Berkshire was a struggling textile company. Buffett originally aimed to profit from its undervalued stock by selling it back to management. However, when the CEO attempted to lowball him in a buyback offer, Buffett, out of frustration, bought a controlling stake in the company instead.

He later called it his “first big mistake.” Why? Because he tied up capital in a dying industry out of spite. He eventually pivoted Berkshire into an investment holding company, but that emotional detour cost him dearly.

Lesson: Never let emotion, especially revenge, guide financial decisions.

Dexter Shoe Company: The $10 Billion Mistake

In 1993, Buffett bought Dexter Shoe Company, a Maine-based shoemaker, for $433 million, paid entirely in Berkshire Hathaway shares.

Dexter was profitable at the time, but Buffett underestimated the impact of foreign competition and cheap imports. Within a few years, Dexter became worthless.

What stung more was that the Berkshire shares he used would have grown to be worth over $10 billion today.

Lesson: Great businesses aren’t just about short-term profits. They need durable, competitive advantages. And never trade high-quality assets for those with decaying value.

Energy Future Holdings: A Bet Gone Dark

In 2007, Buffett invested $2.1 billion in the bonds of Energy Future Holdings, a Texas-based energy company heavily reliant on coal.

He believed it was a safe bet since he was investing in debt, not equity. But when natural gas prices dropped, Energy Future’s coal-based model collapsed. The company went bankrupt in 2014, and Buffett eventually lost around $873 million.

He admitted it was a misjudgment in understanding the dynamics of the energy market.

Lesson: Even debt investments require deep knowledge of the underlying business and sector trends. If it’s too complex or speculative, it’s best to stay away.

Lubrizol Deal: When Ethics Come Into Play

In 2011, Berkshire acquired Lubrizol, a specialty chemicals company. The deal itself seemed fine until it was revealed that Buffett’s trusted lieutenant, David Sokol, had bought Lubrizol shares before suggesting the acquisition to Buffett.

This created a major conflict of interest and damaged Berkshire’s reputation for transparency. Though the investment itself was financially sound, the lack of ethical clarity led to Sokol’s resignation.

Lesson: Ethical lapses, even if they don’t lose you money, can cost reputation and trust, which are harder to rebuild.

Missed the Tech Giants: Amazon, Google, and Walmart

Buffett openly admits that he underestimated the tech industry. He didn’t invest in Amazon or Google (Alphabet) early on, despite recognising their brilliance.

He admired Jeff Bezos, even calling him a “miracle,” but chose not to buy Amazon stock until 2019, well after its meteoric rise. Similarly, he skipped Google, despite using its products regularly.

Another miss was Walmart. Buffett held its stock briefly but sold it too early, missing its e-commerce resurgence.

Lesson: Sticking to what you know is wise, but refusing to learn new things may cost you far more. Ignorance can be expensive.

The Airlines Flip-Flop

Buffett had sworn off airlines after past failures, famously calling them a death trap for investors. But in the 2010s, he bought large stakes in Delta, United, Southwest, and American Airlines, believing the industry had matured.

Then came COVID-19. Travel halted, and airlines bled cash. In 2020, Buffett sold all his airline holdings at a loss, citing permanent changes in the business model.

Lesson: Even seasoned investors can fall for recency bias. Industries evolve fast, sometimes irreversibly.

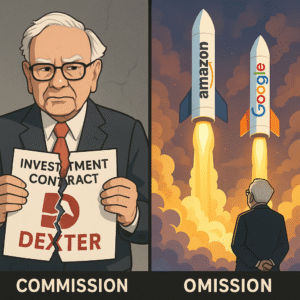

Errors of Commission vs Omission: What Hurts More

Buffett classifies mistakes into two types.

Errors of Commission are investing in something you shouldn’t have, like Dexter or Energy Future.

Errors of Omission are not investing when you should have, like missing Amazon and Google.

He says the errors of omission have cost him more because the potential upside was massive.

“The biggest mistakes are the things you didn’t do,” he once told his shareholders.

Lesson: Regret isn’t just about what you bought. It’s also about what you didn’t.

Final Thoughts: Misses ≠ Failure

Warren Buffett’s misses weren’t fatal. They shaped his investing wisdom.

He learned to avoid emotional investing.

He stayed away from leverage and complexity.

He doubled down on ethics and simplicity.

He stayed humble and kept evolving.

The beauty of Buffett’s approach lies not in perfection, but in the power of reflection and correction. Even the world’s best investor admits he’s made billion-dollar mistakes. But his edge lies in this:

You don’t need to time the market – just improve your decision-making with every lesson.

Contributor: Team Leveraged Growth