Why Your Portfolio Needs Exposure Beyond the Rupee

A pilot never plans a long-haul flight with just one airport in mind. Weather may be clear at takeoff, but storms, technical issues, or airspace restrictions can appear without warning. That’s why every flight plan includes multiple alternate airports across different regions. If one airport becomes unavailable, the journey doesn’t end, the plane simply lands elsewhere and continues safely.

Your investment portfolio works the same way.

When all investments are concentrated in domestic assets tied only to the Indian economy and the rupee, returns can soar during favourable conditions. But this also means your wealth is exposed to a single set of risks, economic slowdowns, policy changes, inflation, or currency volatility.

International diversification acts like those alternate airports. Different economies follow different cycles. When one market faces turbulence, another may be cruising smoothly. This flexibility adds stability, protects long-term goals, and keeps your financial journey on course.

In an uncertain world, smart investing isn’t about betting everything on one clear runway, it’s about always having a safe place to land.

India’s Position in the Global Investment Landscape

India is one of the fastest-growing economies in the world, yet in terms of global market capitalisation, it represents a surprisingly small share. According to studies by Morgan Stanley Capital International (MSCI) and the World Bank, India accounts for less than 4% of global equity market capitalisation. This means an investor who limits themselves to Indian markets is leaving behind more than 95% of the global investable universe.

This international universe includes sectors and companies that are underrepresented or entirely absent in India, among them, large global technology companies, advanced semiconductor manufacturers, and international healthcare innovators. Without international exposure, investors miss out on the broader sweep of global economic growth.

Key insight: Diversification is not merely about reducing risk; it is also about expanding opportunities.

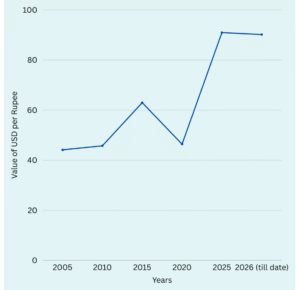

Currency Diversification and the Rupee

Currency plays a critical role in international investing. Over the long term, the Indian rupee has gradually depreciated against major global currencies, particularly the US dollar. Historical data published by the Reserve Bank of India and the World Bank shows that the rupee has weakened steadily over the past two decades.

When Indian investors hold assets denominated in foreign currencies, this depreciation can work in their favour. Returns earned in overseas markets may translate into higher values in rupee terms when converted back to INR. As a result, international investments can provide both asset growth from global markets and an additional currency-related return, making currency diversification a natural hedge against domestic inflation and economic shocks.

Why Global Diversification Reduces Portfolio Risk

Different countries follow different economic cycles. Interest rates, inflation, policy decisions, and demographics all vary across regions. As a result, global markets rarely move in perfect synchronisation.

Studies by MSCI, Vanguard, and Morningstar indicate that portfolios combining domestic and international market exposure are more likely to experience lower volatility and smaller drawdowns over time, compared to portfolios concentrated in a single country. Diversification does not eliminate losses, but it meaningfully improves long-term performance.

The key concept here: risk can be mitigated by holding assets with imperfect correlation to one another.

Do Tax Changes Make Global Investing Less Worthwhile?

Tax often comes up as a concern when Indian investors think about investing overseas. Most of this discussion revolves around the Liberalised Remittance Scheme (LRS), which allows residents to legally send money abroad each year for investments, education, travel, and other permitted purposes. Along with it comes Tax Collected at Source (TCS), which is commonly misunderstood.

TCS is not an extra tax or a penalty on foreign investing, it is simply an advance collection that can be adjusted when filing your income tax return. While it may temporarily affect cash flow, it does not change the long-term logic or potential benefits of global diversification.

Recent proposals have suggested raising the TCS threshold, meaning higher amounts might be withheld at the time of remittance. However, since TCS is an advance collection and not an additional tax, the net tax cost of international investing is determined by your total tax liability and available credits, not merely the upfront withholding.

Additionally, foreign income may be subject to withholding taxes on dividends or interest, and tax treaties between India and other countries can influence the effective tax rate. Proper planning , such as using tax credits or investing via tax-efficient vehicles, helps minimise these costs.

In other words, while taxes add complexity, they don’t negate the underlying financial benefits of diversification. Thoughtful tax planning should be part of any investment strategy, but it shouldn’t deter investors from gaining valuable global exposure.

Global Exposure: What Research Says About How Much to Hold

Studies by Vanguard and Morningstar show that markets around the world rarely move in perfect sync, meaning foreign equities can help smooth portfolio swings. Data from MSCI further confirms that Indian markets often behave differently from global peers, creating a natural case for geographic diversification.

Academic research and market analyses suggest that international equities can form roughly 20–40% of the total equity portion of a globally diversified portfolio, based on global market capitalisation and correlation studies.

In the Indian context, expert commentary in publications like the Economic Times and LiveMint notes that even moderate exposure, around 10–20% of total investments , can provide meaningful sector and currency diversification while complementing domestic growth. Importantly, these figures are observations from market research, not personal advice; the exact allocation varies with individual goals, time horizons, and risk tolerance.

In short, researchers highlight that even a modest allocation of 10–20% can have tangible diversification benefits, while higher allocations of up to 30–40% of equity are observed in global portfolio models, all depending on risk appetite and investment horizon.

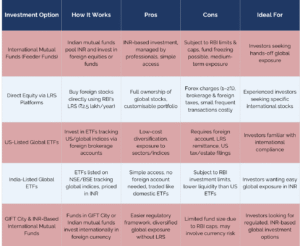

How Indian Investors Can Access Global Markets

Investors in India have several well-organised options to invest in global markets, each with its own advantages and limitations:

The Importance of Rebalancing

Over time, asset allocations drift as a result of market movements and currency fluctuations. Rebalancing periodically, typically once a year, helps maintain the desired risk profile and supports disciplined investing behaviour.

Final Thought

International diversification isn’t about turning your back on India. It’s about acknowledging a simple fact: not all economies, currencies, and markets perform well at the same time. Taxes may nibble at the edges, but the bigger picture is clear , a globally diversified portfolio protects your purchasing power, cushions against local shocks, and lets you participate in the world’s biggest growth stories.

In cricket terms, think of India as your star batsman, the one you rely on to anchor the innings. But it takes more than one batsman to win a match. You need bowlers who can handle difficult conditions, fielders who can save crucial runs, and all-rounders who adapt as the pitch changes. That supporting role is what global investments play, providing ballast to your portfolio when conditions at home become challenging.

Rather than letting tax changes discourage you, step back and look at the bigger picture. The world is your investment playground, and the smartest portfolios are the ones that know how to play both at home and away.

Contributor: Team Leveraged Growth