Black money is a term that sparks curiosity, controversy, and confusion in equal measure. For some, it is the hidden stash of unaccounted cash lying in lockers and suitcases. For others, it represents an entire underground economy that silently runs parallel to India’s official economy. But what exactly is black money, how does it circulate, and why does it matter so much? Let’s navigate the maze.

What Is Black Money?

At its core, black money refers to income that is not reported to the authorities, either to avoid taxation or to conceal illicit activities. It is not just money earned from crime; it also includes legitimate income that is deliberately hidden. For example, a builder selling apartments partly in cash, a doctor not officially billing certain patients, or a trader under-invoicing imports.

Economists often categorize money into three types:

- White money – legally earned, thoroughly reported, and taxed.

- Grey money – partly declared, often hidden through loopholes.

- Black money – entirely unreported, often moving through cash transactions or secret channels.

The blurred boundaries between these categories make regulation challenging, contributing to the larger shadow economy.

How Black Money Circulates

Black money is not just hoarded in vaults; it flows through everyday transactions. Major avenues include:

- Real Estate: Property deals often involve a “cash component” to reduce stamp duty or taxes. This makes real estate one of the most significant sources of black money.

- Cash-intensive Businesses: Small retailers, restaurants, and service providers can under-report sales. Since customers pay cash, much of it goes unrecorded.

- Hawala Networks: An informal, trust-based system to transfer money without physical movement, commonly used for remittances and offshore transfers.

- Offshore Tax Havens: Funds are parked in places like Mauritius, Singapore, and Switzerland through shell companies or layered transactions, making them nearly invisible.

Each channel creates new layers of opacity, widening the maze.

The Size of the Shadow Economy

Quantifying black money is notoriously tricky, but credible estimates paint a staggering picture.

- The World Bank estimated that India’s shadow economy accounts for approximately 20% of the country’s GDP, or roughly $490 billion, in recent years.

- In 2022, the Global Financial Integrity (GFI) report highlighted that India lost an average of $64 billion annually in illicit financial flows during the last decade.

- The Swiss National Bank reported that Indian deposits in Swiss banks totalled over ₹31,000 crore as of 2023. Though not all of this is illegal, it reflects the continuing preference for offshore stashes.

These numbers underline that black money is not just a fringe issue; it is a systemic challenge.

The Impact on the Economy

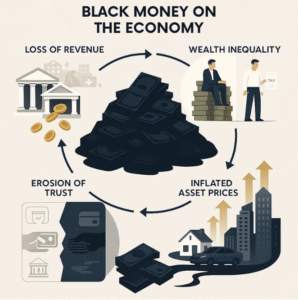

The effects of black money ripple through multiple layers of the economy:

- Loss of Revenue: Unreported income reduces tax collections, straining government budgets for welfare, healthcare, and infrastructure.

- Wealth Inequality: Those who hide wealth avoid taxes, while honest taxpayers bear the burden.

- Inflated Asset Prices: Inflows of unaccounted cash into real estate or luxury markets distort actual demand and push up prices.

- Erosion of Trust: A parallel cash-driven economy undermines faith in institutions and formal systems.

In essence, black money diverts resources from productive use and fuels a vicious cycle of inequality and inefficiency.

Government Crackdowns

India has experimented with multiple measures to tackle the black money menace:

- Demonetization (2016): Overnight, ₹500 and ₹1,000 notes (which made up 86% of currency in circulation) were scrapped to flush out hoarded cash. While it temporarily disrupted the cash economy, much of the money eventually returned to banks, raising questions about the effectiveness of the measure.

- Goods and Services Tax (GST): By unifying indirect taxes and creating a digital trail, GST has reduced opportunities for under-invoicing and fake billing.

- Digital Payments Push: Initiatives like UPI have boosted transparency by reducing reliance on cash.

- Benami Property Act & Income Disclosure Schemes: These targeted hidden assets and offered windows for voluntary disclosures.

Despite these, black money has proven resilient, adapting quickly through newer channels like cryptocurrencies and complex cross-border structures.

- Demonetization (2016): Overnight, ₹500 and ₹1,000 notes (which made up 86% of currency in circulation) were scrapped to flush out hoarded cash. While it temporarily disrupted the cash economy, much of the money eventually returned to banks, raising questions about the effectiveness of the measure.

Why It Matters Now

Black money is not just a moral issue; it is an economic drag. At a time when India is striving for rapid growth and global positioning, a shadow economy accounting for nearly one-fifth of the GDP is a significant hindrance. It distorts policy effectiveness, deprives the government of vital funds, and perpetuates systemic corruption.

The challenge is not only about cracking down but also about creating an ecosystem where compliance becomes easier and evasion less attractive. Simplified taxation, reduced discretionary powers, and deeper digital integration are steps in that direction.

The Maze Continues

Black money in India is not a new phenomenon; it has evolved for decades, surviving crackdowns, reforms, and even demonetization. Like a maze, it has multiple entry and exit points, hidden pathways, and ever-changing routes. Every time the government blocks one lane, new ones appear.

The real solution may lie not in headline-grabbing crackdowns but in systemic reforms that reward transparency, make compliance effortless, and reduce the scope for corruption. Until then, the black money maze will remain one of India’s most complex and enduring challenges.

Contributor: Team Leveraged Growth