Electric Vehicles (EVs) once felt like they belonged to the realm of science fiction – a futuristic concept far removed from everyday reality. Today, they are transforming the automotive landscape, moving from a niche innovation to a central player in the transition to sustainable transportation. From sleek sedans that whisper silently through bustling city streets to rugged electric trucks conquering off-road trails, EVs are no longer a novelty – they are the new normal.

Unpacking the EV Value Chain

The EV industry is at a turning point, transitioning from rapid growth to early maturity. Adoption is accelerating, but challenges persist – fragile supply chains, fluctuating battery material costs, and the urgent need for a robust charging infrastructure signal an evolving landscape. The manufacturing process itself unfolds in key stages, each essential to shaping the vehicles of tomorrow:-

Global EV Market Surges Toward Mainstream

The global EV market continues its transformative journey in 2024, firmly establishing itself as a cornerstone of the automotive industry’s future. With EV sales projected to reach 17 million units this year – an impressive leap from 14 million in 2023 – the momentum is undeniable. EVs are

expected to claim nearly 19.2% of the light-vehicle market share, up from 18% in 2023. This growth underscores their evolution from niche products to mainstream contenders, reshaping consumer habits and industrial priorities worldwide. As of 2024, the global EV market is projected to reach a revenue of approximately $786.2 billion. Looking ahead, the market is expected to experience a compound annual growth rate (CAGR) of 6.63% from 2025 to 2029, driving the market volume to an estimated $1,084.0 billion by 2029.

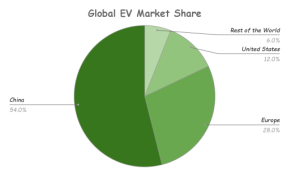

The global EV market is dominated by China, which accounts for around 55% of global sales, driven by strong policies, investments in battery technology, and robust domestic manufacturing. Europe follows closely, with EV adoption growing despite challenges like subsidy cuts in Germany and France. The U.S. also sees steady growth, supported by federal incentives such as the Inflation Reduction Act, which supports the EV shift by offering tax credits for new and used EVs, incentivizing domestic manufacturing and battery production, and funding nationwide EV charging infrastructure. It also promotes clean energy integration to ensure sustainable EV adoption. Emerging economies, including India, Thailand, and Vietnam, are gaining traction with affordable EV models and government-led initiatives. By 2035, EVs are projected to represent two-thirds of global vehicle sales, reflecting the ongoing transformation of the global automotive landscape.

Global EV Pioneers

The global EV market is rapidly evolving. According to EV volumes, BYD and Tesla dominated the first half of 2024, capturing over 30% of the worldwide market. Tesla leads globally with its advanced battery technology and popular models by revenue. At the same time, BYD, leveraging its stronghold in China and expanding its European presence, surpassed Tesla in total sales, accounting for 21% of global deliveries (1.19 million units).

BMW ranked third globally with over 210 thousand units sold, and Volkswagen secured fifth place with approximately 157 thousand units sold. The market is increasingly influenced by Chinese automakers, who now comprise over half of the top 20 brands by sales, challenging traditional giants like Tesla, BMW, and Volkswagen as they strive to retain their competitive edge.

China’s EV Dominance and Rivalries

China has advanced its EV industry through various strategies, including the dual-credit system, which pushes automakers to increase electrified vehicle production. Regulatory measures, like easier access to EV license plates and financial incentives, such as rebates and tax exemptions, have also played a key role. The government has invested in R&D and charging infrastructure, while local governments in cities like Shanghai, Shenzhen, and Beijing have introduced rebate programs to promote EV adoption. However, China’s dominance in critical components like batteries and rare earth materials has raised concerns globally.

In response, regions like the U.S., the European Union (EU), and countries such as India are intensifying efforts to strengthen local EV production. India is making significant investments in battery manufacturing and expanding EV infrastructure through initiatives like the FAME II program, aimed at enhancing domestic EV production and charging networks.

India’s EV Market Landscape

India’s EV industry stands at the crossroads of transformation, poised to redefine the nation’s mobility landscape. With a booming automotive sector and a growing appetite for sustainable transportation, India is fast emerging as a global EV powerhouse. Driven by ambitious government targets, innovative automakers, and an ever-increasing consumer base, the country is poised to become the world’s third-largest automotive market by 2030. This surge isn’t just about numbers; it’s about reshaping the future of transportation in one of the world’s most populous and dynamic economies.

India’s EV market is charging ahead with impressive growth. Valued at $8.03 billion in 2023, it is expected to skyrocket to $117.78 billion by 2032, reflecting an impressive CAGR of 22.4%. The

push towards EV adoption is fueled by rising population demands and a heavy reliance on imported crude oil, which accounts for nearly 80% of the country’s requirement for cruise oil. To tackle this, the government, led by NITI Aayog, aims for 70% EV adoption across all vehicle types by 2030, aiming to achieve net-zero carbon emissions by 2070.

The Carbon Credit Edge for EVs

Collaborating with an electric truck mobility company offered us unique insights into India’s rapidly evolving carbon credit ecosystem. With a revamped Carbon Credit Trading Scheme (CCTS) introduced in 2023, businesses now have unprecedented opportunities to leverage carbon credits for growth and sustainability. Let’s explore how this is shaping the future.

India’s Carbon Credit Trading Scheme (CCTS)

The CCTS establishes a market for tradable carbon credits and is divided into two key markets:

Compliance Market (Starting 2025-26):

In this mandatory system, high-emission industries like steel must adhere to government-imposed emission targets. Companies exceeding their limits must purchase carbon credits to offset emissions, while those emitting less can sell surplus credits for profit. This mechanism creates a strong monetary incentive for reducing emissions.

Voluntary Market (Launch Date TBA):

This optional market empowers businesses and individuals to offset their carbon footprint by purchasing credits voluntarily. It enables them to achieve sustainability or net-zero goals, driven by stakeholder expectations for greener practices. This market reflects the growing importance of environmental responsibility in corporate strategy.

Carbon Credits Powering India’s EV Sector

India’s carbon credit projects are driving transformation in the EV industry through two major avenues:

Renewable Energy Charging Solutions:

Charging stations powered by clean energy sources, such as solar and wind, reduce reliance on fossil fuels while generating carbon credits. For example, Indian Oil Corporation Limited, in collaboration with Hygge Energy, has developed renewable energy tracking systems that blend sustainability with economic value. These innovations demonstrate how clean energy is reshaping the infrastructure supporting EV adoption.

EV Manufacturing and Usage:

Transitioning from gasoline vehicles to EVs is significantly cutting emissions, contributing to cleaner air and sustainable urban development. Carbon credit projects incentivize this shift, creating a ripple effect of innovation and environmental impact within India’s automotive ecosystem

Powering India’s EV Policy Pulse

FAME I: Laying the Foundation for EV Adoption

India’s electric mobility journey began in 2015 with the introduction of the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme with an initial budget of ₹795 crore for two years. However, the scheme was extended several times, and the final extension was until March 31, 2019, with an additional allocation of ₹100 crore. Designed to promote EV affordability and local manufacturing, the scheme provided financial incentives to EV buyers and supported the development of essential EV components like batteries and electric motors.

FAME II: Scaling up EV Adoption and Infrastructure

Building on the success of FAME I, FAME II intensified India’s EV push with significant investments in public EV charging infrastructure and demand incentives. The Ministry of Heavy Industries (MHI) approved ₹800 crore to establish 7,432 public EV charging stations and ₹73.50 crore to upgrade 980 existing charging stations. The scheme targeted the electrification of public and shared transportation, including 7,090 electric buses, 5 lakh e-three-wheelers, 55,000 e-four wheeler passenger cars, and 10 lakh e-two-wheelers. With ₹5,790 crore in subsidies, over 1.34 million EVs were sold, reinforcing India’s EV leadership ambitions.

EMPS: Focused Support for Smaller EVs

To adapt to changing market dynamics, the Electric Mobility Promotion Scheme (EMPS) replaced FAME II from April 1, 2024, to September 30, 2024. With a budget of ₹778 crore, EMPS focused on high-demand segments like electric two-wheelers (e-2Ws) and electric three-wheelers (e 3Ws). The scheme supported 3,72,215 EVs, including 3,33,387 e-2Ws and 38,828 e-3Ws, covering electric rickshaws, e-carts, and L5-category vehicles. Prioritizing advanced battery technology, EMPS aimed to accelerate last-mile connectivity and personal mobility.

PM E-DRIVE Scheme: Advancing EV Adoption and Infrastructure

India’s future EV policy targets electrifying 8,00,000 diesel buses over 2024 – 2030, replacing more than one-third of the country’s diesel bus fleet. This initiative focuses on reducing vehicular emissions while promoting large-scale investments in EV manufacturing and charging infrastructure. Additionally, the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme commits ₹10,900 crore to support EV adoption, including two-wheelers, three-wheelers, ambulances, and trucks. It also allocates ₹2,000 crore for 72,000 fast-charging

stations and ₹780 crore for upgrading EV testing facilities, reinforcing India’s sustainable transportation goals.

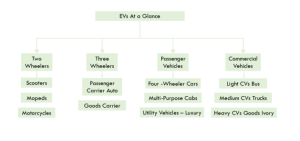

Types of Vehicles

Key Players in India’s EV Growth

Vehicle Type: Two-Wheeler

Ola: Ola Electric has established itself as a leader in the Indian electric two-wheeler market, making a significant impact with its ambitious growth strategies and diverse product range. The company operates a highly automated “mega-factory” in Tamil Nadu, with a projected annual production capacity of 10 million units.

Ather Energy: Ather Energy is an Indian manufacturer specializing in high-performance electric scooters. Known for models like the Ather 450X, the company aims to revolutionize urban mobility with innovative, tech-driven solutions and a focus on sustainability.

Vehicle Type: Four-Wheeler

Tata Motors: Tata Motors has evolved from a truck and taxicab reputation to a leader in India’s EV revolution. By 2024, its diverse lineup – featuring the Nexon (EV), Tiago (EV), and Punch (EV) –

drove a 43% surge in EV sales, securing over 70% market share in the segment and redefining its image in the passenger vehicle market.

Mahindra & Mahindra: Mahindra & Mahindra (M&M), India’s most considerable SUV manufacturer, has revamped its EV strategy by creating a subsidiary, Mahindra Electric Automobile Ltd, with plans to invest ₹12,000 crore and launching five electric SUVs by 2026.

Morris Garage: MG Motor India has launched its first all-electric Crossover Utility Vehicle, the Windsor EV, priced from ₹9.9 lakhs. Based on the Wuling Cloud EV, it joins MG’s EV lineup alongside the ZS EV and Comet EV, positioning MG as a strong competitor to Tata Motors. MG’s joint venture with JSW Group aims to accelerate its growth in India’s market.

Hyundai: Hyundai Motor India is expanding its offerings with the upcoming Creta EV launch in January 2025 and the locally assembled IONIQ 5 while enhancing EV infrastructure with plans for 600 fast-charging stations nationwide. The company focuses on strategic partnerships, including one with Exide Energy for battery localization, to support India’s growing EV market.

Vehicle Type: Commercial Vehicle

Ashok Leyland: Ashok Leyland is advancing its portfolio by delivering electric trucks like the AVTR 55T and BOSS Electric series, designed for urban logistics. The company is investing ₹1,200 crore in manufacturing electric buses and enhancing EV capabilities in Tamil Nadu.

Olectra Greentech: Olectra Greentech has strengthened its position in India’s EV market by supplying over 2,100 electric buses and reporting a significant increase in profits and revenue in 2024. The company has also extended its partnership with BYD until 2030 to enhance its electric bus offerings.

| Sl No. | Feature | Tata Nexon EV (Tata Motors) | XUV400 EV (M&M) | MG ZS EV (Morris Garage) | IONIQ EV (Hyundai) |

| 1 | Range (in km) | 489 | 456 | 461 | 631 |

| 2 | Maximum Torque (in bhp) | 148 | 147.51 | 174.33 | 214.56 |

| 3 | Charging Time (AC) | 6 hrs 36 mins | 6 hrs 30 mins | Upto 9 hrs | 6 hrs 55 mins |

| 4 | Battery Capacity (in kWh) | 46.08 | 39.4 | 50.3 | 72.6 |

The Significance of Charging Infrastructure

The availability of public charging facilities is a cornerstone of the EV revolution. It provides confidence to existing EV users and encourages prospective buyers to transition to EVs. Fast charging stations, in particular, play a pivotal role in reducing charging times and enhancing the overall efficiency of EV usage. India’s efforts in this domain reflect a clear commitment to sustainable mobility and reducing carbon emissions. With infrastructure continuing to grow, the nation is well-positioned to pave the way for a cleaner and more energy-efficient future.

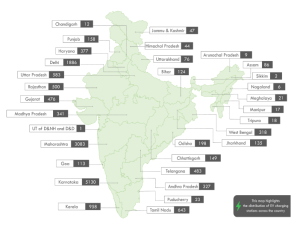

Expanding India’s EV Charging Network

This map showcases the distribution of EV charging stations across India, highlighting regional progress in electric mobility infrastructure. States like Maharashtra, Karnataka, and Tamil Nadu lead with significant installations, reflecting their commitment to sustainable transport. Conversely, regions like Sikkim and Nagaland lag behind, underscoring the need for more equitable development to drive EV adoption nationwide.

The Cost of EVs: Breaking Down the Price Tag

Although EVs provide significant advantages, such as lower operating costs and environmental benefits, their upfront cost remains higher than traditional petrol or diesel cars. This is primarily due to the high cost of advanced battery manufacturing, involving expensive raw materials like lithium and cobalt, and the complexity of production processes. Their nascent charging infrastructure and limited production scale further influence the high cost of EVs. However, as technology progresses, manufacturing expands, and market competition intensifies, the prices of EVs are anticipated to drop significantly over time. Click on the link to view the Excel file provided by the Bureau of Energy Efficiency, which offers a detailed breakdown of the price of compared to a regular petrol car.

The Road Ahead: Will EVs Replace ICE Vehicles?

As the automotive industry undergoes a significant transformation, the debate between Internal Combustion Engine (ICE) vehicles and EVs has become a focal point of discussion. With the push for sustainability and technological advancements, it’s crucial to understand how these two types of vehicles differ in efficiency, cost, and environmental impact.

ICE vehicles rely on high-specific energy fuels that emit greenhouse gases, while EVs use electricity stored in low-specific energy batteries, producing no tailpipe emissions. Fuel tanks in ICE vehicles take up little space and are lightweight, but EV batteries are larger and heavier. ICE vehicles have higher maintenance and running costs, lower energy efficiency (30%), and a complex gear system. They are also noisy and require speed to achieve maximum torque. In contrast, EVs have lower maintenance and running costs, boast higher energy efficiency (80%), operate with a simple gear system, and deliver maximum torque instantly while running quietly. While EVs may have a higher initial purchase price, their lower operating and maintenance costs, combined with available incentives, often result in a favorable Total Cost of Ownership (TCO) compared to ICE vehicles. This makes them an economically viable option for many consumers.

Exploring the Pros and Cons of EVs

EVs promise a cleaner, greener future with significant advantages, but their adoption comes with a fair share of challenges. While they reduce tailpipe emissions and offer lower running costs than internal combustion vehicles, their broader impact reveals several drawbacks.

One major issue is limited charging infrastructure, especially in rural areas, which leads to range anxiety for drivers. Charging EVs also takes longer compared to traditional refueling, adding inconvenience. Despite incentives, the high upfront cost of EVs, mainly due to expensive battery

materials, remains a barrier. Additionally, battery production relies on mining materials like lithium and cobalt, which raises ethical and environmental concerns. Furthermore, the high manufacturing emissions associated with EVs, particularly during battery production, can take years to offset the initial ecological impact.

Another drawback is the underdeveloped battery recycling infrastructure, creating long-term waste management challenges. Moreover, as EV adoption grows, it could strain electricity grids, especially in regions still dependent on fossil fuels. These disadvantages highlight the ongoing challenges in EV adoption, though advancements in technology and infrastructure are paving the way for a more sustainable future.

While the challenges surrounding EV adoption are significant, continued progress in technology, infrastructure, and sustainability practices is essential to unlocking their full potential and ensuring a more sustainable and efficient future for mobility.

Contributor: Team Leveraged Growth