These days, buying something expensive doesn’t need months of saving or second thoughts. Just click “Buy Now” and choose No-Cost EMI, no interest, no hassle, just a few small instalments

It sounds perfect, right?

Well… not quite.

Let’s take a closer look at what “No-Cost EMI” really means, how it works, and what no one tells you before you make that transaction.

What Is No-Cost EMI?

A No-Cost EMI (Equated Monthly Instalment) arrangement is designed to let you purchase an item and pay for it in monthly instalments without paying additional interest. For example, if a product costs ₹1,00,000 and you select a six-month No-Cost EMI, your monthly repayment is typically ₹16,667. The concept is simple and attractive: easier budget management, no heavy upfront payment, and the perception of zero additional cost.

How Does It Actually Work?

In reality, No-Cost EMI is a financial arrangement involving interplay between merchants, banks, and sometimes manufacturers:

- The bank typically charges standard interest on the loan.

- The merchant or manufacturer offers an upfront discount roughly equal to the total interest cost, effectively covering your interest payments.

- Thus, you end up paying the original product price(maybe more), split over monthly instalments, creating an impression of “no interest” even though the interest component exists.

Sometimes, however, merchants may simply build the interest amount into the listed price, or offer a lower discount compared to what’s available for upfront (lump-sum) payments.

Potential Hidden Charges and Downsides

No-Cost EMI is not always cost-free or the best deal. Consider these aspects:

- Processing Fees: Many banks levy processing fees (often 1–3% of the product price), which can add substantially to your final outlay.

- GST on Interest: Even if the merchant covers the interest, you may have to pay GST on the interest component, increasing your effective cost.

- Sacrifice of Better Discounts: Upfront payments may qualify for better discounts or cashback offers, which you forfeit by selecting EMI.

- Inflated Product Price: In some sales, the product’s MRP may be subtly increased to compensate for the “no-cost” financing.

- Strict Terms: The offer may be limited to select products, brands, or tenures and often requires a credit card or specific bank approval.

- Credit Risks: Missing an EMI payment can negatively affect your credit score, and some schemes are reported as personal loans on your credit report.

- Budget Overload: Multiple EMIs running in parallel may silently undermine your monthly budget and savings discipline.

Why No-Cost EMI Feels So Attractive

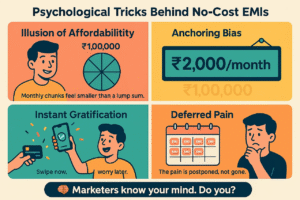

-

- Illusion of Affordability: Smaller monthly payments appear manageable.

- Anchoring Bias: Consumers focus on the low monthly figure, losing sight of the total outflow.

- Instant Gratification & Deferred Pain: Immediate possession without the pain of a large withdrawal, often at the expense of future savings.

When Does No-Cost EMI Actually Make Sense?

One must try to avoid this so-called No-Cost EMI, but here are some situations you can actually consider this as an option:-

- You’re buying something essential (like a phone for work or college)

- The merchant is genuinely covering the interest

- There are no processing fees or better alternative offers

- You’re 100% confident you’ll never miss a payment

If all the boxes check out, go ahead. Just know what you’re walking into.

Final Takeaway: Read Before You Swipe

No-Cost EMI is a brilliant marketing tool. It’s convenient, tempting, and sometimes even useful. But it’s not always free, and it’s certainly not magic.

Before you opt in, ask yourself:

- Am I avoiding a lump sum or just delaying pain?

- Is there a smarter way to pay?

- Will this EMI mess with my future savings or budget?

Remember: just because something says “no cost” doesn’t mean there’s no catch.

So next time you see a “No-Cost EMI” banner flashing at you, pause for a moment, and swipe with awareness.

Contributor: Team Leveraged Growth