For decades, Asian Paints has been the undisputed leader of India’s decorative paint industry, a ₹70,000 crore market known for high margins, low brand-switching, and deep dealer networks. Backed by legacy, a robust supply chain, and smart branding, the company has long been considered invincible.

But something has changed.

The year 2024–25 has brought a wave of disruption that the sector hasn’t seen in years. From declining profits to new players capturing share rapidly, the Indian paint industry is experiencing a rare shake-up. And it’s not just business analysts who are taking notice; so are investors, dealers, and consumers.

Asian Paints’ Stronghold Faces a Test

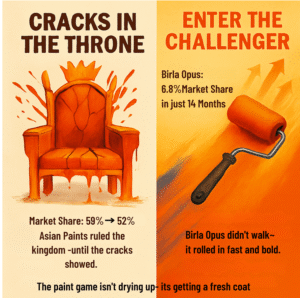

Asian Paints, once controlling nearly 59% of India’s decorative paints market, has reportedly seen its share drop to about 52% in a short span. This erosion may not seem alarming at first glance, but in a category with limited major players and high brand loyalty, even a small shift represents significant ground lost.

Even more concerning is the company’s Q4 FY25 performance, with profits falling 45% year-on-year, attributed to a combination of subdued demand and increased competitive pricing.

While the management continues to project confidence, highlighting a move toward “value-led growth” and innovation-led expansion, the challenges are becoming increasingly visible.

Birla Opus: Making a Loud Entry

The Aditya Birla Group’s entry into the sector via Birla Opus has made the biggest splash. In just over a year of full operations, the company has already captured ~6.8% market share, something that took decades for some legacy players.

Their approach includes an INR 10,000 crore investment in setting up five manufacturing plants across India. This has enabled rapid onboarding of dealers and distributors. Birla Opus is offering higher margins and incentives along with aggressive branding and advertising across touchpoints.

While most new entrants take time to scale in this industry, Birla Opus seems to be playing a different game – fast, aggressive, and well-funded.

JSW Paints: Quiet but Consistent

Though not as flashy, JSW Paints, launched in 2019, has slowly been building its brand. It has focused largely on premium home buyers and real estate developers, particularly in South and West India. With the backing of the JSW Group, it’s gained ground with a differentiated pricing strategy and emphasis on quality.

JSW may not have made as much noise as Birla Opus, but its targeted regional growth and gradual expansion are helping it gain a foothold, especially in urban centers and under-penetrated categories.

Dealers Are Shifting Loyalties

Historically, Asian Paints commanded over 70% of turnover from many dealers, thanks to its long-standing relationships, supply consistency, and branding power. However, with Birla and JSW offering more attractive terms such as better margins, faster payment cycles, and greater flexibility, many dealers are now stocking a wider range of brands.

Some reports suggest that Asian Paints’ dealer turnover contribution has dropped to 30–35% in key markets – a sign that even deeply entrenched relationships can be tested in the face of better economics.

What About Other Players?

It’s not a three-horse race. The Indian paint market is crowded, yet wide open.

Berger Paints remains strong in Tier 2 and Tier 3 cities with a focus on volume growth.

Dulux (AkzoNobel) continues to play in the premium category with its international brand appeal.

Nerolac, Indigo, and Shalimar each hold niche strengths in metal paints, industrial coatings, or price-sensitive segments.

In short, the race is intensifying across price points, regions, and product categories.

Stock Market Speaks

Investors, too, are watching closely.

While the NIFTY 50 gained ~7% over the past year, Asian Paints’ stock is down by ~19%, reflecting concerns about slowing growth and rising competition. The market may be factoring in a period of margin pressure, potential loss of pricing power, and uncertain dealer retention.

So… What’s Next?

Will Asian Paints innovate and defend its turf?

Will Birla Opus continue its hyper-growth streak?

Can JSW Paints scale beyond its regional dominance?

And what role will players like Dulux and Berger play in this evolving picture?

One thing is certain, the paint industry in India is going through a rare churn, and the results could redefine who gets to colour the country’s walls in the years to come.

Contributor: Team Leveraged Growth