India has emerged as one of the world’s fastest-growing aviation markets, riding on rising disposable incomes, expanding middle-class aspirations, and improved connectivity. The country’s domestic passenger traffic crossed 153 million in FY24, and forecasts suggest this could touch 300 million by the end of the decade, positioning India as the third-largest aviation market globally. Yet, behind the headline growth story lies a more nuanced reality – while demand is soaring, profitability remains elusive.

The Demand Tailwinds

Air travel in India has undergone a structural shift. A decade ago, flying was aspirational; today, it has become mainstream for a significant portion of urban India. The UDAN (Ude Desh ka Aam Nagrik) scheme has helped expand regional connectivity, bringing smaller cities onto the aviation map. Low-cost carriers (LCCs) dominate, offering affordable fares to a rapidly expanding base of price-sensitive travelers.

India’s demographic dividend supports long-term demand. With a young, upwardly mobile population and rising urbanization, the trajectory of air traffic growth remains structurally strong. Seasonal surges in travel, especially during festivals and holidays, also push load factors above 85%, reinforcing demand resilience.

Profitability Under Pressure

But soaring demand doesn’t translate into soaring profits. The biggest cost headwind for Indian carriers is Aviation Turbine Fuel (ATF), which forms around 35-40% of operating expenses – significantly higher than the global average of 20-25%. This is largely due to high state-level taxes, making Indian carriers structurally disadvantaged compared to global peers.

At the same time, fares remain competitive. Regulatory fare caps, combined with aggressive pricing wars, keep yields (revenue per passenger per kilometer) low. Even with high occupancy, revenue per passenger often struggles to cover the elevated cost base.

The result: a paradox where planes are full, but profits are thin. Many carriers generate strong operating revenues yet struggle with net profitability, often relying on debt to fund expansions or cover losses.

Financial Fragility in Focus

The financial vulnerability of the sector is underscored by repeated failures. Kingfisher Airlines, Jet Airways, and most recently Go First collapsed under unsustainable debt, high costs, and external shocks. Their exits underscore the sector’s structural fragility, a market where demand is robust, but business models lack resilience.

Currency fluctuations compound the problem, as a large portion of airline costs – including fuel, aircraft leases, and maintenance are dollar-denominated. A weakening rupee erodes margins even when domestic demand remains strong.

Infrastructure and Policy Bottlenecks

Airports form the backbone of the ecosystem, but capacity mismatches are evident. Metro hubs such as Delhi, Mumbai, and Bengaluru operate at near-saturation, while several regional airports remain underutilized. Congestion not only delays flights but also reduces operational efficiency and increases costs.

Policy uncertainty adds another layer of risk. Airlines face fare regulations, slot constraints, and taxation inconsistencies across states. The lack of a cohesive national aviation fuel policy continues to be a sticking point for industry players. Without reforms, the sector risks being caught in a cycle of demand growth without profitability.

IndiGo: The Efficiency Outlier

In this turbulent landscape, IndiGo has emerged as the clear market leader, commanding over 60% market share. Its success lies in ruthless efficiency and relentless cost control.

One of its most striking advantages comes from aircraft turnaround discipline. IndiGo flights are known for early arrivals, which allow planes to complete more trips in a single day compared to competitors. This higher utilization not only boosts revenue but also spreads fixed costs more effectively across additional flights.

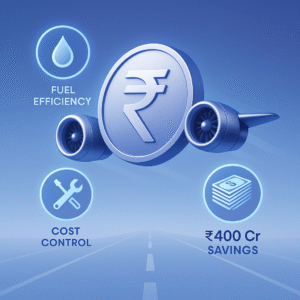

Operational discipline is complemented by innovative cost-cutting. IndiGo saves nearly ₹400 crore annually by implementing measures such as using lighter seats and service equipment, avoiding fuel-intensive onboard ovens, and optimizing fleet operations. This laser-sharp focus on efficiency translates into structural cost advantages that peers struggle to replicate.

IndiGo’s single-aircraft family strategy (mainly Airbus A320s) further reduces complexity in training, maintenance, and spares management, driving down costs while boosting operational reliability.

That said, even IndiGo is not immune to external pressures. While it remains consistently profitable relative to peers, its margins are still highly sensitive to ATF volatility, currency fluctuations, and regulatory interventions.

Investor Perspective: Risks vs. Opportunity

For investors, Indian aviation presents both structural opportunity and cyclical risk. The demand runway is undeniable, but profitability depends on reforms and operational discipline. Key watch factors include:

- ATF Tax Rationalization: A uniform GST framework for aviation fuel could lower structural costs.

- Airport Capacity Expansion: New airports and metro expansions will ease congestion, improving efficiency.

- Market-Driven Pricing: Easing fare caps would allow airlines to adjust pricing based on demand-supply realities.

- Fleet Modernization: Newer, fuel-efficient aircraft could help reduce per-seat costs.

Without reforms, the industry risks repeating past cycles, expanding aggressively to capture demand but collapsing under financial strain.

The Flight Path Forward

India’s aviation sector sits at a crossroads. The demand side is secure – passengers will keep flying, and air travel will continue to outpace rail and road for speed and convenience. However, unless cost structures are addressed and policy bottlenecks resolved, profitability will remain turbulent.

For now, Indian skies are full of planes, but the sector’s balance sheets tell a different story. The next phase of growth will require not just carrying passengers, but also carrying profits – a feat that demands both strategic discipline from airlines and structural support from policymakers.

Contributor: Team Leveraged Growth