Exchange Traded Funds (ETFs) have surged in popularity as a versatile investment option in India, offering investors diversification, transparency, and low-cost access to a wide range of markets. However, despite tracking similar benchmarks, ETFs can still vary significantly in performance. Understanding how to analyze and select the right ETF is crucial for maximizing long-term wealth creation. This guide breaks down the key steps and metrics you need to evaluate ETFs thoroughly and invest like a professional.

Understanding the ETF’s Objective and Portfolio Holdings

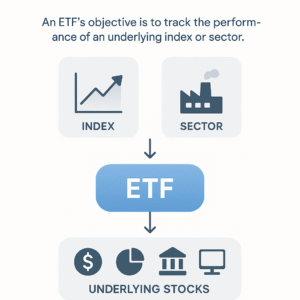

Each ETF is designed with a specific goal. Some track broad market indices like the Nifty 50 or Sensex, while others focus on sectors such as technology, banking, or pharmaceuticals. Thematic ETFs might target emerging trends like renewable energy or electric vehicles. It’s essential to confirm that the ETF’s stated objective matches your investment goals. Next, analyze the portfolio holdings: the top constituents should clearly support the fund’s theme without excessive concentration in any single stock. For example, a technology-focused ETF should include major companies like Infosys, Tata Consultancy Services (TCS), HCL Technologies, and Tech Mahindra.

Evaluating Costs: Expense Ratio and Tracking Error

Costs directly impact your net returns over time. The expense ratio, the annual fee charged by the fund, should ideally be below 0.5% for Indian ETFs. A lower expense ratio means you keep more of your gains. Equally critical is tracking error, which measures how closely the ETF follows its benchmark index. A tracking error of less than 1% is considered good, indicating efficient index replication. High tracking error may indicate problems like poor fund management, higher transaction costs, or liquidity issues in the underlying securities.

Assessing Liquidity for Seamless Trading

Liquidity is often underestimated but essential for investors who trade frequently. ETFs trade on stock exchanges, so assessing liquidity involves looking at both the ETF’s average daily trading volume and the liquidity of its underlying stocks. Even if the ETF’s volume is moderate, highly liquid underlying assets can enable smooth buying and selling through authorized participants. Pay attention to the bid-ask spread; a narrower spread reflects lower trading costs and better price efficiency. Avoid trading during the initial 30 to 60 minutes after market open to sidestep price distortions. Use limit orders and monitor the indicative Net Asset Value (NAV) to ensure fair execution prices.

Analyzing Performance and Risk Metrics

Historical returns give important clues but require context. Analyze ETF performance over multiple time frames – 1, 3, and 5 years to gauge consistency. Compare these returns with the Total Return Index (TRI) version of the benchmark, which accounts for dividends reinvested, to get a more accurate picture of performance. Evaluate risk-adjusted returns using the Sharpe ratio; a figure above 1 suggests the ETF generates good returns per unit of risk. Additionally, consider volatility and drawdowns to assess stability under market stress. The goal is consistent, risk-aware performance rather than just chasing high returns.

Making an Informed Choice: Putting It All Together

The ideal ETF matches your financial goals, risk tolerance, and investment horizon. Look for clear objectives, balanced holdings, low expense ratios (preferably under 0.5%), tracking errors below 1%, strong liquidity with tight bid-ask spreads, and solid risk-adjusted returns, as evidenced by Sharpe ratios above 1. Remember, ETF investing isn’t a set-and-forget approach; ongoing monitoring ensures your holdings remain aligned with your strategy and continue to track their benchmarks effectively.

ETFs have revolutionized investing by providing low-cost, diversified access to Indian markets. With this step-by-step, data-driven analysis framework, you can confidently select ETFs that build toward your long-term wealth creation.

This structured, quantitative approach takes the guesswork out of ETF selection, turning you into a savvy, professional investor in a rapidly growing market.

Contributor: Team Leveraged Growth