A Reality-Based Investor’s Guide

The idea of an IPO has always carried excitement. A company goes public, headlines turn loud, social media fills up with opinions, and retail investors rush to apply in the hope of quick gains. For many, IPOs feel like rare opportunities that must not be missed.

But the reality of the Indian IPO market today is very different from the perception created online. Over the last two years, investors have seen both extremes. Some IPOs delivered strong listing gains and sustained performance. Others struggled to hold their issue price, and a few eroded wealth quietly over time.

In this environment, analysing an IPO is no longer optional. It is essential.

This blog explains how to evaluate an IPO logically, calmly, and independently, without being influenced by hype or fear of missing out.

Understanding the Current Reality of the Indian IPO Market

As of late 2025, the Indian IPO market has clearly entered a more selective phase. The easy money era is over. Institutional investors have become cautious. Foreign portfolio investors are more valuation sensitive. Retail participation remains strong, but enthusiasm alone is no longer enough to support weak businesses.

Many companies that wanted to list earlier have delayed their plans. Some have revised valuations downward. Others are waiting for better market conditions. This itself is a signal that the market is demanding quality. The focus has shifted from brand names to balance sheets, from stories to sustainability.

In such a phase, blindly applying to IPOs can be risky. Careful analysis, however, can still uncover solid long-term opportunities.

The DRHP Is Not Optional Anymore

The Draft Red Herring Prospectus is the most important document in an IPO. It is not marketing material. It is a legal disclosure document. Every important truth about the company is hidden inside it. When reading the DRHP, the first thing to understand is how the company actually makes money. Revenue growth by itself is not enough. You need to check whether revenues are recurring, diversified, and backed by real demand.

One common pattern seen in recent IPOs is companies showing a sudden improvement in profitability just before listing. On closer inspection, many such profits are driven by other income rather than core operations. Interest income, one-time asset sales, or investment gains are often responsible for the turnaround. A company that is operationally weak but financially engineered to look profitable before listing should immediately raise questions. Sustainable businesses do not rely on accounting timing to appear healthy.

Cash flow is equally important. A company can report profits and still struggle to generate cash. Consistently negative operating cash flows despite reported profits are a warning sign that should not be ignored.

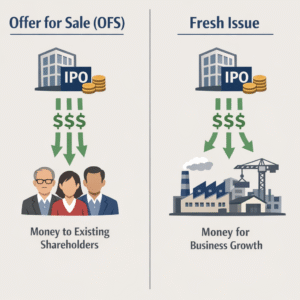

Offer for Sale Versus Fresh Issue Matters More Than You Think

Every IPO has two possible components. One is a fresh issue where the company raises new capital. The other is an offer for sale where existing shareholders sell their stake. In a fresh issue, the money comes into the company and is used for growth, expansion, debt reduction, or working capital. This strengthens the business if the funds are used efficiently.

In an offer for sale, the proceeds go to the promoters or early investors. The company itself does not receive these funds. A high offer for sale component is not automatically bad, but it requires deeper analysis. If promoters are significantly reducing their stake and exiting early, investors must ask why. Confidence in the future is often reflected in how much skin promoters keep in the game after listing.

Promoter Quality and Governance Cannot Be Ignored

Financial numbers tell part of the story. The rest is told by the people running the company. Promoter background, experience, and integrity matter. A strong promoter with a long-term vision can navigate difficult phases. Weak governance can destroy even the best business models.

Look for transparency in disclosures. Frequent related party transactions, complex group structures, and vague explanations in the DRHP often point to governance risks. Promoter holding after the IPO is another key indicator. Reasonable dilution is normal. Aggressive dilution is not.

Valuation Should Be Viewed Through a Long-Term Lens

Valuation is where most IPO debates get emotional. Investors compare price-to-earnings ratios without understanding the context. A high valuation is justified only if growth is visible, margins are improving, and the business has pricing power. Paying premium valuations for unproven or cyclical businesses is one of the most common mistakes retail investors make.

It is also important to understand industry cycles. Companies often list during peak profitability phases. If margins are at historic highs due to favorable conditions, future earnings may disappoint. A realistic investor asks whether today’s numbers are sustainable over the next five years.

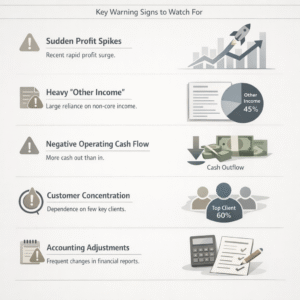

Red Flags That Deserve Serious Attention

Certain patterns appear repeatedly in weak IPOs.

Revenue dependence on a small number of clients

Sudden margin expansion without operational explanation

Heavy reliance on adjusted metrics

Negative operating cash flows

Large contingent liabilities

Frequent restructuring before listing

None of these individually guarantees failure, but together they significantly increase the risk.

IPO Investing Is Not About Speed

One of the biggest myths around IPOs is that decisions must be made quickly. In reality, patience is an advantage. Not applying for an IPO is also a decision. Many quality companies become better investments after listing when prices stabilise, and more data becomes available.

Long-term wealth is built by avoiding bad investments as much as by finding good ones.

Final Thoughts: Independence Is the Real Edge

The Indian IPO market today rewards clarity, not excitement. It rewards preparation, not prediction. Investors who rely on analysis rather than opinions are better positioned to protect and grow their capital. An IPO is not a shortcut to wealth. It is a business partnership. Understanding that changes the way you approach every new issue.

When you read the DRHP carefully, evaluate promoters honestly, assess valuations realistically, and accept that skipping an IPO is sometimes the best choice, you move from being a participant to being an investor.

And in the long run, that distinction makes all the difference.

Contributor: Team Leveraged Growth