Click here to download the report

Key Highlights of Goodyear

- In FY22, Goodyear launched its brand-new Assurance ComfortTred range of tyres for luxury vehicles in the Indian market

- It has collaborated with Assurance International, a part of Satya Group, for a new line of engine oils, helping the company foray into the automotive lubricants segment

- It has partnered with Lexus, a luxury vehicles company to manufacture tyres for EVs to shape the future of mobility

- The proportion of manufacturing to the trading mix of the Company stands at 1.45:1 as of FY22

Indian Tyres Industry

- India represents the fourth-largest market for tyres in the world

- Tyre Industry is estimated to reach 221.8 Mn units by FY27, exhibiting a CAGR of 3.59% during FY22-FY27

- The market is concentrated in India, with the top 10 manufacturers accounting for ~80% of the total market share

- MRF, Balakrishna Industries, and Apollo Tyres are the top players in the market with 35%, 34%, and 17% market share, respectively

- The two-wheeler tyre segment has dominated the industry in recent years

- Demand drivers include the increasing ownership of vehicles due to rapid urbanization, and the emergence of the middle class aids the tyre industry

- Preference for personal mobility triggered by the pandemic has further enhanced the demand

Pioneering Innovation Since the Past Century

Goodyear India Ltd. (NSE: GOODYEAR) entered the Indian market in 1922. It is named after Charles Goodyear, inventor of the vulcanization process and is engaged in tyre manufacturing in India. It is a subsidiary of the U.S. company, ‘Goodyear Tire and Rubber Company’ which was established in 1898. The Holding Company made the world’s first pneumatic airplane tyre in 1909 and the first radial tyre for commercial aircraft in 1983. Moreover, the 1970 Apollo 14 moon lander was designed with Goodyear’s XLT tyres. Goodyear produces, distributes, and markets tyres for trucks, buses, two-wheelers, cars, farm equipments, and aircrafts. In India, Goodyear is a leading brand in the farm segment that supplies tyres to all major tractor companies. It has two plants, one in Ballabgarh and one in Aurangabad. It also manufactures tyres for passenger and commercial cars. The Company supplies tyres to the leading Original Equipment Manufacturers (OEMs) in the passenger car segment. It has been a pioneer in introducing tubeless radial tyres in the market.

Journey

Goodyear India entered the Indian markets in 1922. In 1961, it started manufacturing operations in the Ballabhgarh plant, followed by the Aurangabad plant in 1996. In the late 1990s, the Company introduced two new products, namely `Power King’ in the Bias Truck Tyre segment and wrangler-RT/s in the fabric radial segment for cars and other vehicles, which received high acclamation for their quality and acceptance. In 1993, Goodyear formed a 50–50 joint venture with South– Asian Tyres Ltd. (SATL) at Aurangabad to manufacture state-of-the-art radial tyres for cars and light trucks and bias construction tyres for graders and earthmovers and fully acquired the Company after five years. It launched tubeless radial tyres for the passenger car category in FY02, making it the first tyre manufacturer in the country to offer a complete tubeless tyre range for all types of passenger cars. A few years later, it introduced the ‘Vajra Super Farm Tyre,’ which became a significant hit in the farm segment. In FY12, it revolutionized the tyre industry by introducing the ‘run on flat’ range. In FY18, it was awarded the ‘Prince Michael International Safety Award.’ A year later, it was recognized by J.D. Power as No. 1 in customer satisfaction among small cars in original equipment. In FY22, it completed a century of operations in India.

Indian Tyre Industry

India represents the fourth-largest tyre market in the world after China, Europe, and the United States. The Indian Tyre Market reached a volume of 182 Mn units in FY21 and is estimated to reach 221.8 Mn units by FY27, exhibiting a CAGR of 3.59% during the forecast period FY22-FY27. The tyre market is concentrated in India, with the top 10 manufacturers accounting for around 80% of the total market share. MRF, Balakrishna Industries, and Apollo Tyres are the leading players in the industry. MRF and Balakrishna Industries have approximately 35% and 34% market shares, respectively. Apollo Tyres has 17% and 15% market share in the Truck & Bus segment and the Passenger car radial (PCR) segment, respectively. Goodyear has a market share of only 2%, but it is a major player in the farm tyre segment accounting for over 30% market share in tractor tyres. Based on the vehicle type, the Indian tyre market can be segmented into the following categories-

- Two Wheeler (contributes to over 50% of the total sales volume)

- Passenger Cars

- Light Commercial vehicles

- Medium and heavy commercial vehicles

- Three-wheelers

- Off The Road vehicles

The demand for tyres is primarily catalyzed by two end-user segments – Original Equipment Manufacturing (OEMs) and the replacement segment. OEM is a company that sells goods to another company, which uses them as components in their products. Replacement is the market for various equipment required for maintenance or enhancement of the original product after being sold to the customers. The increasing ownership of vehicles is due to rapid urbanization and the emergence of the middle class, aiding the tyre industry. Rising mobility and rapid industrialization have increased truck and bus tyre demand. In India, auto parts production has increased due to various favourable government schemes, such as Atmanirbhar Bharat Abhiyan, which includes ₹51,000 crore package to aid auto manufacturing. The Indian economy is mainly agricultural. It contributes to ~20% of India’s GDP. The Government continues to focus on this industry by extending a host of incentives and also the farmers’ income by increasing the Minimum Support Price (MSP) every year. The MSP increase plan for FY23 is in the range of 4%-9%. An increase in the disposable income of the farmers will lead to more demand for agricultural equipment, tractors, and tyres.

Business Model

Goodyear has a pan-India presence and has ~2,500 retail store locations in India. Additionally, one can use the Company’s website to find a suitable tyre for their cars and then shop online or locate an outlet nearby. Goodyear majorly supplies tyres for tractors and farm vehicles. The Company generates revenue by selling tyres, tubes, and flaps. Tyres and tubes account for most of its revenue, while it generates only a minuscule amount by selling flaps. The sales performance of various products during FY22 is as follows-

It derives revenue from both indigenous sales in India and exports. In FY22, out of the total revenue of ₹2,429.42 crores generated, ₹2,379.60 crores accounted for sales in India, and the rest was ₹49.82 crore (representing nearly 2% of revenue) from exports. The Company exports some of its finished products to countries like Sri Lanka, the Philippines, Thailand, Dubai, and Australia. The Company also imports capital goods, stores and spares, and raw materials from countries like the Philippines, Germany, China, and South Africa. Goodyear manufactures farm tyres (tractor) and commercial truck tyres while it trades in passenger car radial tyres (manufactured by a sister concern operating in India). The proportion of manufacturing to the trading mix of the Company stands at 1.45:1 as of FY22.

Currently, the holding Company caters to six segments globally, including tyres for passenger vehicles (P.V.s), commercial vehicles, and aircraft, but in India, it is confined to P.V.s and farm verticals. It caters to a range of OEMs across P.V. and farm segments. The Company is working on a range of future products, including tyres specifically for electric vehicles. It is also evaluating options to enter into the two and three-wheeler space and the commercial vehicle realm. Goodyear utilizes its two innovation centres in Ohio and Luxembourg to develop new products.

It has recently forayed into the automotive lubricants segment in India. The Company has collaborated with Assurance International, a part of Satya Group, for a new line of engine oils that will be manufactured, sourced, and distributed in the country to complement Goodyear’s tyre product portfolio in the region. Goodyear, as a company, focuses on innovation. Goodyear’s concept tyres are purely conceptual and aim to stretch the imagination and spark a debate on future mobility challenges. Here are some of the concept ranges that the Company has thought of and that we can see in the future-

SWOT Analysis

Strengths:

Strong Heritage

- The Company is leading in the farm category with a rich heritage of ~100 years in India. It has maintained a high share of business with Original Equipment (O.E.) customers and a strong position in the replacement market. It works with its main OEM customers on pricing based on Raw Material Index (RMI), driving trust and transparency.

Farm Leadership

- The Company continues to maintain its leadership position in the Farm category. Agriculture is currently the Indian Government’s top priority sector. The MSP increase plan for FY23 is in the range of 4%-9%. As the income of farmers increases, they can invest more in tyres and other farm equipment to enhance their productivity.

Weakness:

Concentration in the Agriculture Segment

- Indian tyre Industry is dominated by the Commercial category (Truck & Bus), contributing more than 50% of the tyre industry revenue. However, Goodyear has a limited presence in the Commercial tyre category, which limits its ability for portfolio selling and ability to mitigate the risk of the Farm category.

Weak Cash Flows

- The Company’s cash flows are decreasing as it has not been able to generate enough cash. In FY22, the Company’s Cash Flow stood at ₹18,579 lakh crores as against ₹38,292 crores in FY21, with much cash being deployed towards making finished goods. Huge dividends were paid during both years, which also drained money.

Opportunities:

Industry Potential

- The Indian agriculture sector has immense potential in the future as the need for agricultural products increases with the simultaneous increase in population. The growth necessitates the farmers to switch to advanced technologies to deliver higher productivity. This increases the demand for tyres for efficient transportation.

Segment Demand

- Premium and SUV segments in the passenger car tyre industry continue to increase demand for higher rim size segments which are also target market segments for the Company. Car owners show a positive outlook for SUVs. As Goodyear continues to deliver best-in-class products, it will see profitable growth by capitalizing on the SUV segment.

Threats:

High Competition

- Although the Company has managed to survive competition with agility, the competitive intensity remains high. The Company faces stiff competition from CEAT, MRF, Apollo, Balakrishna Industries, and Bridgestone tyres.

Price Fluctuations

- The cost of raw materials for tyres, including prices of synthetic rubber, carbon black, chemical solvents, etc., are all extremely unpredictable, posing immense challenges for tyre firms.

Government Policies

- Government Policies with respect to export duties, import duties, the tax levied on automobile industries, and the economic condition of the nation affects the industry as it determines the sale of automobiles.

Differentiating Strategies

Innovation Excellence

The Company focuses on innovation excellence, as they create leading technologies, products, and services that anticipate consumer and fleets’ mobility and sustainability needs. They focus on delivering the right tyre, to the right place, at the right time and cost. They have a strong team of researchers and scientists who excel in diverse physics, computing, and mathematics subjects. Their tyres are thus able to deliver high-quality performance under the toughest driving conditions and difficult terrain.

Customer Focus

The customers are at the centre of their business. They have an interactive and well-designed website which enhances the customer experience. They can simply put the model of their vehicle and the website will provide them with compatible tyres. They can then compare the features of various recommendations and then order them online to get doorstep delivery. Additionally, the primary objective of the Company is to cater to the demands of the middle class, which makes up the majority of the consumer market mix. They do this by providing affordable yet high-quality tyres.

Sales and Marketing Excellence

Goodyear tries to capitalize on the brand image that its parent Company has built over a century. They do this by providing them with leading technologies and sustainable products and services. Increased grip, smooth braking, and mileage efficiency are some of the benefits they provide. The smooth and comfortable riding experience ensures they are the customers’ preferred choice.

Diversified Product Portfolio Strategy

Goodyear is one of the leading tyre manufacturers in India. With products ranging from performance, passenger and SUV / 4X4 and several other high-performance tyres, it carries a versatile product portfolio to satisfy the needs of every customer.

Strategic Exclusive Stores

GIL has taken the initiative to open up around 150 luxurious retail tyre outlets across the country to strengthen its presence in India’s large tyre replacement market. This organized tyre retailing format has shown promising results in markets like China and the ASEAN countries and is an intelligent initiative to differentiate Goodyear’s brand from its competitors.

Michael Porter 5 Force Analysis

1. Barriers to Entry:

- The tyre industry requires substantial capital requirements, which makes it difficult for new parties to enter. The expenditure is mainly due to high R&D costs coupled with strict licensing and legal requisites. Customers prefer differentiated products to standardized ones. Customer service and relationship management are essential for companies. Therefore, the barrier to entry is high.

2. Bargaining Power of Suppliers:

- It is easier for buyers such as Goodyear to switch suppliers. There is an abundance of suppliers in the tyre car market. Thus, the suppliers have less control over the prices. International suppliers offer competitive credit periods and rates for rubber, which is a major raw material. All these factors contribute to making the bargaining power of suppliers low.

3. Bargaining Power of Buyers:

- Buyers cannot easily find product alternatives, and switching is difficult. They have a few firms to choose from and do not have much control over prices. They prefer quality and differentiated products, so they cannot find another company selling the same product. They also do not provide the threat of backward integration. Thus, the bargaining power of buyers is low.

4. Rivalry among Competitors:

The exit barriers in the industry are high due to heavy investments and government regulations; thus, firms do not quickly leave the business. The major players in the market MRF, J.K. Tyres, and, Apollo account for 80% of the organized tyre market share. Since the individual market share of these companies is very close to each other, they cannot pass on the fluctuations in raw material prices to OEMs due to the fear of losing market share. This results in high competition among industry players on the grounds of price, product differentiation, and customer service.

5. Threat of Substitutes:

There are two kinds of substitutes available in the market. Many cheap tyre substitutes are available due to the over-dumping of tyre products from Chinese manufacturers in India. These substitute products are cheap, defective, and of low quality. This might not affect the Company’s OEM business due to higher quality and brand concerns for OEMs. Still, it might affect the Company’s replacement business since its products are recognized as a premium category in the market. The other substitutes provide high-quality but expensive products, but Goodyear offers lower prices with good quality. Thus, the threat of substitutes is low overall.

Branding

- Goodyear offers all the benefits today’s drivers are looking for, from innovative technology and performance handling to all-weather reliability and affordable quality. It is a solid global brand in a category dominated by local players. The tyres of the parent company are frequently chosen by companies such as BMW, Audi, Mercedes, Rolls Royce, Land Rover, Ferrari, Maserati, Alfa Romeo, Peugeot, Ford, Saab, Chrysler, Toyota, Skoda, and more. With such big brands as its clients, the Company has earned the trust of small customers over the years.

- This year, Goodyear has launched its brand-new Assurance ComfortTred range of tyres for luxury vehicles in the Indian market. It combines advanced technology and sophisticated tread pattern with a consumer-focused design that is touted to “redefine the luxury driving experience.”

- Goodyear ranked No. 1 in Customer Satisfaction in the Small Car Segment as per J.D. Power FY19 India Original Equipment Tyre Customer Satisfaction Index (TCSI) Study. The J.D. Power India Original Equipment Tyre Customer Satisfaction Award is the highest recognition of product quality in the automotive industry.

- It is set to shape the future of electric mobility. It has partnered with Lexus, a luxury car brand to manufacture tyres for its upcoming E.V.s. The LF-30 electrified concept tyre includes features such as E.V. motor cooling, Reduced aerodynamic drag, and Noise reduction through biomimicry.

- The Company is devoted to developing intelligent new tyre technologies for the needs of today’s drivers. From tyres that deliver excellent performance under the toughest of challenging driving conditions to long-lasting tyres that save customers money at the fuel pump, they put the driver first in everything they do.

- Citroen C3 E.V., an electric vehicle expected to arrive on the Indian shores in FY23, is designed with Goodyear Eagle G.O. concept tyres.

Financial Analysis

Current Ratio

The current ratio has declined over the past two financial years, which can be attributed to an increase in the Company’s current liabilities, especially trade payables, which rose to ₹48,672 crores and ₹48,314 crores, respectively, in both years. It deployed the money for the purchase of raw materials and capital goods. Previously, it had been in the range of ₹20,000- ₹30,000 crores. The current ratio of the top players is lower -MRF-1.45; APOLLO 0.93; J.K.- 1.02.

Dips in Profit before Tax

The PBT (Profit before tax) of the Company has been on a decline. It picked up slightly during FY21, majorly because of recovery after the COVID-19 pandemic, as there was pent-up demand due to the gradual easing of lockdown during the second half of the financial year. The cost of raw materials had been on the rise during the past financial years, and the depreciation cost increased slightly, which led to declining PBTs.

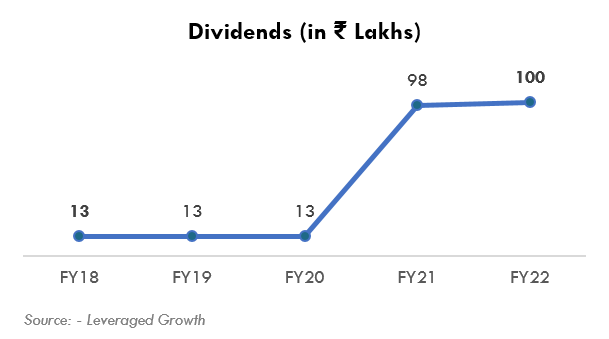

Healthy Dividends

The Company has a consistent track record of paying dividends to its shareholders, as shown in the graph above. The Company declared a final dividend of ₹18 and ₹20 in the past two years, along with a special dividend of ₹80. The total amount of Cash Flows on account of dividends paid amounted to ₹21,379 crores and ₹23,648 crores in FY21 and FY22, respectively, while the Net Profits for the same time were ₹13,626 crores and ₹10,289 crores. The Company has not generated enough cash in the past two years to sustain dividends. It has managed to pay the dividends via the large net cash position on its Balance Sheet. Paying dividends out of cash on the balance sheet is not sustainable in the long run.

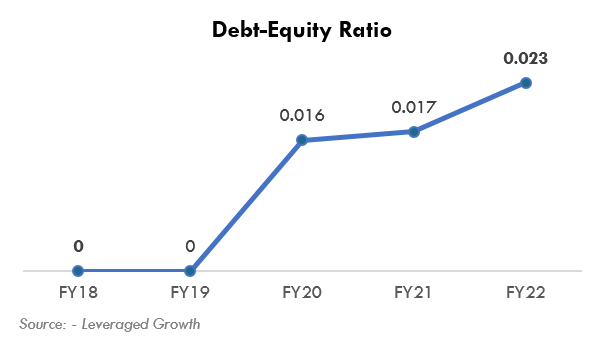

Debt-Equity Ratio

The Debt-Equity ratio of the Company is very low, and the Company was entirely debt-free until FY19. It took debt as lease liability in FY19, amounting to ₹1,484 crores. Lease liability accounts for right-of-use assets which were used for producing more stock-in-trade. The liabilities as of 31 March 2022 stand at ₹1,666 crores. The debt-equity for major players is MRF-0.15, JK-1.12, and Apollo tyres-0.46.

Environmental, Social & Governance

Environmental

The Company has maintained its green vision right from the introduction of the BioTred corn-based compound in FY01 to its current work on renewable biomass tyres. Steps taken by the Company for utilizing alternative sources of energy include Solar Power utilization and Diesel generator operation during power outages. It has announced a new tyre range with ~70% sustainable materials, which comes as a significant step towards the goal of 100% sustainable material-based tyre production by FY30. In FY22, the dust collector machine was replaced with IE4 Motor, Reduced Energy Consumption on Compressors. Also, the Company focused on power consumption reduction through Power Factor (P.F.) improvement during FY22.

Social

The Company has continuously strived to be socially, ethically, and environmentally responsible. Developments were focused in areas of Ballabgarh and Faridabad, where the Company’s manufacturing facility is located. Projects undertaken by the Company in FY21-FY22 were:

1. COVID-19 Support to Hospitals in Faridabad – The Company extended support to help fight against COVID-19. This initiative has helped strengthen the public health system’s response to the COVID-19 pandemic in the district of Faridabad.

2. Adopt a School – The Company supported the Government Girls High School No.1, NIT, Faridabad, to enhance the infrastructure of the primary and senior sections. This comprised providing a walkway cover, R.O. Cover, and grouting wire inside the wall in the primary section and undertaking groundwork, classroom repair work in 7 classrooms, and toilet repair for five sanitation Units in the secondary section. The International Association for Human Values implemented the project.

3. Development of Green Area – 580 meters stretch of Greenbelt area in Ballabgarh was developed with a vision to enhance air quality and increase green cover. Indian Pollution Control Association (IPCA) is responsible for developing, maintaining, and ensuring the upkeep of the Greenbelt and is also the implementing partner.

4. Covid-19 Support to Asian Institute of Medical Sciences- It provided access to advanced medical facilities and radiology services through the donation of medical equipment for the overall advancement of the public healthcare system.

Governance

The Company held its 61st Annual General Meeting on 1st August 2022, where it finalized a Dividend of ₹20/- per equity share of ₹10/- each and a special dividend of ₹80/- for the financial year ended 31st March 2022. This was done in mark with the completion of 100 years of the Company in India. The promoters hold a 74% stake in the business which reflects their confidence in the future of the Company. The other holding patterns are illustrated in the chart below.

Risk Analysis

Concentration Risk

The Company has a limited presence in the Commercial category (Truck & Bus), which contributes to almost half of the tyre industry. A majority of its revenue is driven by sales of tires for farm vehicles. This limits its ability to mitigate the risk of the Farm category. The competitors of the Company like MRF and J.K. manufacture tyres for two-wheelers, commercial cars, and, passenger vehicles, which greatly mitigates risk arising from low demand from any one segment. Goodyear is trying to expand its product portfolio to manufacture tires for a variety of vehicle types.

Foreign Exchange Risk

The Company operates internationally and is exposed to foreign exchange risk about operating activities (when revenue or expense is denominated in a foreign currency) arising from foreign currency transactions, primarily concerning the USD and EUR. It has approved policies to enter into foreign currency contracts to manage the impact of changes in foreign exchange rates on the results of operations and future foreign currency-denominated cash flows.

Macro-Economic Risk

Current geopolitical conditions, anticipated COVID-19 waves, rising inflation, monsoon, and liquidity are some factors that can impact the performance of Goodyear. Additionally, the Company has to import rubber, which is a major raw material since there is a huge demand-supply mismatch of rubber in the Country. The global shortage of rubber and any disruption in the supply chain will have an adverse impact.

Regulatory Risk

Government Policies with respect to export duties, import duties, the tax levied on automobile industries and the economic condition of the nation are out of the control of the Company and effects the industry as it determines the sale of automobiles. Also, the government announces tyre safety standards on rolling resistance, wet grip, and, rolling sound emissions which the Company has to adhere to.

COVID-19 Impact

Covid-19 has witnessed evolving consumer behaviour with a shift in preference from shared mobility to personal mobility. However, in the mid to long term, as the effects of Covid-19 recede and as the economy opens up, consumers are likely to return to pre-Covid levels for shared mobility. The state-wise lockdown measures undertaken given the Covid-19 pandemic have marginally impacted Farm tyre industry volumes in FY22. The farm tyre industry was at an all-time high in FY21 despite Covid-19 and managed to maintain the same in FY22 despite a high base of FY21. Covid-19 impacted the beginning of the fiscal year, but there was a gradual pickup in demand, and the Company has delivered robust volume growth driven by channel expansion and extraction.

End Note

The Government continues to focus on the agriculture industry by extending various incentives. The farmers’ income is increasing with the help of the Minimum support price (MSP) every year. The MSP increase plan for FY23 is in the range of 4%-9%. This will lead to an increase in disposable income, thereby driving sales of tractors and tyres. The Company can capitalize on a booming automotive market in India through its operational excellence. The demand for SUVs and premium mobility continues to be positive. Will the Company be able to pioneer future mobility with its innovation and technology?

What are the latest developments at Goodyear India Ltd?

How has Goodyear India Ltd performed financially in recent years?

What is the competitive landscape of the tire industry in India?

How has Goodyear India Ltd adapted to changes in consumer preferences and behavior?

What is the vision and mission of Goodyear India Ltd?

Disclaimer: The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. Certain transactions -including those involving futures, options, another derivative product as well as non-investment grade securities – involve substantial risk and are not suitable for all investors. No representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. This information is subject to change without any prior notice. The company reserves the right to make modifications and alternations to this statement as may be required from time to time without any prior approval. Leveraged growth, its associates, their directors and the employees may from time to time, effect or have affected an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any company referred to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting the document. This report has been prepared on the basis of information that is already available in publicly accessible media or developed through analysis of Leveraged Growth. The views expressed are those of the analyst, and the company may or may not subscribe to all the views expressed therein. This document is being supplied to you solely for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, Country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Leveraged Growth to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. Neither the Firm, not its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The person accessing this information specifically agrees to exempt Leveraged Growth or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold Leveraged Growth or any of its affiliates or employees responsible for any such misuse and further agrees to hold Leveraged Growth or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

Contributor: Team Leveraged Growth