Welcome to CRED – where paying your credit card bills is no longer a chore but a rewarding ritual. It’s not just an app; it’s a playground for the financially disciplined, a haven for those who believe in “rewards for the right actions.”

CRED isn’t just about tracking payments or managing cards – it’s about making your creditworthy lifestyle cooler. Because here’s the deal: when you win at managing money, you deserve to win big. So, why settle for boring when you can get rewarded for doing what you already do?

As CRED says, “Not everyone gets it,” if you do, welcome to the club where good behavior isn’t just appreciated – it’s celebrated.

Most innovations and novel business ideas exist because they aim to solve a particular problem the common man faces. Kunal Shah, the founder, realized he struggled to manage his credit card bills like most others. Instead of complaining, the ambitious serial entrepreneur addressed the issue by launching his own company in 2018. The startup’s purpose was to make the credit card management process simpler and incentivize the deserving, i.e., the people who pay their bills on or before time, through rewards, offers, and discounts. The app was also designed to help track expenses, adding another benefit to the end users.

History and Founders

Kunal Shah graduated in Philosophy from Wilson College and decided to pursue an MBA from the Narsee Monjee Institute of Management Studies. However, as we have seen in multiple cases, he chose to drop out midway to follow his entrepreneurial dreams.

He began his journey with Paisaback, which he co-founded with Sandeep Tandon in 2009. The company, however, eventually was shut down. The following year, in 2010, the duo founded Freecharge. This well-known e-commerce platform offered various financial services, including mobile recharge and bill payment. It was acquired by Snapdeal in 2015 for $400 million. Finally, in 2018, he founded CRED, which became his first unicorn on April 6, 2021.

Business Model

CRED is a platform that helps people manage their credit cards. It encourages users to pay their bills on time by offering exclusive discounts and rewards. The business model is relatively simple and has three central pillars: the CRED app, the customers, and the partnering businesses offering exclusive deals.

The App: This is the most critical component of the business model. It acts as a platform for connecting users to various other businesses that want to draw eyeballs to their products through exclusive offers. The app’s seamless payment system further enhances user experience and acts as a catalyst to the growing network.

The Customers: One of the most essential parts of business is the customers. They earn rewards and points when they make timely payments of their bills, which are redeemed within the application for prompt purchases. Also, the platform is exclusive only to those members who have a credit score of 750 and above.

Businesses that provide offers: Various businesses provide rewards to the users to enhance visibility and broaden their customer base. Businesses showcase products and services to a diverse audience through its platform, attracting new customers and boosting revenue. This is particularly valuable for SMEs seeking cost-effective alternatives to expansive marketing campaigns. CRED acts as a connective hub, facilitating mutual growth between businesses and its vibrant user community.

Revenue Model

Cred has emerged as a fintech powerhouse, leveraging its affluent user base to build diverse revenue streams. The company primarily generates income through five key engines, with additional offerings in the pipeline. Here’s a closer look at its revenue model:

1. Payments: The Foundation of Cred’s Ecosystem

- Credit Card Bill Payments: Cred earns a small commission from banks for facilitating timely credit card payments.

- Utility Bill Payments: Since April 2022, Cred has expanded to utility bills like electricity, mobile postpaid, and DTH, adding another revenue layer.

- UPI Payments: Launched in 2022, Cred offers UPI-based transactions with cashback incentives to capture market share. UPI platforms earn a nominal fee per transaction.

- Payment Gateway: Cred also provides plug-ins for third-party websites and apps, earning payment processing fees.

While payments establish Cred’s ecosystem, the revenue from this segment alone is limited. Enter its core drivers.

2. Lending: The Holy Grail of Fintech Revenue

Lending has become Cred’s primary revenue generator:

- Credit Line Services: Offering loans up to ₹5 lakh without paperwork, Cred’s loan book expanded from ₹6,000 crore in 2022 to ₹15,000 crore.

- Products in Lending:

- Cred Mint: A peer-to-peer lending platform (temporarily paused due to regulations).

- Cred Flash: A buy-now-pay-later product catering to high-ticket purchases.

Cred’s focus on affluent customers and large loan sizes (₹1 lakh and above) makes its lending segment less prone to the stress seen in smaller, unsecured loans.

3. Insurance: Tackling Motor Insurance with Cred Garage

- Cred Garage: A vehicle management platform that facilitates motor insurance renewals, traffic fine payments, and fuel bill cashbacks.

- User Base Growth: From 42 lakh vehicles managed in FY24 to 60 lakh by September 2024.

- Revenue Potential: Motor insurance being one of the largest non-life insurance categories in India, Cred’s affluent users owning multiple vehicles provide a significant growth avenue.

4. Shopping and Travel: Curated Offerings for a Niche Audience

- Curated Products: Cred offers exclusive deals from direct-to-consumer brands, often at significant discounts. Smaller brands use Cred to gain visibility and test new launches.

- Travel Packages: Partnering with hotels and travel companies, Cred provides premium yet discounted travel options for its user base.

5. Wealth and Investments: Building Financial Planning Tools

- Kuvera Acquisition: Cred’s entry into wealth management allows it to offer direct mutual funds, SIPs, FDs, and digital gold.

- Advisory Services: Kuvera’s financial planning tools and taxation advice integrate into Cred, enhancing customer stickiness.

Financing Roadmap

CRED has successfully received funding of around $1billion. The startup has completed 9 funding rounds, including 1 seed, 3 early, and 5 late stages. It was last funded $140 million in the Series F round in June 2022. The institutional investor, PeakXV, has the highest external stake of 10.4% in CRED, followed by Ribbit Capital, Tiger Global, and others. The following displays various funding rounds the company has completed:-

| Investors | Round Name | Funding Amt | Valuations |

|---|---|---|---|

| Sequoia Capital India | Seed | $993K | Not Revealed |

| Sequoia Capital, RTP Ventures, and 25 others | Series A | $24.2 | Not Revealed |

| Sequoia Capital, Ribbit Capital, and seven others | Series B | $120M | ▲$450 Million |

| DST Global, Tiger Global Management, and seven others | Series C | $81M | ▲$806 Million |

| Coatue, Insight Partners, and nine others | Series D | $215M | ▲$2.2 Billion |

| Tiger Global Management, Marshall Wace, and eight others | Series E | $251M | ▲$4.01 Billion |

| GIC Singapore, Tiger Global Management, and three others | Series F | $140M | ▲$6.4 Billion |

Financials

Financial Performance

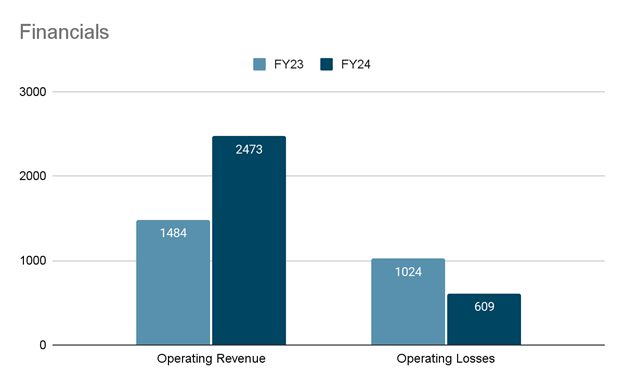

- Revenue Growth: Operating revenue surged 66% to ₹2,473 crore in FY24, up from ₹1,484 crore in FY23. This was driven by increased member engagement and diverse revenue streams.

- Operating Loss Reduction: Operating losses decreased by 41%, down to ₹609 crore from ₹1,024 crore in the previous year due to a decline in marketing expenses by 36%, and monthly transacting users increased by 34% on a y.o.y basis. Total operating expenditure, including one-time costs, stood at ₹3,082 crore. Its customer acquisition costs fell by 40%.

- Net Loss: Net loss rose 22% year-on-year to ₹1,644 crore, primarily due to one-time employee stock ownership plan costs and taxes.

All amounts in INR crores*

Operational Highlights

- Payments and Credit Growth: Total payment volume (TPV) increased 55% year-on-year to ₹6.87 lakh crore, with an average UPI transaction ticket size of ₹3,000, higher than competitors like PhonePe and Paytm.

- Revenue Streams: About 90% of revenue comes from credit, payments, and insurance. The company facilitated lending partners in building a ₹15,000 crore loan book, focusing on prime and super-prime customers.

- Monetization and Engagement: The monetized user base grew by 58%, with monthly active users reaching 13 million and monthly transacting users at 11 million.

CRED’s FY24 performance underscores its transition from a credit card rewards app to a comprehensive financial services platform, emphasizing customer engagement, cost efficiency, and diversified offerings.

What Lies Ahead?

Cred now boasts more than 13 million monthly active users, with 11 million transacting regularly. Features like UPI payments and e-commerce drive higher user engagement on the platform. As the fourth-largest UPI app, Cred processed 147 million transactions worth ₹50,720 crore in August 2024. Its average transaction size of ₹3,000 significantly outpaces competitors like PhonePe and Paytm, which average ₹1,200-1,500.

Cred is cautiously expanding its portfolio to include additional financial products while avoiding speculative offerings or high-interest loans. Payments, lending, and insurance drive over 90% of its revenue. The company is well-positioned to scale its monetization strategy by cross-selling complementary products to its affluent user base. Cred’s ability to combine trust, innovation, and user-centric services makes it a formidable player in India’s fintech landscape.

Contributor: Team Leveraged Growth