Click here to download the report

Key Highlights

- Rebranded to Cosmo First Limited

- Foraying into the D2C Petcare industry with the launch of ZIGLY, a platform providing a broad range of pet care products and services

- Focus on shifting from regular BOPP commodity films to more specialty films

- Cosmo is one of the few companies globally and the only one in India producing BOPP synthetic paper

- Planning to launch heat-resistant BOPP films for offices and homes during FY23

- Exports accounted for ~53.55% of revenue, reinstating the company’s export focus

- The company announced a 1:2 bonus issue on 9 May 2022 with a record date of 18 June 2022

Indian Packaging Industry

- Valued at USD 50.5 billion in 2019 and is expected to grow at a CAGR of 26.7% till 2025

- Rapid e-commerce expansion coupled with the pandemic has driven the industry in recent years

- Packaging consumption has increased by 200% in the past decade

- Indian BOPP Industry has been growing at almost double of India’s GDP growth rate over the long term, with a production capability of ~700k MT per annum

A Pioneer in BOPP Films

Cosmo First Limited (NSE: COSMOFIRST), the most prominent Indian BOPP films exporter, has a product portfolio encompassing various specialty films for lamination, labeling, flexible packaging, and industrial application. It is the world’s largest manufacturer of thermal lamination films and exports products to over 80 countries. BOPP films have huge demand due to their quality protection and shelf-life extensions. These are produced by stretching polypropylene films and are used in various applications, including packaging and lamination.

The company has expanded its business activities beyond films into specialty chemicals (masterbatches, coatings, textile chemicals, and soon-to-launch adhesives). Apart from this, it has forayed into the D2C pet care business with the launch of ZIGLY, a platform offering the broadest range of pet care products and services. It accounts for nearly 26% of India’s total Biaxially Oriented Polypropylene (BOPP) films capacity. Cosmo’s customer base encompasses leading global flexible packaging and labels face stock manufacturers, including Amcor and Huhtamaki, which service giants like PepsiCo, HUL, Apple, and Nestle.

In 2023, the company rebranded as Cosmo First Limited from Cosmo Films Limited. Cosmo First Limited stands for a four-decade young Indian business conglomerate that thrives on innovation to unlock value in diverse sunrise sectors such as Films, Consumer Care, Specialty Chemicals, and D2C Pet Care.

Major Segments:

Journey

The global leader in specialty packaging was established in 1981 when Mr. Ashok Jaipuria, a pioneering entrepreneur and philanthropist, initiated BOPP Films production in India with Cosmo’s first plant in Aurangabad. Later in 2002, the company acquired Gujarat Propack Ltd., which boasted a capacity of 13,000 MT coupled with two production lines. In 2004, it established its first extrusion coating line and a Metalliser at Aurangabad. The company acquired the GBC Commercial Print Finish business of ACCO Brands Corporation of the USA in 2009 and commissioned a new plant in South Korea in 2011. In 2020, the company expanded into new specialty chemicals and began its foray into the B2C Pet Care industry.

Industry Analysis

The Global Packaging Market was valued at USD 1,002 billion in 2021 and is expected to be worth USD 1,275 billion by 2027. The Indian Packaging Market stood at USD 50.5 billion in 2019 and is expected to grow at a CAGR of 26.7% from 2020-2025. The Indian packaging industry is among the largest globally owing to the rising population, changes in lifestyle & media penetration. In the last decade, packaging consumption has surged by 200%, with the pharmaceuticals and F&B industries driving the market. Considerable investments in these industries have created growth opportunities for the packaging market.

With growing awareness, the requirement for eco-friendly and sustainable packaging is increasing steadily. The demand for recyclable packaging material is also rising, owing to billions of parcels being delivered annually. The industry has evolved significantly during the pandemic, which has witnessed new trends adopted by competitors, including smart, safe, and sustainable packaging with innovation and artistic touch. Factors like an increased working population requiring instant food solutions with higher shelf-life have forced packaging companies to develop innovative and durable packaging solutions. The Covid-19 pandemic has resulted in the rapid expansion of the online shopping and e-commerce sector, which catalyzed the demand for the packaging sector.

Many FMCG companies have adopted sustainable packaging solutions to enhance their image as responsible brands. The efficient capacity utilization is fuelled by robust domestic and international demand. India’s strong BOPP film demand is supported by low packaged food penetration and rising personal disposable income. Investments in the organized retail industry and changing packing format from rigid to flexible packing will further add to increasing demand. Zigly- D2C pet care business also has a lucrative industry. The pet care market in India is expected to grow at a value of ₹ 7,500 crores between 2021-2026 on account of rising nuclear families, changes in lifestyle, urbanization, and increasing pet ownership. No large-scale organized players in India offer comprehensive end-to-end solutions to customers. The industry size, low penetration, and high growth potential provide a clear business opportunity.

Business Model

The company follows a B2B model catering to the packaging demands of FMCG and Pharmaceutical companies. It has divided its product portfolio into two parts BOPP commodity films and specialty films.

Specialty films are value-added products with higher margins (2x-10x) and little competition compared to BOPP commodity films. Cosmo wants to de-commoditize its business by shifting from regular BOPP commodity films like adhesive tapes to more specialty films. Cosmo is one of the few companies globally and the only one in India producing BOPP synthetic paper.

Moreover, the company has forayed into the D2C pet care business under ZIGLY. The platform will offer pet parents an array of pet care products and services, from pet food and treats to grooming supplies and health care products. They also plan to launch a heat-resistant BOPP film for offices and homes during FY23, having significant potential as it enhances recyclability and minimizes environmental impact. The Masterbatch production unit set up in FY21 is fully operational and has successfully produced various masterbatches for in-house and external customers. In FY22, around 50% of the total revenue accrued to exports which benefited the company through dollar appreciation.

Swot Analysis

Strengths

- Wide Product Range

A diverse portfolio, including a mix of commodity and specialty films, allowing it to become a solution for all types of packaging across the globe. However, they are focussing on specialty films with high margins and less competition.

- Premium Clientele

With an export presence in over 80 countries, its client base includes the leading label manufacturers and flexible packaging giants like Amcor, Constantia, and, Huhtamaki, servicing household names like PepsiCo, Coca-Cola, Unilever, and P&G.

- Robust R&D

Cosmo leverages its intensive and successful R&D setup that innovates new solutions every year, providing the company with a competitive advantage.

- Focus on Customer Relationship

Strong customer relationship management enables customer centricity with robust service offerings and cross-functional alignment while improving end-user engagement. This helps the company attract customers and build a strong relationship with them.

Weaknesses

- Undiversified Manufacturing

All the Indian manufacturing units are based in two states- Maharashtra (primarily) and Gujarat. Any significant disruptive event in these two states will have a massive impact on the company’s functioning.

- Lack of Loyalty

The company’s focus on innovation comes at a cost since it reduces supplier confidence, who constantly fear being replaced by technological advancements.

- High Cost of Technology

Constant upgrades involving new technologies, including AI and ML, are necessary to cater to the rising demand for packaging solutions that increases costs.

Opportunities

- Positive Demand Outlook

Increasing demand for ready-to-eat packaged foods and snacks has been the driving force behind the demand for BOPP films, which are used for packaging and labeling. Moreover, the company ensures that its products meet the sustainability requirement by partnering with the best global brands to offer structure rationalization and recyclability solutions in various categories.

- Government Support

Regulators worldwide are taking various steps to minimize and manage packaging waste. In India, too, the Government favors recyclable substrates and formats for packaging. Different nations hold an increasing number of awareness campaigns that put BOPP films into the limelight as they are recyclable, biodegradable, and one of the premier eco-friendly films in the market.

- Cost Reduction

Digital efforts drive down costs and increasingly gain a competitive edge with consumers. Moreover, with IoT (Internet of Things) gaining popularity, packaging as an enabler will be far more intuitive and help provide instantaneous information to consumers about packed products.

Threats

- Rising Competition

Rising competition from domestic and foreign players is significant, compelling companies to cut prices and decrease profitability. Major competitors include the market leader Jindal Films and Treofan.

- Cost Concerns

Recycling plastic waste is an expensive process that requires the support of urban and local bodies, which are usually futile, forcing firms to take responsibility and push costs.

- Raw Material Price Volatility

Polypropylene, major raw material, is a derivative of crude oil; volatility in crude oil prices can impact its prices, although they are not linearly correlated. A cost-plus operating model operates, and much of the burden of high raw materials pass on to the customers.

Differentiating Strategies

- Strong R&D

Continuous investments in R&D, Marketing, and Customer Satisfaction have resulted in growing specialty film sales. New R&D laboratories have been set up for textile, and adhesive developmental work, with recent focus areas including film business, textile chemicals, and masterbatches. Cosmo is well-positioned to profit from accelerated expansion and drive new product development globally, supported by its ongoing efforts in R&D.

- Robust Export Footprint

The company is recognized globally for its innovative and sustainable products. Exports have played a huge part in generating revenue for the company. This has resulted in the establishment of sales offices in strategic locations to cater to global demand. Cosmo has sales offices in the US, Canada, Germany, China, and Japan.

- Sustainability

Cosmo has leveraged the rising awareness of sustainable packaging requirements through sustainability projects and manufacturing processes. These processes have promoted cost optimization apart from contributing to the environment. It has constantly discovered new ideas in this space, including green product packaging solutions and Green Manufacturing practices to meet its customers’ needs.

- Expansive Production Portfolio

The company has recently forayed into the D2C Petcare business under Zigly, the market for which is expected to reach ₹ 7,500 crores. Moreover, the company aims to launch 15-20 experience centers by FY23 and enhance its online presence. Long-term plans include opening a separate company for the Petcare vertical.

Michael Porter 5 Force Analysis

1. Barriers to Entry

High investment in R&D is required to keep innovating new products. Since these investments take a long time to give returns, few players would be willing to do so. Therefore, consolidating the client base would be difficult for a new entrant given the long-standing players in the industry who already have a relationship with their clients. Moreover, regulations in the plastic industry resist new participation since companies need to comply with the requisite rules and regulations created by the Bureau of Indian Standards. The barriers to entry are high.

2. Bargaining Power of Suppliers

The polypropylene and polymer manufacturers in India run in an oligopolistic market with a few big players like Reliance Industries Limited, Indian Oil Corporation, and Hindustan Petroleum Corporation Limited, among others from which the company gets its raw materials. The bargaining power of suppliers is bound to be high. However, many companies in the packaging industry, including Cosmo, have taken initiatives for the backward integration of their products. This reduces their reliance on suppliers for raw materials.

3. Bargaining Power of Buyers

The flexible packaging industry operates in a cost-plus operating model. Hence, the end-user would feel the impact of any change in raw material prices. So, the bargaining scope is less since the buyers do not have an option other than paying the cost-push price set by the companies.

4. Threat of Substitutes

BOPP films are the preferred packaging option for those who aims for a sustainable packaging. Hence, the threat of substitutes is low. Moreover, Cosmo has stepped up in manufacturing BOPP synthetic paper, which will act as a replacement for pulp paper in many applications.

5. Rivalry among Competitors

Innovation and leveraging technology are key differentiators in the industry. Therefore, big players have a competitive advantage in terms of their capabilities to bring that innovation to the market, which small players lack.

Branding

- One fundamental branding change was that the company rebranded as Cosmo First Limited. The new name portrays the innovation focus of this business conglomerate, creating value in several industries.

- During the same year, the company forayed into the Pet Care business through its platform ZIGLY offering an array of pet care solutions.

- They provide dedicated resources to the sales staff to engage with global companies—encouraging end-user participation. The company, the converter, and the brands form a tripartite relationship to find answers to unmet demands. Cosmo maintains a global brand visibility strategy that includes digital marketing, print media advertising, and participation in trade shows, among other things.

- The company received several awards, including the “CII National Level Scale Award” for Supply Chain and Logistics Excellence and the “IFCA Star Award” under the innovations category for the heat-resistant BOPP Film & CPP Specialized Film.

Financial Analysis

1. Impressive Top and Bottom-Line Growth

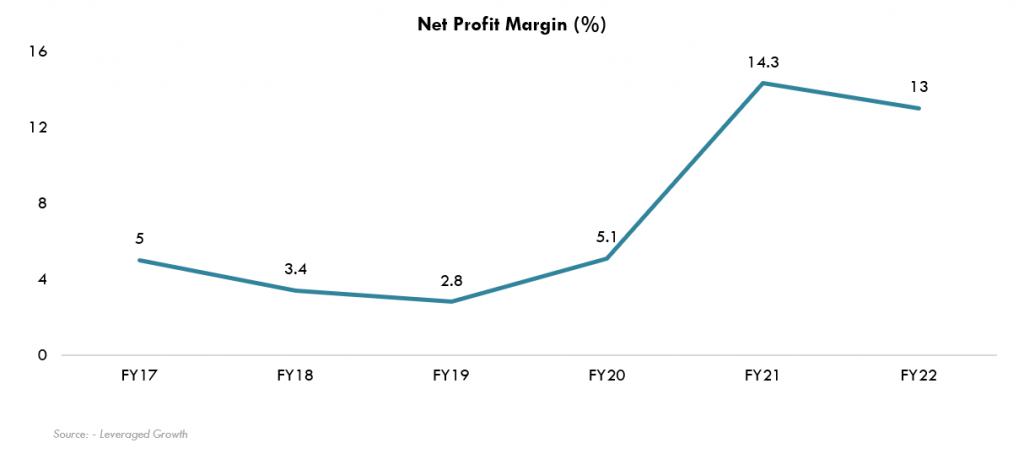

Cosmo has registered an excellent top-line and bottom-line YoY growth. The PAT has increased to 396.61crores in FY22, growing 67.51% YoY. This was mainly due to the growth in the specialty films business, which has registered a growth rate of 18% YOY in the last three years and has contributed to the top-line growth. The company’s top line grew to 3038.39 crores in FY22, showing a 32.95% increase YoY, owing to India’s strong demand for BOPP films supported by low packaged food penetration in India and rising personal disposable income.

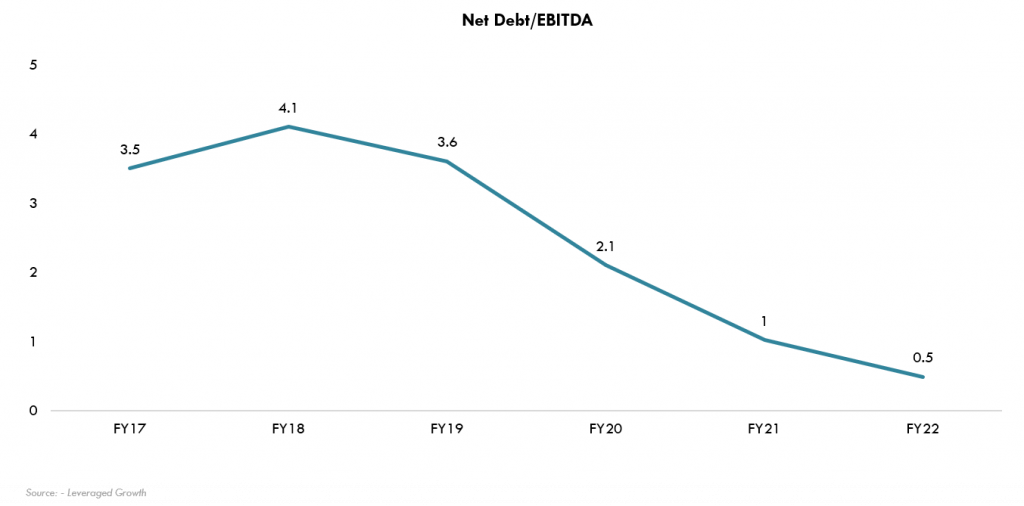

2. Successful Debt Reduction

The company was observed to focus on reducing net debt and improving its credit metrics. They seem to fulfill its objectives to ensure that the company can continue to provide an adequate return to shareholders by pricing products and services commensurately with the level of risk involved. During FY22, the consolidated net debt condensed to 303 crores from 438 crores last year owing to surplus cash generations from operations. It has set up a subsidiary project to produce masterbatches (an essential ingredient of flexible packaging film), involving minimal CAPEX primarily funded through internal accruals.

3. Impressive EBITDA growth

In FY22, the company posted an impressive 44.1% growth in its EBITDA, as sales increased by 32.95% from their overall operations and because of the subsidiaries’ improved performance. This strengthened EBITDA is primarily fuelled by increased specialty sales, improved operating margins, and superior subsidiary performance. Apart from this, de-bottlenecking, a major production line focused on enabling specialty film production, contributed to this growth. The company incurred a capital expenditure of ₹ 283 crores, primarily on specialized BOPET lines and value-added capacity. The company continues to strengthen its exports through brand visibility initiatives taken during the year. In FY22, exports increased to ₹ 1292 crores from ₹ 874 crores the previous year.

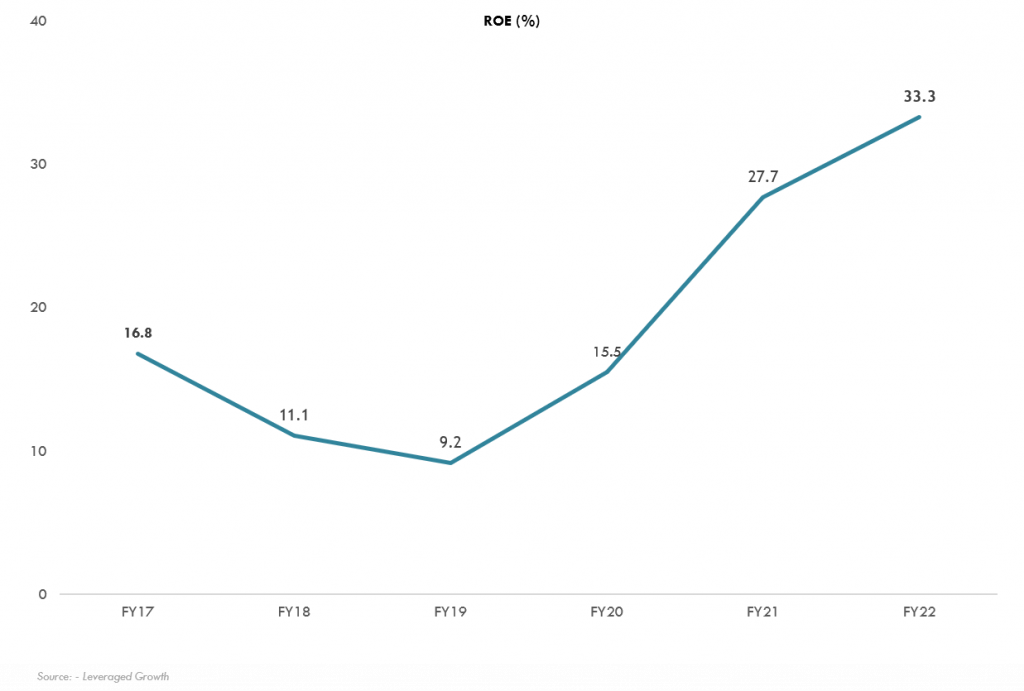

4. Recovering Return on Equity

Cosmo has posted an impressive RoE of 33.31% in FY22, recovering from the poor figures of the past five years. The RoE was mainly impacted due to the sharp fall in the company’s Net Profit margin due to different factors like demonetization, transport strikes in Maharashtra, which subdued BOPP margins, and the Covid-19 pandemic.

Environmental, Social, and Governance

Environmental

The company has been continually working on sustainability projects and initiatives to offer recyclability solutions across product categories, including mono-layered structures. It will invest in R&D to expand its specialty film portfolio by providing sustainable solutions. It leverages efficiency improvements to reduce power consumption. To contribute to rural livelihood, the company has pledged to plant 1,00,000 trees, of which 40,000 have been planted in Maharashtra.

Social

The company initiatives go beyond its facilities and mills to impact the less privileged. While the CSR spending for the year crossed ₹ 3.55 crores, lives touched during covid stood at 4,42,168. The company also launched Cosmo Education Program to promote education and constructed sanitation blocks in government schools in multiple states.

The company has set up Cosmo Foundation, the company’s philanthropic arm, carrying out several initiatives like running dispensaries and providing educational workshops. The foundation aims to assist underprivileged children and youth. The company has undertaken several initiatives such as the Computer Literacy Program, Cosmo Gyan Vihar Kendra, Basic English Learning Program, and Life Skill Education Program. Cosmo Foundation now has impacted the lives of over 10,000 students partnering with 43 government schools across 29 villages in Aurangabad and Vadodara.

Governance

The company’s board comprises of nine directors and complies with the SEBI (LODR) Regulations, 2015. There is no inter-relationship among any board members. No materially significant related-party transactions during the financial year conflicted with the company’s interests. Cosmo has a whistle-blower policy whereby stakeholders and employees are encouraged to communicate their concerns about illegal or unethical practices freely. The Board of Directors had declared two interim dividends of ₹25 and ₹10 per equity share in FY22.

Risk Analysis

The company is committed to adopting a de-risking strategy while making investments that involve regular risk monitoring. The company follows a well-defined, integrated framework that incorporates financial and non-financial risks while promoting an understanding of risk tolerance and awareness.

1. Strategic Risk

Risks regarding changing consumer demand, competition, and intellectual property challenges prevail. The company responds to these risks through risk mitigation processes involving fast product development and relying on owned patents and trademarks in foreign countries in which they operate.

2. Operational Risk

Risks related to demand and supply gaps are addressed through strategic capacity additions and de-bottlenecking of production lines. The company’s IT systems and networks remain potentially vulnerable to threats. A strong internal framework & stringent supervision can act as a mitigation strategy.

3. Financial Risk

Currency fluctuations affect the revenue; therefore, these are addressed through various derivative contracts like currency options, cross-currency swaps, and interest rate swaps that manage and hedge risks.

4. Compliance Risk

Government authorities have passed regulations regarding safety, Greenhouse Gas Emissions, climate change, and plastic recycling. The company ensures it does not violate environmental and safety laws while protecting its proprietary technology globally.

Impact of COVID-19

The pandemic and the Russia-Ukraine crisis have created a turbulent global economy that has increased inflationary pressures and strained the global supply chain. The industry saw a growth in demand post-Covid as people have saved money and now want to spend. Initially, when Covid began spreading in India, the company shut down its plants due to government directives. Later on, most of its supply chain partners were affected, and many were closed.

However, rising demand for hygiene products, increased the demand for packaging segment. But some segments did not do so well. For example, the company supplies synthetic papers for restaurant menu cards. Most restaurants were closed and shifted to the digital realm when they opened, hurting the demand. Broadly, there was a positive impact on demand, especially on the label side.

The EndNote

Post-covid, the flexible packaging industry is expected to witness immense growth due to the anticipated shift in consumer preferences. Cosmo’s R&D could help it stand out in the industry through its continuous innovation and new product launches. It has also decided to change its name to Cosmo First and has forayed into the Petcare industry.

Considering these factors, an essential issue arises: Will Cosmo’s strategy of focusing on sustainable packaging and foraying into new industries work out in the long run?

Stock Price History for the past 10 years

Disclaimer: The report and information contained herein are strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied, or distributed, in part or whole, to any other person or the media or reproduced in any form, without prior written consent. This report and information herein are solely for informational purposes and may not be used or considered as an offer document or solicitation of an offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting, and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their investment objectives, financial positions, and the needs of a specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. Certain transactions -including those involving futures, options, other derivative products as well as non-investment grade securities – involve substantial risk and are not suitable for all investors. No representation or warranty, express or implied, is made as to the accuracy, completeness, or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement incorporated in this document are provided solely to enhance the transparency and should not be treated as an endorsement of the views expressed in the report. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alternations to this statement as may be required from time to time without any prior approval. Leveraged Growth, its associates, their directors, and the employees may from time to time, effect or have effected an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any Company referred to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting the document. This report has been prepared based on information that is already available in publicly accessible media or developed through an analysis of Leveraged Growth. The views expressed are those of the analyst, and the Company may or may not subscribe to all the views expressed therein. This document is being supplied to you solely for your information and may not be reproduced, redistributed, or passed on, directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction, where such distribution, publication, availability, or use would be contrary to law, regulation or which would subject Leveraged Growth to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to a certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. Neither the firm nor its directors, employees, agents, or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The person accessing this information specifically agrees to exempt Leveraged Growth or any of its affiliates or employees from, any responsibility/liability arising from such misuse and agrees not to hold Leveraged Growth or any of its affiliates or employees responsible for any such misuse and further agrees to hold Leveraged Growth or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

Contributor: Team Leveraged Growth