Real Revolution or Risky Gamble?

The race to harness the power of artificial intelligence is on, with billions flooding into the industry – an opportunity that promises to reshape the future or end in a costly misstep. It is now for us to witness.

Current Situation

Since mid-2024, significant capital has been flowing into AI companies, particularly in areas like chips, cloud infrastructure, and data centers. As several companies now carry valuations in the hundreds of billions of dollars, the industry is grappling with a key question: Are these investments signaling the dawn of a new era, or are they a risky bet on an unproven future?

Technology Adoption Pattern

Revolutionary technologies follow recognizable patterns.

The internet connected the world, then came the dot-com crash. Blockchain promised decentralization, followed by crypto winter. 3D printing was expected to transform manufacturing, but it became a specialized tool for specific industries.

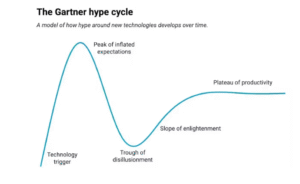

There is a framework for this, called the Gartner Hype Cycle.

The cycle works like this: a breakthrough creates excitement, media coverage increases, investors provide funding, expectations grow beyond current capabilities, reality creates disappointment, and the technology enters the “Trough of Disillusionment.”

After initial excitement fades, the technology finds practical applications and moves up the “Slope of Enlightenment” toward the “Plateau of Productivity.”

AI is somewhere on this curve. The question is determining its current position.

Current Financial Data

Nvidia

Nvidia’s Q3 2025 results on 19th November 2025 showed record revenue of $57 billion and strong gross margins of 73%, driven by high demand for its GPUs.[1] CEO Jensen Huang reported robust sales of Blackwell GPUs and noted that cloud GPUs were sold out. Despite exceeding earnings expectations and offering a strong Q4 revenue outlook, Nvidia’s stock closed down 3.1% due to concerns over high valuations in the AI sector.

From a $5 trillion peak in late October, Nvidia’s market cap has declined over the past two months, reaching $4.25 trillion by 15 December 2025, reflecting a 15% drop in valuation.[2] This downward trend in Nvidia’s stock and market value highlights investor caution regarding overvaluation in AI-related companies.

OpenAI

OpenAI completed an employee share sale at a $500 billion valuation in October 2025, up from $300 billion in April 2025.[3]This makes it the world’s most valuable private company.

In the first half of 2025, OpenAI generated $4.3 billion in revenue but spent $2.5 billion in cash.[4] By August 2025, its annual revenue rate reached $13 billion, up from $200 million in early 2023. The company has 800 million weekly active users.

However, OpenAI expects to spend approximately $22 billion this year against $13 billion in sales, resulting in a $9 billion loss.[5] The company spends $1.69 for every dollar it earns.

HSBC projects OpenAI won’t be profitable by 2030 and faces a $207 billion funding gap to support its growth plans.[6] The bank estimates OpenAI will need $1.4 trillion in computer spending through 2033.

OpenAI makes advanced technology. When valuations double in months and companies lose $1.69 for every dollar earned, this represents specific market behavior.

The Circular Investment Pattern

The AI ecosystem operates through a complex web of investments and partnerships, centered around OpenAI with a $500 billion valuation. Major technology companies invest billions into AI firms, which then use that capital to purchase hardware and cloud services from the same companies. For example, Microsoft invests $13 billion in OpenAI with the requirement that OpenAI use Microsoft’s Azure cloud services.[7] Similarly, Nvidia invests up to $100 billion in OpenAI, which then purchases Nvidia chips.[8] Oracle provides cloud infrastructure while spending billions on Nvidia hardware.

This interconnected cycle creates a situation where investments are essentially recycled back into the same companies, inflating valuations without any real added value. The money flows from investors to AI firms, and then back into the pockets of the investors through service and hardware purchases. This demonstrates a closed-loop system that boosts valuations but doesn’t contribute to genuine innovation or growth.

AI Infrastructure Control

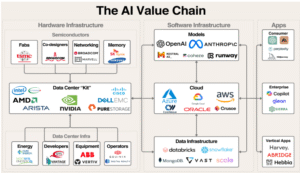

When using AI tools, you access infrastructure controlled by specific companies. Here is how the system is structured.

The Hardware Layer: Foundation Components

At the base is the hardware: chips, memory, networking equipment, and data centers.

The Chip Makers

A small number of companies dominate semiconductors. TSMC produces the majority of global chips. For AI specifically, Nvidia controls more than 90% of the AI chip market.[10] Training large language models happens on Nvidia hardware.

The circular investment structure reinforces this position. When chip makers invest billions in AI companies, those companies use the funds to buy chips, effectively creating guaranteed demand.

The Supporting Infrastructure

Chips require additional components. Networking enables high-speed data transfer. Memory stores information. Data centers house the equipment.

Without this foundation, AI systems do not function.

The Software Layer: Computational Processing

After hardware is operational, software converts computational power into functional systems.

The Model Makers

A few companies build the algorithms behind chatbots and image generators. OpenAI’s GPT-4 has approximately 61% market share in generative AI.[11] When you interact with an AI system, you are likely using a model built by OpenAI or Anthropic.

The Cloud Giants

These models need computing infrastructure. AWS, Microsoft Azure, and Google Cloud control the majority of the market. They provide the computational environment where AI models operate.

Major cloud providers have invested billions in AI companies with requirements that those companies use their cloud services exclusively. This ties investment capital directly to service revenue.

The Data Layer: Information Processing

AI models depend on the data they are trained on. This layer involves storing and processing large datasets.

Google, Meta, and Microsoft have access to data from Gmail, Facebook, LinkedIn, and other sources.

More data enables better models. Better models attract more users. More users generate more data. This creates a self-reinforcing cycle.

The Application Layer: User Interfaces

Finally, there are applications. ChatGPT for consumers, GitHub Copilot for developers, AI tools for legal services, healthcare, and marketing.

These applications are not independent. They operate on cloud infrastructure, use AI models from model makers, and run on hardware from chip manufacturers. Everything is interconnected.

The Vertical Integration Strategy

Microsoft, Google, and Amazon are not only building AI infrastructure. They are investing in startups and connecting them to their platforms.

For new companies, competing with organizations that control multiple layers of the infrastructure presents challenges. The investment network shows this clearly: major companies with trillion-dollar valuations sit at the top, investing in and providing services to the layers below.

Market Analysis

Soaring Valuations

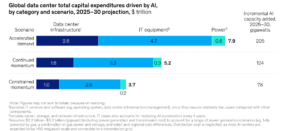

There are now 498 AI companies valued at $1 billion or more, with a combined worth of $2.7 trillion.[12] More than 1,300 AI startups have valuations over $100 million. Tech companies are projected to spend about $380 billion this year on AI infrastructure.[13] UBS forecasts global AI spending will reach $423 billion in 2025 and $1.3 trillion by 2030.[14]

The Investment Gap

The Wall Street Journal reports that American consumers spend only $12 billion per year on AI services.[15] This represents a $500 billion investment against a $12 billion return. A research paper from October 2025 calculated that this investment scale requires generating $2 trillion in annual revenue by 2030 to justify costs.[16] Current AI revenues stand at only $20 billion, requiring a 100-fold increase.

Industry Perspective

Industry leaders are divided on AI’s trajectory. Former Intel CEO Pat Gelsinger acknowledges the technological shift is real but requires years to mature despite current high valuations.[17] Nvidia CEO Jensen Huang projects $500 billion in GPU orders for 2025-2026,[18] while Meta’s Mark Zuckerberg and Alphabet’s Sundar Pichai emphasize sustainable growth and responsible development. Global AI spending is projected at $375 billion in 2025, reaching $500 billion by 2026.[19]

McKinsey’s April 28, 2025, report estimates capital investments to support AI – related data center capacity demand could range from about $3 trillion to $8 trillion by 2030.[20] If the demand for AI continues, this investment could exceed Germany’s 2025 GDP of $4.74 trillion[21] and India’s $4.19 trillion,[22] representing more capital than the world’s third and fourth-largest economies produce annually.

An Economy Priced for the Future

Specific companies control the AI infrastructure. A small number of organizations dominate each layer – from chip manufacturing to cloud computing to AI models. The spending is large. The potential exists. The risks are present.

The investment network illustrates the interconnectedness of these relationships. Microsoft, Nvidia, and Oracle invest billions in OpenAI, which purchases hardware and cloud services from those same companies. This creates a system where money flows in interconnected circles.

Control rests with a few companies. Whether current economics match expectations depends on whether the technology develops fast enough to justify valuations that assume significant future advancement.

The question is whether the technology can deliver results that match current expectations, and whether economic returns can support the investment levels in a system where investments flow in circular patterns.

Contributor: Team Leveraged Growth