Click here to download the report.

This edition reviews key market movements, major financial stories, and practical insights for investors.

1. Market Recap – July 2025

Equities: Global and Indian indices saw mixed performance; Nifty 50 fell on FII outflows, US tariffs, and weak earnings, while Nasdaq 100 rose on strong tech results despite volatility.

Commodities: Crude oil gained on OPEC+ cuts and geopolitical tensions; gold and silver benefited from safe-haven flows.

Bonds: Yields rose in both US and India due to inflation surprises and hawkish central bank signals.

Currencies: INR weakened against USD amid outflows and tariff concerns; DXY had its best July since 2019.

2. Featured Blog – Jane Street Scandal

A deep dive into SEBI’s accusation of index manipulation by quantitative giant Jane Street, including intraday price moves and “marking the close” tactics that allegedly yielded ₹735 crore in one day. SEBI froze ₹4,843.5 crore before partially lifting trading bans under strict conditions.

3. Financial Insights You Can’t Miss

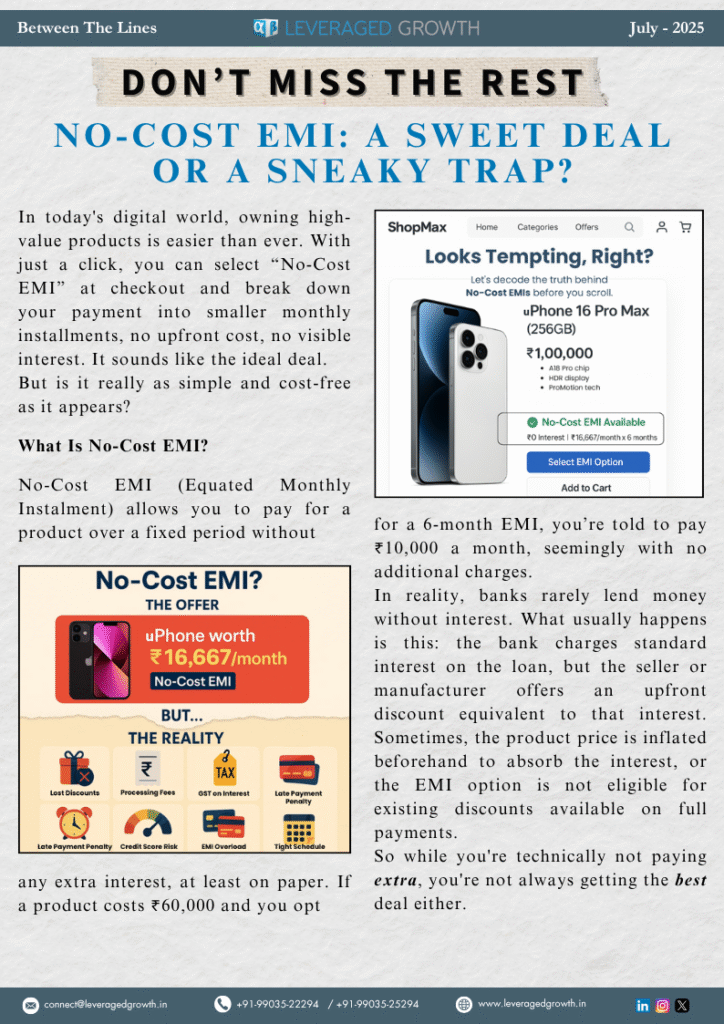

No-Cost EMI: Explained as not always truly “cost-free” due to hidden fees, inflated MRPs, and blocked credit limits.

Grey Market Premiums (GMP): Highlighted as sentiment indicators for IPOs but unreliable for investment decisions, especially in SME listings.

USD Dominance: Reviewed its historical rise, “Dollar Smile Theory,” global reserve trends, and emerging threats from local currency settlements and CBDCs.

Privacy as a Service (PaaS): Rising market for tools like VPNs, burner emails, and identity scrubbing amid data breaches and cyber scams.

4. Calendar of Key Events – Aug 2025

Includes RBI policy meeting, US CPI release, India’s Independence Day, Jackson Hole Symposium, and India’s Q1 FY26 GDP data.

5. Interactive Section

Finance riddle challenge for readers.