Cricket in India has transformed into more than just a sport; it’s a high-stakes business. With the rise of franchise-based T20 leagues, particularly the Indian Premier League (IPL), cricket teams have evolved into corporate entities with structured revenue models, valuations rivalling those of mid-sized companies, and ambitions that extend far beyond the boundary ropes.

While fans watch for sixes and hat-tricks, India’s cricket franchises are silently pulling in hundreds of crores every season. But how exactly do they earn this money? Let’s break down the financial playbook of Indian cricket franchises, both on and off the field.

1. Central Revenue Pool: The Backbone of Franchise Earnings

A large share of revenue for Indian cricket franchises comes from the central revenue pool, administered by the BCCI (Board of Control for Cricket in India). This pool is made up primarily of media rights and league-level sponsorships.

In 2022, the IPL media rights for the 2023–2027 cycle were sold for a staggering ₹48,390 crore, making it one of the most valuable sports broadcasting deals globally. This revenue is split approximately 50:50. Half stays with the BCCI, while the other half is equally distributed among the 10 franchises.

Each IPL team receives around ₹400 to ₹450 crore annually from this shared pool, regardless of their performance. This stable, recurring income ensures that even teams with lower brand presence or poor seasons can remain financially viable.

2. Sponsorships and Branding: Big Money on the Jerseys

Another critical revenue source for Indian cricket franchises is sponsorship income. IPL jerseys are now prime branding space, with multiple slots on the front, back, sleeves, and even caps. Brands pay top dollar to get associated with the massive viewership the league attracts.

Franchises like the Mumbai Indians and Chennai Super Kings command sponsorship deals worth ₹70 to ₹100 crore per season. Even newer or lower-ranked teams like the Gujarat Titans and the Punjab Kings earn significant revenue from jersey sponsors, strategic partners, and digital endorsements.

Sponsorships aren’t just limited to match days. They extend into content collaborations, influencer tie-ups, and fan engagement campaigns across social media, giving brands year-round visibility.

3. Matchday Revenue: Stadiums as Profit Centers

Franchises hosting home matches also earn from ticket sales, corporate boxes, hospitality suites, and in-stadium merchandise. Teams like CSK and RCB, which have a massive and loyal home fan base, often enjoy packed stadiums with high ticket demand.

On average, a single match can bring in ₹4 to ₹6 crore in ticket revenue, depending on the city, opponent, and day of the week. Over seven home games, this adds up to a significant income stream, particularly when coupled with premium hospitality offerings and exclusive fan experiences.

4. Merchandising: Monetising Fan Loyalty

From replica jerseys and caps to mugs, phone covers, and collectibles, franchises are tapping into merchandise as both a revenue stream and a branding tool. While not the largest source of income today, merchandising plays a key role in deepening fan engagement and establishing a franchise’s identity beyond the match calendar.

Estimates suggest that top IPL franchises earn ₹10 to ₹20 crore annually from merchandise, with increasing focus on official e-commerce tie-ups and influencer-led promotions. Some teams are even exploring digital collectibles and NFTs as part of future growth.

5. Valuations on the Rise: Cricket as an Asset Class

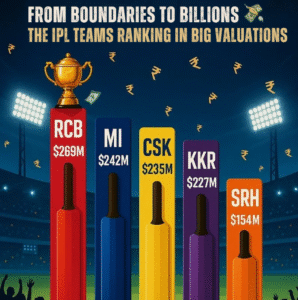

Indian cricket franchises have seen explosive growth in their valuations over the past few years. The overall IPL ecosystem is valued at $18.5 billion, while the standalone brand value sits at $3.9 billion.

A franchise like RCB commands a valuation of over $260 million, even without owning tangible assets such as stadiums. What they do own is a high-value combination of brand equity, fan base, digital traction, and future revenue potential.

This financial success has attracted interest from private equity firms, institutional investors, and international sports groups, positioning cricket franchises as long-term growth assets in the sports entertainment sector.

6. Going Global: The Rise of Multi-League Ownership

In recent years, Indian cricket franchises have begun expanding beyond the IPL. Many of them now own or operate teams in international T20 leagues, including MI Emirates in the ILT20 and MI Cape Town in SA20 by the Mumbai Indians, Texas Super Kings in the MLC by Chennai Super Kings, Dubai Capitals in the ILT20 by Delhi Capitals, and Durban’s Super Giants in SA20 by the owners of Lucknow Super Giants.

This multi-league ownership model allows franchises to operate year-round, reach new audiences, and create cross-border revenue opportunities through global sponsorships, licensing, and media deals.

It is a model inspired by global football clubs and is gradually turning Indian cricket franchises into global sports brands.

7. The Digital Edge: Content, Community, and Commerce

Modern cricket franchises are no longer just about match results. They are media houses and lifestyle brands. Teams invest heavily in content creation, including behind-the-scenes training footage, player vlogs, team challenges, and social media storytelling.

This content attracts not just fans but also brand collaborations, influencer campaigns, and ad revenue, especially on platforms like YouTube and Instagram. Some franchises have even launched fan subscription models and premium content access.

Digital engagement amplifies fan loyalty, drives merchandise sales, and keeps the franchise relevant throughout the year.

Conclusion: The Business Beyond the Boundary

Today’s cricket franchise is a blend of sports, media, commerce, and brand strategy. From revenue-sharing agreements with the BCCI to global expansion across leagues, these entities are building diversified, future-proof business models.

While the on-field drama may last just a few months a year, the real action – the valuations, deals, expansions, and monetisation continues all year round.

Cricket has become a full-fledged enterprise. And Indian franchises are leading the charge not just by winning titles but by rewriting how sports businesses operate in the modern era.

Contributor: Team Leveraged Growth