In a beverage market dominated by cola giants with deep pockets and flashier campaigns, a lesser-known player from Punjab is quietly rewriting the rules of the game. Launched in 2017 by three cousins with just INR 1 crore in capital, Lahori Zeera is not just a fizzy drink; it’s a fascinating case study in Bharat-focused strategy, efficient operations, and flavour-driven brand building.

The brand, which started with a single SKU – a masala-based jeera drink inspired by Indian street flavours, has grown into a multi-product FMCG contender. It has done so without celebrity endorsements, glossy TV commercials, or even a strong digital presence. Instead, Lahori has focused on three things: flavour, affordability, and offline distribution. The result? It now sells over 50 lakh bottles per day during peak summer and is rapidly scaling to 80 lakh daily capacity across four bottling plants.

Cracking the Indian Beverage Market

India’s non-alcoholic beverage market is already sizable at INR 67,000 crore, and according to the Indian Beverage Association, it’s expected to hit INR 1.5 lakh crore by 2030. While global brands like Coca-Cola, Pepsi, and Thums Up have chased urban consumers with mega budgets and international playbooks, Lahori quietly went where they didn’t: small-town India and the kirana shelves.

Rather than entering crowded metros, Lahori prioritised Tier 2 and Tier 3 cities, semi-urban areas, and rural belts. These are markets where the palate leans towards local, familiar flavours. Lahori Zeera’s cumin-based taste, reminiscent of traditional homemade drinks, filled that gap.

From 1 Lakh to 50 Lakh Bottles a Day

What makes Lahori’s rise particularly compelling is its manufacturing scale. The company went from selling around 96,000 bottles a day in 2017 to crossing 5 million bottles/day in 2025. That kind of growth didn’t happen on demand alone. Lahori invested early in backend capacity, now operating four large-scale bottling units with plans to add more.

The brand didn’t just bet on product-market fit, it doubled down on ensuring that when demand picked up, supply wouldn’t falter. They’re building infrastructure that matches the ambition of an FMCG powerhouse.

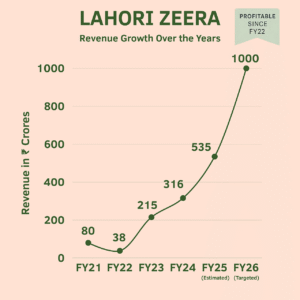

The Revenue Journey

Despite a COVID-induced dip in FY22, Lahori’s financial performance has been stellar:

- FY21 – INR 80 Crores

- FY22 – INR 38 Crores (pandemic slowdown)

- FY23 – INR 215 Crores

- FY24 – INR 316 Crores

- FY25 (projected) – INR 535 Crores

- FY26 (target) – INR 1,000 Crores

Notably, the company turned profitable in FY22 and has maintained profitability since, a rare feat among beverage startups.

A Sensible Funding Approach

Unlike the high-burn, growth-at-any-cost approach seen across D2C and FMCG sectors, Lahori was bootstrapped for five years. It only sought funding after achieving profitability. In 2022, it raised INR 40 crore from Belgian family office Verlinvest, followed by a much larger INR 450 crore round from Motilal Oswal in 2024. Yet, the founding team still holds around 70% of the company, maintaining strategic control and vision.

The Power of Flavour-Led Expansion

From one masala drink to multiple flavour profiles, Lahori has diversified its portfolio smartly:

- Lahori Zeera

- Nimboo

- Kacha Aam

- Shikanji

- Imli Banta

All beverages are preservative-free and retail at around INR 10, appealing to cost-conscious yet quality-seeking Indian consumers. Around 85% of its sales still come from offline retail, with deep penetration into general trade. This grassroots strategy enables Lahori to own shelf space in kirana stores across 20+ states.

Building Without Burn

What sets Lahori apart is its commitment to long-term sustainability. It isn’t chasing vanity metrics or pumping cash into celebrity endorsements. Instead, it’s focusing on flavour innovation, production efficiency, and retail relationships. The company has consciously avoided traditional mass media, building brand equity directly at the point-of-sale.

Even as it scales, Lahori retains its focus on Bharat, flavour, and margins. It isn’t trying to out-Coke Coca-Cola. It’s playing a completely different game and winning.

Final Thoughts

Lahori Zeera represents a shift in how consumer brands can scale in India. It proves that a deep understanding of local tastes, disciplined execution, and capital efficiency can take on the biggest players in the game.

As the INR 1.5 lakh crore beverage market evolves, Lahori’s strategy might just become the blueprint for how to build desi unicorns without the burn. Because in India, as Lahori shows us, masala always scales.

Contributor: Team Leveraged Growth