Once a person retires it is difficult for him or her to find a source of income especially during their 80s or 90s due to health reasons or changes in the work culture from the time they retired. Hence, it is important for everyone to plan the finances for their retirement life well in advance.

Life expectancy, retirement goals and flexibility in expenses are the key factors to be considered while planning a retirement.

Introduction

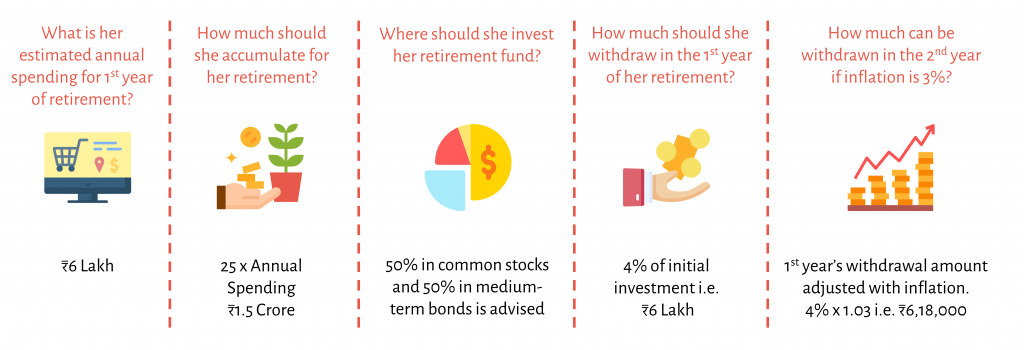

William P. Bengen introduced the 4% rule of thumb in 1994. As per this rule, retirees withdraw 4% of the retirement fund in the 1st year of their retirement and subsequently, the withdrawal rate increases by the previous year’s inflation rate to preserve their purchasing power and living standard.

To understand this strategy better let us take the example of Ms. ‘A’, a 40-year old woman planning for her retirement.

Why 25 times?

To ensure that 4% withdrawn in the 1st year of retirement is sufficient to meet 1st year’s expenses it is advised to hold a retirement fund that is 25 times the 1st year’s annual spending. 25 times is basically the total fund to be accumulated (100%) divided by the withdrawal rate i.e. 100/4.

Why should the Allocation be 50:50 in Stocks and Bonds?

The 4% rule suggests a 50:50 investment in Index Stocks and Medium-Term Bonds. After withdrawing 4% from the retirement fund each year, the remaining fund including returns need to be rebalanced every year. Rebalancing should be in 50:50 proportion until and unless the retirement goals have changed.

Stocks, in general, give higher returns than debt funds due to its riskiness. A person who invested in stocks a year before the Great Depression of 1929 or the Great Recession of 2007-08 experienced a decline of 89% and 49% immediately. Hence, 50% in debt can come to the rescue in such times while the stock market recovers slowly.

Conservative investors might choose to invest less in stocks but very less investment in stocks does more harm than very high investment in stocks. Based on the research data from 1926 to 1976, even after a 100% investment in stocks, the portfolio lasted for 25 years but a portfolio with 0% investment in stocks lasted for only 15 years. So, to ensure longevity 50 to 75% of investment in common stock is advised. Also, it has been proven that by increasing the stock investments from 50% to 75% of the total portfolio had very little to lose with just 3 years difference in longevity during such high volatile market conditions, had the market been favourable this additional risk would have been rewarded.

Also, retirement goals play an important role in deciding the portfolio division. Retirees who want to leave a part of the investment for their legal heirs or those who are ready to take up the extra risk to earn more and spend comfortably can go ahead with 75% of investment in stocks.

For example, A person retired in 1929 with $500,000 in a retirement fund invested completely in stocks and had less than $200,000 left by the end of 1932. Due to deflation her expenses fell from $20,000 in 1929 to $15,300 in 1932 but withdrawal percentage increased from 4% (20,000/5,00,000) in 1929 to 7.6% (15,300/2,00,000) in 1932.

Based on the research and the above example, after the 1929 market crash, a risk-averse retiree would have invested all his remaining funds in bonds. But that would have been a wrong decision because firstly the portfolio would have lasted for only 17 years i.e. till 1946 and secondly, he wasn’t taking into consideration the fact that stock market recovers in some time. While, a risk-taking retiree might have invested 50% in stocks, and the same investment would have lasted for 28 years i.e. till 1957. Hence, investment in both stocks and debt should be carefully planned as both are important.

Why should the withdrawal rate be 4%?

From the table below, we can understand the impact of a few adverse financial events that took place between 1926 and 1976. Where stock returns declined drastically and inflation rates skyrocketed but, the 4% rule remained unaffected.

The graph below shows the change in minimum longevity of the portfolio due to the change in the 1st year’s withdrawal percentage based on the data from 1926-1976. As the withdrawal rate increases the portfolio longevity declines.

Although savings last the longest and the impact of past financial events was lowest on the portfolio at a 3% initial withdrawal rate, the retiree fails to retain her purchasing power and will have to increase the initial investment to 33.33 times (100/3) of her annual spending. Thus, 4% is the ideal withdrawal rate as it may not be possible for everyone to save so much.

The impact of major financial events was mild in 4% initial withdrawal strategy, while a 5% withdrawal strategy has shown adverse results by reducing longevity by 5 to 10 years especially, during the worst period for retirees i.e., from 1966 to 1995.

Conclusion

Research by Bengen has proven that 4.15% is the maximum safe withdrawal limit and hence, termed as “Safemax”. 4% withdrawal has a success rate of 95% says, says Forbes.

Based on a retiree’s requirement he or she should decide the initial withdrawal rate. An early retiree who needs the retirement fund to last for 50 years may choose a withdrawal rate not more than 3.5% and accumulate 29 times (100/3.5) the 1st year expenses as the retirement fund.Retirement planning is quite important because on an average a person retires by 60-65 years but can live up to 90 or 95 years. These 25 to 35 years are highly uncertain in terms of medical expenses, and financial market conditions. Hence, a low withdrawal percentage is the safest while taking into consideration a good standard of living.

Unlike most other withdrawal strategies, the 4% rule suggests that the retirees stick to a low withdrawal amount even if it is less than 4% adjusted by inflation during a market boom so that the surplus can be used during the periods of adverse market returns.

While the future is always uncertain, the 4% rule is a good approach to keep a check on retirement spending.

Contributor: Kavya Venati

Research Desk | Leveraged Growth

I am a recent MBA Finance graduate and currently preparing for FRM. I am an Economics enthusiast looking forward to research on Econometrics and Quantitative Finance. I am passionate about making Finance simple for everyone. Apart from that I also enjoy reading books and trekking.